[EDITOR’S NOTE: this is the final installment of the OAG360 story in which Helen El Mallakh, director of the International Research Center for Energy and Economic Development (ICEED), discusses the changing political scene and the shifting geopolitical sands that are challenging the balance of oil producers in the Middle East. El Mallakh was keynote speaker at the Energy Finance Discussion Group in Denver last week. Part one of the story may be read here.]

The dynamic duo

Enter MBZ, Muhammed bin Zayed, the crown prince of Abu Dhabi. According to Helen El Mallakh, a geopolitical scholar and expert in the Middle East, MBZ has become highly influential in MBS’ (Muhammed bin Salman’s) life.

El Mallakh says MBZ has become a mentor to the crown prince (MBS). Much like MBS, MBZ has become controversial due to his push against Islamic fundamentalism and extremism in addition to his interventionist foreign policy.

These two coming together is important because it has aligned UAE and Saudi Arabia, specifically, on two main issues of interest. The first is containing Iran and the second is Qatar’s natural gas.

The blockade

When the Qatar blockade first began in 2017 many believed it was because UAE and Saudi Arabia were upset over Qatar’s position on Iran and terrorism. But El Mallakh in response said, “from my assessment, it’s actually more about political control over Qatar, and more importantly, making sure that cheap natural gas flows from Qatar into UAE.”

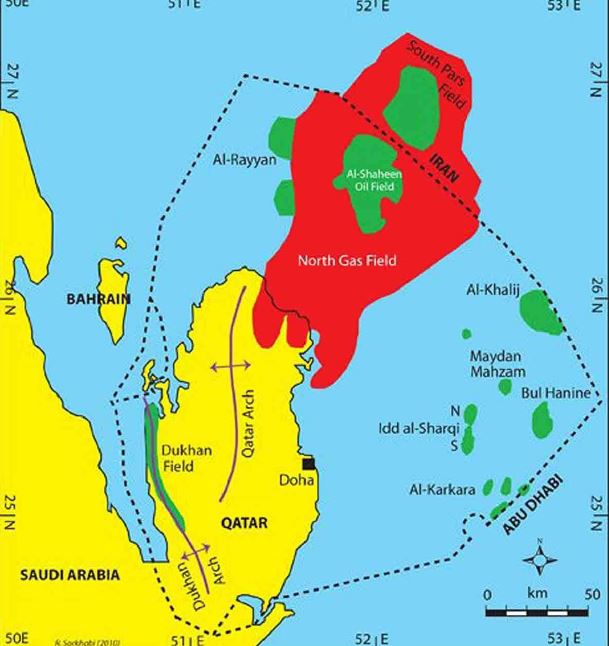

This makes sense since Qatar is currently the world’s largest LNG supplier and holds 14% of the world’s gas reserves. And most importantly, Qatar’s North Gas Field partially overlaps Iran’s South Pars Field, El Mallakh was quick to point out.

Ironically, when UAE and Saudi Arabia blockaded Qatar they ended up strengthening ties between Qatar and Iran instead of weakening them because Iran and Turkey were providing aid during this time.

El Mallakh said one really smart thing that Qatar did was that they “never stopped their gas deliveries to UAE during the whole blockade. So they never had given an excuse to their neighbors to come in and invade them. In addition, Qatar has expanded and diversified its trade alliance,” said El Mallakh.

The sanctions dilemma

El Mallakh said that the U.S. leaving the Iran nuclear deal is extremely important, as are the possible outcomes that are associated with it that will unfold in the next few months, especially in view of the upcoming OPEC meeting this weekend.

According to El Mallakh, leaving the Iran deal has aligned the U.S. against Germany, the UK, and France. The reason, according to El Mallakh, is because there is a high likelihood that will affect those countries that remain in the agreement: secondary sanctions will be placed on their companies that are operating in Iran.

“So the U.S. sanctions dilemma is thus: the United States has aligned with Israel, Saudi Arabia, and UAE on the one side; versus the traditional allies, Germany, the UK, and France, who now stand a lot to lose if secondary sanctions are put on them for operations in Iran,” said El Mallakh.

The outcomes

El Mallakh proposed the following possible outcomes, depending on a number of factors that can affect how things develop over the following few months.

Sanctions are hard to do

El Mallakh expressed concern over the effectiveness of the U.S. sanctions because “they’re hard to do.”

“The U.S. government actually has to go after these companies.” She compared this to very large energy companies like ENI and Total who will voluntary get out of the market.

Venezuela production is the elephant in the living room

One of the most important factors is the Venezuela situation, Mallakh said. She explained that “Venezuela is currently producing 1.6 million barrels per day, and that’s declining… if Venezuela gets knocked out of the market, we’re going to have serious, serious supply issues that cannot be met just by Saudi Arabia, Russia, the UAE, and Kuwait.” Therefore, it becomes self-defeating to go through with the U.S.’s sanctions if the situation in Venezuela continues to deteriorate.

Energy sector implications

El Mallakh said “the problem with the whole Iran situation is it increases business uncertainty and political risk overall” and that even if prices do increase, this isn’t necessarily good for the industry overall right now.

“However, for U.S. energy producers, especially those wanting to eventually export more oil, it makes the U.S. a more attractive source” from a geopolitical standpoint, El Mallakh said.

Additionally, El Mallakh added that the vested interests in the region are shifting and that we must be cognizant of the growing rift between the U.S. and its European Allies. This rift consequently makes Russia the big winner in the situation. They receive higher oil prices, gets increased production, and expands its presence in Iran by picking up all the vacated European and Asian projects.

El Mallakh concluded with, overall “U.S. producers actually have a competitive advantage as a reliable supplier, especially given the situation in the Middle East and Venezuela. And U.S. – all the producers all benefit from relatively higher prices. But the problem is you need to continue to expect the unexpected in this region.”

El Mallakh ended her presentation with a Q&A session

QUESTION: So, if you swat the hornets’ nest, and you spark a war between Israel and Iran, Saudis and Iran, whatever it is, if that war actually turns into a shooting fight with – what was it? – half a million standing army in Iran and was it $70 billion being spent by the Saudis, a large, obviously, accomplished military in Israel, if that war turns into a shooting war, how much of world oil production is actually at risk? Could we see 30 million barrels a day go off the market if you have a war that shuts down the straits?

HELEN EL MALLAKH: Oh, absolutely. And the problem is – it wouldn’t just affect oil. It would also affect the LNG, because remember, you’re not going to be getting Qatari LNG out.

The other problem is that I do think that if it does happen, we’re going to see a lot of carry out in terms of naval. They’re going to be trying to obstruct certain Middle East marine pathways, because that’s how they get the tankers out. In addition, it would make it prohibitively expensive to start shipping.

So we have a situation of a clogged oil market, and it would also be the shock. It would be a shock to all those economies. It could cause very serious global repercussions, because it would probably immediately go up to maybe $150 per barrel for the OPEC basket. It can’t be filled.

Saudi Arabia has duplicate pipelines, so they have pipelines. They could still get some production out. But just blocking the Persian Gulf, Iranian Gulf would be a massive, massive problem. And literally, worldwide we don’t have excess capacity to ramp up.

So, it would cause a massive, massive shock to the global economy and something small could escalate very, very quickly.

QUESTION: There are other actors, Hezbollah, etc., on the other side of Saudi Arabia that can shut down that strait as well.

HELEN EL MALLAKH: That’s exactly it. If you look at how people have been – they’ve already been positioning themselves all up and down East Africa to attack each other.

You could even potentially see attacks in the Suez Canal just make it prohibitively expensive. And some oil could get out, but you’re talking extreme disruption and it would cause chaos on the markets.

And when I was listening to a former Israeli prime minister who was saying – “Nobody would do this intentionally.” It’s not that anybody would do this rationally. It’s that it spins out of control, and this is the essential problem. It’s not that people intentionally get into this but it’s hard to put the genie back in the bottle.

QUESTION: Can you talk more about Venezuela?

HELEN EL MALLAKH: Venezuela is a really scary situation right now. Unfortunately, some of our policies of our government are actually exacerbating the situation there. I think that situation could easily get out of control and getting that 1.6 million barrels per day off the market, that would cause a major shock.

I don’t see that we have a very developed strategy for the U.S. to deal with this. This has been an ongoing problem. I wish more attention would be given to it, because I think this is a flashpoint that’s going to come back to bite us. And we’ll be like, “Why didn’t we pay attention to that?”

QUESTION: Can you assess some probabilities of things occurring in terms of percentages?

HELEN EL MALLAKH: I think that ‘business as usual’ is less than 10%. I think that’s going to happen.

I think there’s a 50% to 60% chance that the limited to total EU exit is going to be what’s going to happen, which means there will be no change in oil prices. It’s already been built in.

I think UN sanctions-light which would be expanded, you might be looking at 20%, 25% for that.

I’m going to actually do limited to total EU exit, I give that about 60%; 10% for almost business as usual. I’d probably put the hot war/cold war scenarios together at 10% and UN sanctions-light.

I think the most likely outcome is the limited to total EU exit, and that would have some effect. I don’t think that will have much effect on prices, because I think the Saudis and the Russians and UAE have already increased their production enough to offset what you would lose in Iran. But that assumes that you don’t have Venezuela off, kicked off.

So, what that really means is that the Iran sanctions hurt Iran, and they hurt the Europeans; they benefit the Russians, they benefit the Saudis, they benefit the Emirates, they benefit Russia, and some Asian countries. But the Europeans lose – they’re the big losers.

The upcoming 174th OPEC meeting in Vienna, Austria is scheduled for Friday, June 22, and will immediately be followed by the fourth OPEC/non-OPEC ministerial meeting Saturday.

The opening session is scheduled for 10 a.m. local time (4 a.m. Eastern time).

A closed-session meeting between all OPEC heads of delegation and OPEC Secretary General Mohammad Barkindo will start at 11 a.m local time (5 a.m. Eastern time).

A press conference will then be held at 1 p.m. local time, (7 a.m. Eastern time).