LONDON/NEW YORK/SINGAPORE – With oil prices surging as producers curb supply, fuel prices in many countries have hit multi-year and even all-time highs despite the pandemic knocking demand by millions of barrels per day.

Source: Reuters

The high prices at the pump could hamper a slow and fragile economic recovery as they contribute to inflation and strip consumers of cash to spend, especially in developing countries where the impact of the pandemic remains acute.

Oil prices have risen by more than 30% this year. Still, OPEC+, which groups oil producers from the Organization of the Petroleum Exporting Countries and others, is holding back on raising supply, wary about risks to economic recovery needed to support a rebound in fuel demand.

Yet by standing firm and not easing its output curbs, OPEC+ may be contributing to the slow recovery by pushing up prices, Standard Chartered said in a report.

“It is … extremely risky in its assumptions that high prices will not significantly affect economic recovery (and) oil demand recovery,” the bank said.

Benchmark Brent crude oil futures rose above $71 last week, their highest level since January 2020 before the pandemic started. That was as high as levels seen after attacks on Saudi oil facilities in 2019.

Similarly, pump prices are at or near pre-pandemic levels in 25 countries which account for 80% of global fuel demand, according to energy consultancy FGE.

This, despite still weakened demand. Global oil demand fell by almost 10% due to the pandemic in 2020 from more than 100 million barrels per day (bpd) in 2019.

Even with improvement through 2021 demand in the final quarter is likely to remain 1.4 million bpd lower than the same period in 2019, the Paris-based International Energy Agency has forecast, while OPEC sees the shortfall at some 2 million bpd.

DEVELOPING COUNTRIES

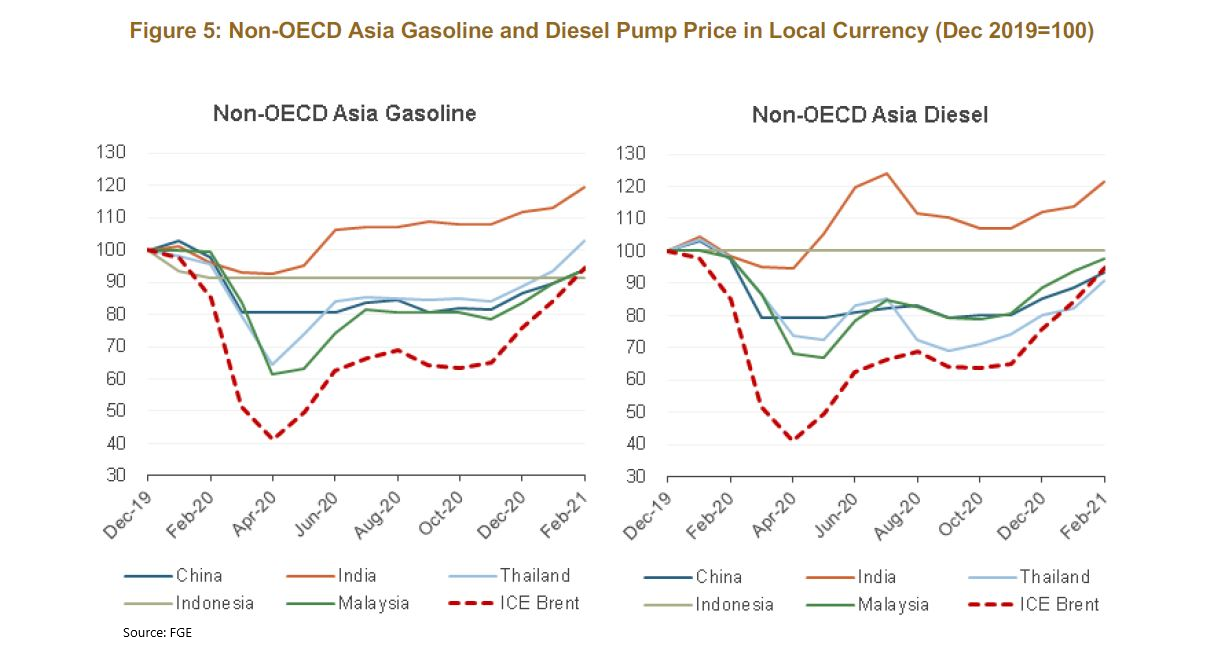

In China, gasoline and diesel prices have increased sharply though they remain down 4% year on year. In Argentina, pump prices have surged 40% higher than pre-pandemic levels, FGE said, with gasoline in Thailand in February also topping pre-pandemic prices.

In Brazil, a move by Petrobras to raise diesel and gasoline prices has prompted a backlash with President Jair Bolsonaro ousting the company’s CEO in response.

In some developing countries, such as Turkey, the rise in fuel prices has been exacerbated by the weakness of local currencies against the dollar.

“We see significantly higher pump prices in developing countries, which can undermine demand growth, especially beyond the structural rebound from the pandemic lows,” said Cuneyt Kazokoglu, head of oil demand analysis at FGE.

“Organic growth in countries like India will certainly be affected by the pump prices,” he said.

Fuel prices have touched record highs in parts of India, and have already hit demand.

Indian Oil Minister Dharmendra Pradhan warned this month that OPEC’s decision to keep output steady could undermine “consumption-led recovery and, more so, hurt consumers, especially in our price-sensitive market.”

Saudi Energy Minister Prince Abdulaziz bin Salman in response said India should start using oil it bought cheaply during the price collapse last year.

In India, as well as Germany and Brazil, new taxes have contributed to rising prices at pumps. Given the high prices, however, some Indian states have cut state-level taxes on petrol and diesel.

Graphic: Non-OECD Asia Gasoline and Diesel Pump Price in Local Currency –

BIGGEST CONSUMER

In the United States, the biggest oil consumer, most analysts and traders are optimistic that high pump prices will have little impact on what is expected to be stronger demand during the peak summer driving season as more people receive vaccinations and take trips they were unable to take during the pandemic.

“You may see a slight downward pressure on what that peak demand is,” said Todd Burford, senior research analyst of oil product markets at Wood Mackenzie, referring to summer demand. “But it would take a longer period of sustained higher prices to shift the total shape of the curve of U.S. gasoline demand for 2021, 2022.”

U.S. gasoline prices rose to nearly $2.80 a gallon on March 9, their highest since June 2019, data from the American Automobile Association showed. Prices have not been that high in March since 2014, AAA data showed.

U.S. gasoline prices have increased because of rising crude prices and a winter storm in Texas this year that forced producers to shut production, said Jeanette McGee, AAA spokeswoman.

U.S. fuel demand is still down more than 10% from the same period last year, data from the U.S. Energy Information Administration (EIA) showed.

U.S. gasoline consumption is expected to grow to 8.6 million barrels per day in 2021, up from 8.03 million bpd in 2020, according to the EIA, before rising to 8.89 million bpd in 2022.

Graphic: U.S. fuel demand to increase through 2022 –