Transaction represents 17% premium to Trinidad price, 25% premium to hostile offer

The recent surge in oil and gas M&A activity extends to oilfield service, as Precision Drilling Corporation (ticker: PD) and Trinidad Drilling (ticker: TDG) announced a merger today.

Precision will acquire Trinidad in an all-stock deal, offering 0.445 of a Precision share for each share of Trinidad. Based on yesterday’s closing prices, this equates to $1.98 per Trinidad share, or $2.11 per share based on Precision’s 30-day average share price. This represents a 17% premium to Trinidad’s 30-day average price of $1.81.

Based on the 30-day average Precision will pay $540 million for Trinidad and will assume $477 million in debt, giving a transaction value of $1.028 billion. Trinidad shareholders will own 29% of the resultant company. One Trinidad director will be appointed to the Precision board, and an additional Trinidad director will be nominated for election.

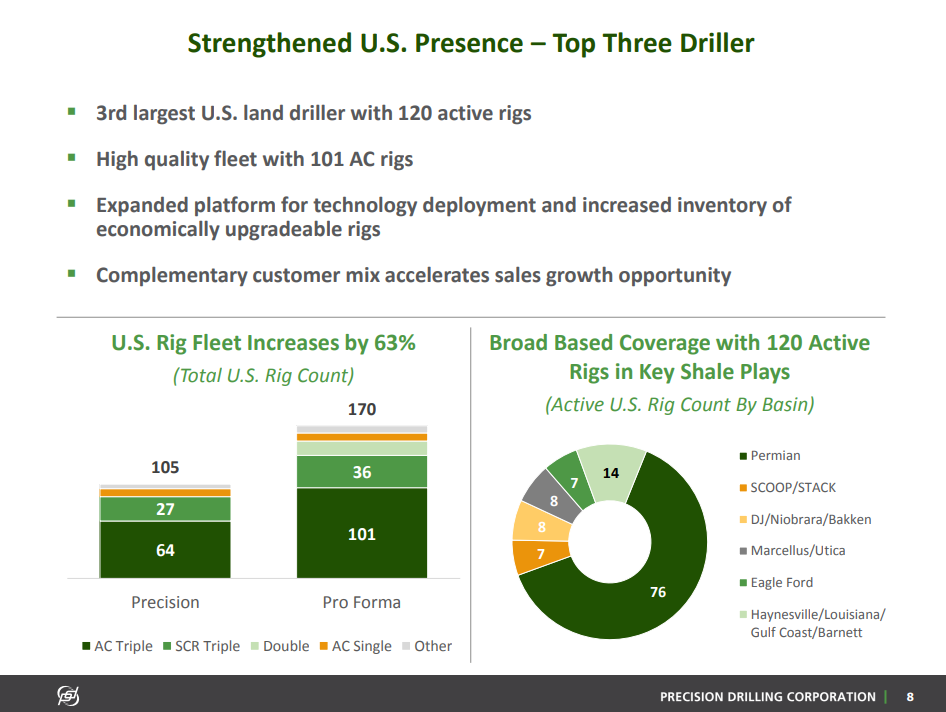

Pro-forma Precision will be the third largest drilling contractor in the U.S. market, according to Brent Conway, Trinidad’s President and Chief. In total, the company has 348 rigs, 215 of which are active. While most of these are in the U.S. and Canada, Precision has 26 international rigs, in Mexico, the Middle East and Georgia. These international rigs are a potential growth opportunity for Precision, as the company reports it is positioned to win future tenders for up to 13 idle rigs.

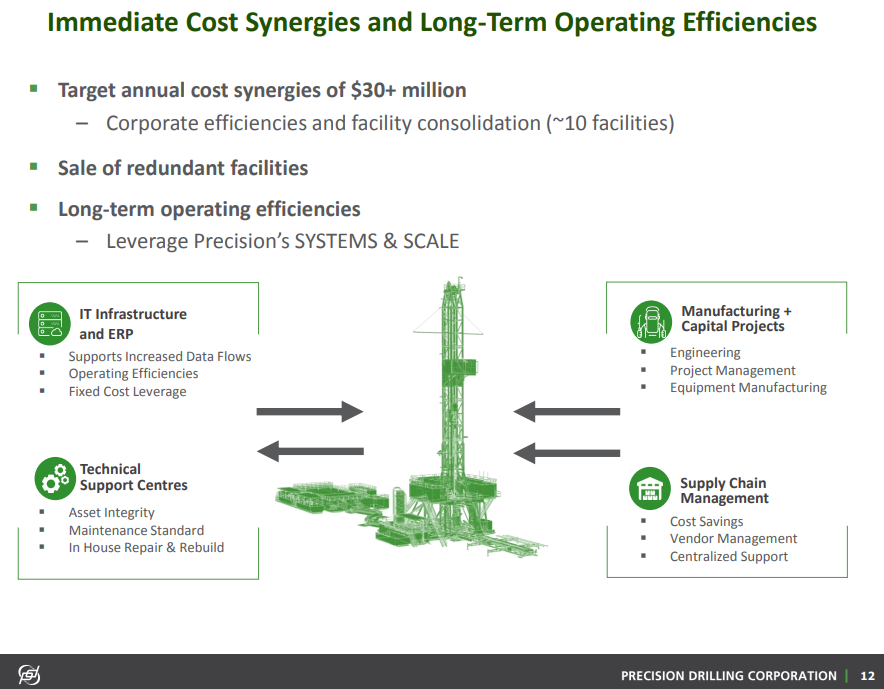

Precision estimates it will realize $30 million in synergies in 2019, primarily through corporate efficiencies and consolidation.

This transaction ends a dramatic period for Trinidad, as the company is the target of a hostile takeover bid from Ensign Energy Services. Ensign offered $1.68 per share in August, for a total offer of $470 million. The Trinidad board strongly opposed this offer, arguing that another offer was likely and Trinidad was worth more as a standalone company.

Kevin Neveu, President and CEO of Precision remarked, “This transaction creates exceptional value for both Trinidad and Precision shareholders. The combination provides a truly unique opportunity to combine two highly-focused drilling contractors that are pursuing similar growth initiatives and competitive strategies and importantly, operating similar Tier 1 assets.”

“From a strategic perspective, Trinidad is a perfect fit with Precision. We can realize immediate synergies, estimated to be over $30 million, through fixed cost reductions, operational efficiencies and reduced public company costs. Over the long-term, the additional scale will further strengthen Precision’s operating leverage and positions the company to service our customers’ continued transition to High Performance drilling services with high spec AC rigs.”