Canada’s PSAC Cuts Canadian Drilling Activity Forecast for 2018

Without adequate pipeline capacity or forthcoming export projects for Canada’s crude oil and natural gas, there is a tough energy economy in Canada that is going to be taking an economic toll on oil and gas development activity.

Canada is besieged by pipeline turmoil between provinces on top of the withdrawal of LNG export and pipeline projects. Moving its oil by rail has been stymied by locomotive and tank car shortages. The end result is that Canada can’t move its oil and natural gas to global markets—with the exception of the U.S. – its biggest energy customer.

As a result, the Petroleum Services Association of Canada (PSAC) has decreased its forecast for the number of wells drilled (rig released) across Canada for 2018. The group cut its forecast for 2018 by 500 wells to 7,400 wells – a six percent cut from its October 2017 forecast of 7,900 wells.

PSAC said it based its updated Forecast on an average natural gas price of $1.75 CDN/Mcf (AECO), crude oil price of US$61.45/barrel (WTI), and a Canada US exchange rate averaging $0.79.

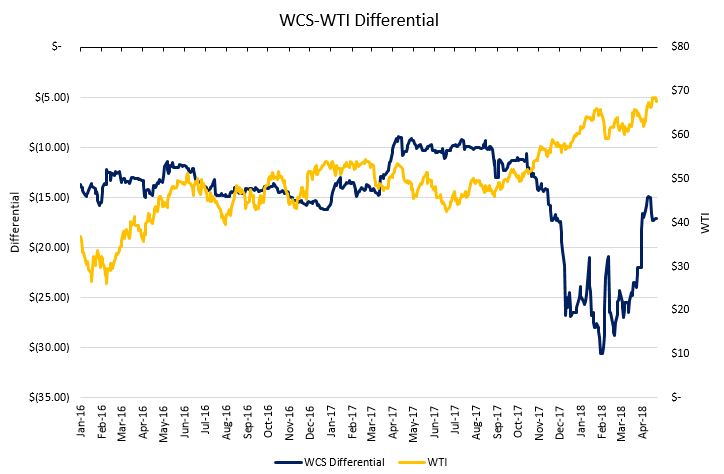

“The improved WTI price shift into the mid to high $60’s is certainly a welcome sign for our industry. However, the disconnect and volatility of the differential between WTI and WCS pricing means that exploration and production (E&P) companies and Canadians are not benefiting to the same level as our ‘energy independent’ focused southern neighbor.

“It’s shameful that we continue to sell our oil to the U.S. at a steep discount to WTI, short-changing Canadians over $15 billion per year. The sooner we expand our customer base, the better off Canadians and quite frankly, the rest of the world will be.”

PSAC President and CEO Tom Whalen said this year’s higher activity “hasn’t necessarily translated into financial bottom lines that signal business sustainability. In fact, we still have a number of services companies making staff reduction adjustments of five to fifteen percent.”

Whalen said while layoffs are a fraction of the 40-60 percent staff reductions during the worst of the 2015-2016 downturn, it is “still a very telling sign that our services sector is far from healthy.”

Revised 2018 well forecast by province – showing revised 2018 forecast compared to original forecast data

- Alberta – 3,800 wells to be drilled in Alberta, down from 4,000 wells – a reduction of 5%

- British Columbia – 500 wells to be drilled in B.C., down from 730 – a reduction of 32%

- Saskatchewan – 2,840 wells to be drilled in Saskatchewan, down from 2,930 – a reduction of 15%

- Manitoba – 255 wells to be drilled in Manitoba, adding 25 wells – an increase of 11%

Whalen said there is a continued shift by the E&Ps from gas well to oil well drilling. That shift to oil is easily supported by the ‘lower for longer’ price outlook for Canadian natural gas, he said.

Financial effects hurting provinces

“We’re also seeing a geographic shift, forecasting 110 less wells to be drilled in B.C than in 2017. While this doesn’t seem like a large number, one needs to keep in mind that these are some of the most complex and ‘service intensive’ wells being drilled in North America today.

“We estimate these 110 wells represent over $850 million in capital that won’t be spent in B.C. this year.

“On the winning side of the equation is Saskatchewan which we estimate will see just over 300 additional wells drilled than 2017. We estimate the capital cost to drill those wells is approximately $400 million.

“When you add those two scenarios together, we’re conservatively looking at approximately $450 million less capital being deployed in Canada than our earlier forecasted numbers suggested,” Whalen said.

Tidewater access is critical for Canada

“It is absolutely mission critical that Canada gets access to tidewater for its oil and natural gas resources,” Whalen said. “Completion of the Kinder Morgan Trans Mountain expansion is but one key imperative to restoring investor confidence in Canada.

“Equally important is the need for Canada to communicate our energy brand internationally, one that proudly speaks to resource development that’s responsible, safe, ethical and to the highest environmental standards in the world.

Whalen pointed to an International Energy Agency (IEA) projection for global demand for energy to increase 31 percent by 2040, including a 49 percent increase in demand for natural gas and a 12 percent increase in the demand for oil.

One of Canada’s large oilsands producers, Cenovus Energy (ticker: CVE), addressed the situation in Canada in its Q1 earnings announcement this week:

“After a strong operational start to the quarter, we took prudent steps to reduce production volumes in response to wider light-heavy differentials, export pipeline capacity constraints and the slow pace of ramp up in oil-by-rail capacity,” said [Cenovus CEO Alex] Pourbaix.

“When Canadian heavy oil is selling at a wide discount to WTI, we have the ability to slow our oil sands production while maintaining steam injection to mobilize the oil. We can then store that mobilized oil in our reservoirs to be produced and sold at a later date when pipeline capacity improves and differentials narrow.”

Cenovus said it is working with rail providers to resolve a shortage of locomotive hauling capacity … . And while the company expects overall industry rail access to improve starting in the second half of the year, if rail capacity improvements take longer than expected, or pipeline capacity tightens again, Cenovus said it may “take further steps to defer production which could result in fluctuating production volumes from month to month.”

Cenovus CEO expresses positivity that the situation will resolve

Pourbaix and other Cenovus executives talked about Canada’s takeaway shortage in the company’s Q1 conference call. Following are excerpts from the call this week.

Q: Alex, you have a unique perspective on takeaway and market access given your background. I’m just teasing your thoughts with the Enbridge Line 3 potentially, are you getting some resistance in Minnesota, with Trans Mountain in British Columbia… how does do you think this ultimately plays out?

And from a differential standpoint, how do we think about the impact of IMO if, come 2020, some of these pipes aren’t online, particularly with some of the slippage that we’re seeing here in the U.S.?

Pourbaix: I’ll talk a little bit about the pipeline situation, and then I’ll let Keith comment on IMO. But I think from the pipeline perspective, and I’ve said this from the start, I remain an optimist that ultimately most, if not all of those three major pipeline projects would go.

I think, clearly, a bit of a complication has been thrown into the Line 3 project with that decision from the administrative law judge. It’s a really big decision. We’re taking a look at it, and I know that Enbridge is taking a look at it, and I don’t understand at this point what their response would be.

But I would just say that the logic of replacing an old pipeline with reliability problems with a brand new state-of-the-art pipeline with state-of-the-art leak detection seems to be a very prudent thing for the State of Minnesota, and I hope that there’s a win-win resolution.

We’re obviously in the middle of a process with TMP (Trans Mountain pipeline) and Kinder Morgan. I remain in close conversation with both Kinder Morgan Canada, the Alberta Government and the Canadian Government and I take a lot of comfort that I think those three parties are all very committed to finding a resolution that will allow that project to proceed, and once again, we’re just waiting to see where that gets to.

And then, on Keystone XL, it obviously continues to proceed, and I know the company is acquiring land on the new right-of-way.

So, I do ultimately believe that that project is going to proceed also. In the interim, as production grows in Alberta, we obviously are going to need rail to balance production and take away, and as I said in my remarks, there has been a bit of a slow start in getting this oil moving.

I think that is overwhelmingly attributable to the lack of spare capacity that the rail companies had when faced with this issue, probably earlier than I think everyone anticipated. But I’m really confident that as we move into the second half of this year and into the first half of 2019, we’re going to be seeing very material volumes of oil moving by rail.

And I would expect, once that situation prevails, we would expect to see WTI/WCS differentials probably persist in the high-teens being reflective of the cost of rail to get oil from Alberta down to the Gulf Coast.

But why don’t I have Keith just talk about the IMO issue.

SVP of Downstream Keith Chiasson: Just building on Alex’s comments, obviously, Line 3 timing could then bring back in the differentials. So, if that gets pushed out past the third, fourth quarter of 2019, we could see some pressure with regards to widened differentials associated with the rail transportation as well as the IMO coming in.

But specifically on the IMO, there are still a lot of questions with regards to the implementation and the response to the changing regulation.

Whether or not refineries will have sufficient capacity or how much sufficient capacity they will have to increase coking utilization, how fast the shipping industry can respond to putting scrubbers on their vessels, as well as how well the regulations will actually be enforced and even if the timing of the regulations sticks to the 2020 implementation.

Still lots of unknowns. We are obviously watching that space. We do have our heavy oil integration with our Wood River and Borger refining capacity. But we’d also look at do we want to bring new production growth into that market if we start seeing kind of Line 3 deferred and delayed, as well as the IMO impact coming.

Q: My follow-up question is, as you think about rail and the negotiations that are going, recognizing those commercial sensitivities – what do you think are really the stumbling blocks in terms of getting this to the finish line, it is conversation around margin, it is conversation around duration?

Pourbaix: I’ll kind of maybe talk at the strategic level and Keith may provide some color on specifics. But my perspective on the rail, I have been closely involved with Keith in dealing with the rail companies really for the better part of a few months now.

And my experience with the rail companies, and I might have said this earlier, but I don’t detect there is any philosophical concern on the part of the rail companies about moving the product. I think they feel that the last time they ramped up their capacity to move oil, I think they felt they spent a lot of time and resources and then they lost that business in very short order once the pipeline solutions became available.

So, I think I’m not surprised nor distressed by the pricing that we’re seeing. I think it is – I think we’ll be able to achieve fair pricing. I think that there is going to be some term to these deals to deal with this issue that the rail companies have.

And I think there is going to be – they’d probably desire to have some element of take-or-pay, which might have been lacking in the past. As I said, our discussions with the rail companies are very productive.

From our perspective, I mean, we really see the importance of getting a rail deal more towards the end of this year, and that’s where we’re targeting to start seeing our barrels move by rail. But there is – I’m not seeing anything that is significantly worrying me that we’re not going to be able to achieve that goal.

Chiasson: We’re actually starting to see increased rail capacity happening in our conversations with the heads of the two rail companies. It’s evident to us that they’ve hired the crews. They are just going through the training process now to get them competent and capable.

They’ve indicated that they’re reactivating a fair amount of locomotives. So, we do see that capacity picking up. There is a fairly heavy turnaround activity happening in the province, and with the new coker startup – upgrading startup this year as well.

We do see the timing for that rail deal to be in the fourth quarter as being more necessary, and we’re taking a very disciplined approach to make sure we get the right deal for us and the rail companies.

[EDITOR’S NOTE: The International Maritime Organization (“IMO”) is an agency of the United Nations which looks at maritime environmental issues. The agency has limited sulfur oxide (SOx) and nitrous oxide (NOx) emissions from ships, capping those emissions to 3.5% m/m (mass by mass). But the IMO mandated globally reducing sulfur content in marine fuel oil to 0.5% m/m by 2020—the initiative is called ‘IMO 2020’, referenced during the Cenovus call as ‘IMO’.]