Range Resources Corporation (ticker: RRC) produced 1,444 MMcf/d of natural gas, 106,038 Bbls/d of NGLs and 15,007 BPD of crude oil and condensate in Q4 2017. Also in Q4 2017, the company had a net income of $221.185 million, or $0.89 per share. This compares to a net loss of $160.709 million, or $(0.66) per share in Q4 2016.

For the full year of 2017, Range produced 1,343 MMcf/d of natural gas, 97,834 Bbls/d of NGLs and 13,115 BPD of crude oil and condensate. In 2017, Range had a net income of $333.146 million, or $1.34 per share. This compares to a net loss of $521.388 million, or $(2.75) per share for the full year of 2016.

Appalachia

Production for the fourth quarter of 2017 averaged approximately 1,799 net MMcfe/d from the Appalachia division, a 27% increase over the prior year. Included in this amount was over 100,000 BPD of liquids production.

The southwest area of the division averaged 1,657 net MMcfe/d during the quarter, a 34% increase over the prior year. This growth was timed with the company’s pipeline capacity additions, Range said.

The northeast area of the division averaged 126 net MMcf/d during the fourth quarter.

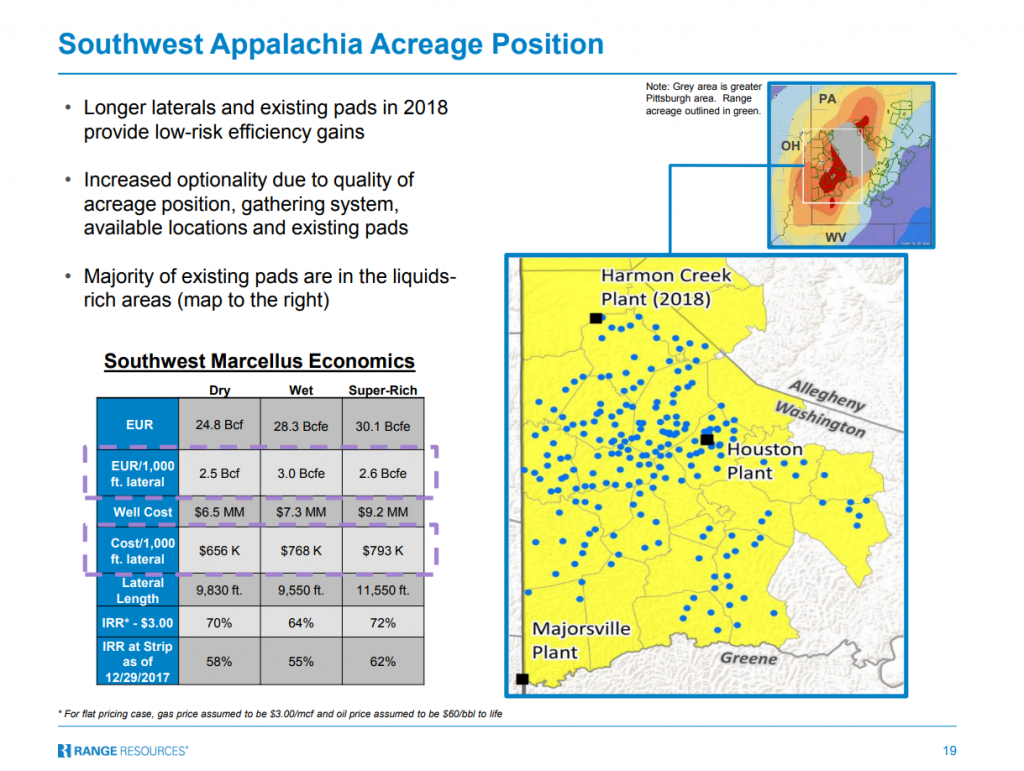

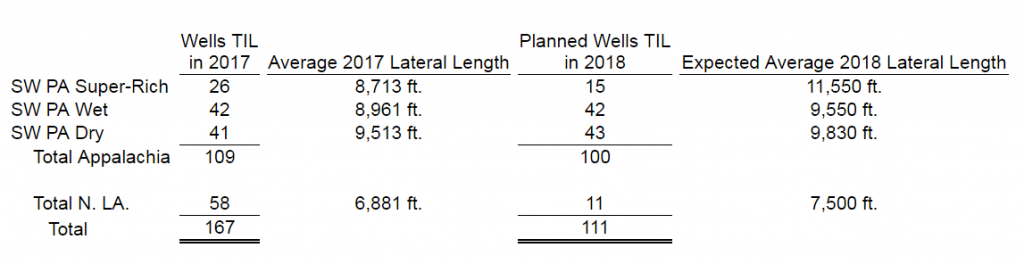

The division brought on-line 42 wells in the fourth quarter, one in the super rich area, 17 in the wet area and 24 in the dry area. The division expects to run five rigs in 2018.

Some noteworthy results from the fourth quarter include:

- A five-well pad in the dry area that produced at a 24-hour IP rate of 36.1 MMcfe/d per well completed with average lateral lengths of 14,400 feet and 73 stages per well

- A five-well pad in the wet area that produced at a 24-hour IP rate of 36.7 MMcfe/d (including 2,814 NGL Bbls/d) per well was completed with average lateral lengths of 13,600 feet and 68 stages per well

- A four-well pad in the super rich area (three wells in Q3 2017 and one well in Q4 2017) that produced at a 24-hour IP rate of 40.3 MMcfe/d (2,880 Bbls NGLs and 1,707 Bbls condensate per day) per well completed with average lateral lengths of 9,800 feet and 49 stages per well

North Louisiana

Production for the division in the fourth quarter of 2017 averaged approximately 348 net MMcfe/d.

The division expects to turn in line 11 wells in 2018. The division will run one rig in 2018 as the team monitors results from 2017, while incorporating additional seismic data processed at the end of 2017, Range said. Production in North Louisiana is expected to decline through 2018, then remain relatively flat.

Drilling

Fourth quarter 2017 drilling expenditures of $369 million funded the drilling of 53 (48 net) wells. Drilling expenditures for the year totaled $1.18 billion, and Range drilled 177 (164 net) wells during the year. A 99% success rate was recorded, Range said. In addition, during 2017, $62 million was spent on acreage purchases, $15 million on gas gathering systems and $51 million on exploration expense.

2018

- Production for the full year 2018 is expected to average approximately 2.23 Bcfe/d. This equates to a year-over-year growth rate of approximately 11%

- Production for the first quarter of 2018 is expected to be approximately 2.18 Bcfe/d

Range’s 2018 capital budget is $941 million. Approximately 85% of the capital budget is expected to be allocated to the Appalachia division and 15% to the North Louisiana division. In Appalachia, approximately 60% of activity will be directed towards liquids-rich drilling.

The 2018 capital budget includes approximately $857.4 million for drilling and recompletions (91% of the total), $54 million for leasehold, $4.3 million for seismic and $25.5 million for pipelines, facilities and other capital expenditures. The budget includes 100 wells expected to be brought on-line during the year in the Marcellus and 11 wells in North Louisiana. In the Marcellus, approximately half of the wells are planned to be drilled from existing pads in 2018.

Conference call Q&A excerpts

Q: You completed roughly 20 wells in North Louisiana in the fourth quarter. What are you looking for as you watch those wells? What about the changes to the completion design in 2018?

Chairman, President and CEO Jeffrey L. Ventura: Again, what we’re doing is recognizing the below performance that we’ve experienced. So, if you go back to 2017, we talked about what the results were for the first-half wells. And although the second-half 2017 wells were significantly better, they’re still below what we were targeting.

So last year, we ran four rigs and at times more than four rigs – six or seven rigs, in a spot period, we’ve cut back. Today, we’re at two rigs. In a week, we’ll be at one and we’ll stay at one rig for the rest of the year. So I think going slower is important.

And at the same time, we’re redirecting our capital up to the Marcellus where we’ve had great results, consistent results. And if anything, it just keeps surprising us to the high side. So we think that’s the right way to allocate capital and it’s the right pace to go at in Louisiana.

Q: Ray, you hit on the supply/demand dynamics in the Northeast gas market. What stood out to me was that you expect pipeline capacity growth of 2x, what you see as production growth out of the basin through the end 2019. You gave a 6 Bcf a day number and I just want to hear a little bit more detail on this – on that analysis that encompasses everybody that’s up there.

EVP and COO Ray N. Walker, Jr.: What we did is, of course, it’s all internal work. And we looked at third quarter – took the timeframe from the third quarter of 2017 through the end of 2019, which isn’t that far away. I mean, it sounds long ways out there, but it’s the end of next year. And when you look at that, we’ve got a pretty good line of sight that is going to happen, and I think there’s pretty much a lot of confidence in that. Certainly, with the current administration and FERC commission, all that looks positive.

So there’s about 12 Bs a day when you sum all that up. We simply took basically the consensus estimates and public data of the Southwest Basin producers, both Utica and Marcellus in the areas that would be connected to those pipes.

And, again, we’re completely holding Northeast PA out. I think that’s a totally different animal up there. But if we look at the producers that are connected to those pipes and what they’ve publicly said and what consensus estimates are built around, it’s about a little over 6 to maybe 6.5 Bs a day of growth that everybody is projecting from the third quarter of 2017 through the end of 2019, so with the same time period.

So this is following, I think what we’ve seen historically in this industry, over the last almost 40 years, I’ve been doing this, is that infrastructure always gets overbuilt. Now the question becomes what happens, and I would also say that 6.2 Bs of gas is at a pretty healthy consensus price of basically over $3. I think it’s $3.07 to $3.09 on a consensus basis that people were predicting that kind of growth. With the strip at $2.85, $2.75 or where it’s today, it’s not there. And clearly that could put that growth level at risk.

So we think, like we said for a long time, that there’s going to be ample pipeline takeaway gas capacity in the basin. It’s going to be overbuilt. We think demand pull will start occurring. We already have a lot of that taking place. Even on the liquid side, it’s beginning to take place where markets are actually coming to us to buy the gas at the tailgate of the Houston plant, so to speak. So we see a lot of that shift beginning to take place, just like we predicted it would for years. And I think that’s kind of how we put all that together internally.

CEO Jeff Ventura: I’d just add to that a little bit. When you look out further into 2020, or 2020 plus, we really believe based on our internal work that you’re going to see sweet spot exhaustion in the Marcellus, Utica as well as in a lot of other plays really all over the county, which is really important when you look at people projecting forward. And then it comes back to who has an inventory that can last. And, again, we think with the quality, the acreage we have and the large number of locations that are in the sweet spot that will put us in a great position. But that’s something that I think is not in the market, but it’s a real technical factor.