Range Resources (NYSE: RRC) announced its Q2 2018 results and remains on track for its 2018 CapEx target despite transportation issues felt throughout the quarter.

Highlights

- Production averaged a record 2,200 MMcfe per day, an increase of 13% YOY

- Liquids production averaged 117,520 barrels per day, a 12% increase YOY

- Pre-hedge NGL realizations were $23.69 per barrel, a 63% increase YOY

- Pre-hedge crude oil and condensate realizations of $63.07, a 45% increase YOY

- Cash from operations of $175 million, and non-GAAP cash flow of $237 million

- Net loss of $80 million ($0.32 per diluted share), non-GAAP net income of $50 million ($0.20 per diluted share)

CapEx on target

Range in the second quarter had $260 million in drilling operations expenditures, which led to the drilling and completion of 30 wells at a 100% success rate. Range during Q2 also bought acreage for $10.3 million and is remaining with $941 million total capital budget for 2018.

Subsequent to quarter-end, Range sold Midcontinent properties for $23 million, consisting of approximately 11 MMcfe per day of production and expected annualized cash flow of approximately $3 million.

Top natural gas production

Range’s net production for Q2 2018 averaged 2,200 MMcfe per day, consisting of 1,495 MMcf per day of natural gas, 104,219 barrels per day of NGLs and 13,301 barrels per day of condensate and oil. This makes Range one of the top 10 natural gas producers in the U.S. and a top three NGL producer amongst E&P companies.

Transportation hiccups and outlook

The transportation of natural gas liquids on Sunoco’s Mariner East 1 pipeline was suspended for almost two months during the second quarter. As a result, Range lost access to capacity on the Mariner East 1 pipeline for a combined 40,000 barrels per day of ethane and propane. The Mariner East 1 pipeline was returned to service in mid-June.

In early June, TransCanada’s Leach Xpress project on which Range holds natural gas capacity (300,000 Dth/day) was taken offline following a pipeline rupture in West Virginia. Range rerouted the natural gas production earmarked for the Leach Xpress capacity into local Appalachian markets. On July 15th, the Leach Xpress project returned to service.

Energy Transfer’s Rover project (phase 2), which is the last major natural gas transportation project for which Range has contracted capacity, is expected to reach full completion in Q3 2018. Once the Rover project is in service, over 70% of Range’s production can be sold in the Gulf Coast market.

Q & A

Selected Q & A from Range Resources Q2 earnings call included below:

Q: Jeff, thanks for all the color on how you’re thinking about asset monetizations. But I wonder if I could just dig a little deeper on the just – to the extent you can, how you see the current market in the wake of the Chesapeake deal in particular? And I guess, specifically, again to the extent you can, how you feel about – whether you expect your likely disposals that you can see line of sight for currently, to be acreage predominantly or acreage with production. In which case, how should we think about cash flow? And I’ve got a related follow-up, please.

Range Resources’ President & CEO, Jeffrey L. Ventura: Yeah, let me, as you might expect, I’m going to do it at a higher level. I think the quality of the assets’ really critical, and I think if you look at the quality of our assets versus the Chesapeake deal, there’s really no comparison. I mean, you can look at it, recoveries per thousand-foot, cost per thousand-foot, cost structure. So, I think quality is really important, so I think that’s not analogous at all.

The other thing I’ll say, and this is at a very high level. So, I’m not sure if this will affect your follow-up question, but feel free to ask it, but in my call notes, I said our near-term goal is to get leverage below three times. And I will say that we expect that by year-end we’ll be able to accomplish that.

Q: I’m going to ask one more if I may just real quick, and it’s just really I want to finish on a positive note, because obviously you guys, I don’t know how the heck you did it, but you managed to navigate these pipeline issues fairly well it seems relative to our expectations for sure, so congratulations on that. I just wanted to get your perspective looking forward. Do you see any other pipeline issues or challenges ahead of you? Or do you think that we’re pretty much past the worst at this point? I’ll leave it there, thanks.

Range Resources’ President & CEO, Jeffrey L. Ventura: Yeah. Well, thank you, Doug, and I was teasing, very much respect your work and how you do a great job and we appreciate that. And again, take you for the positive comments. It was a very tough quarter. And I give a lot of credit, our marketing team really did a great job and operational team of overcoming two really big issues, you’ll remember, 40,000 barrels per day on Mariner East I is a lot, and that’s a big advantage we have of being able to move those, our products to international as well as 300 million per day on the gas pipeline, and then being able to move that and really almost not miss a beat, keep production up and then beat price across the board for all products. So, great accomplishment by the operations and the marketing teams, so appreciate your comment.

If you look at us, I think we’re in a great position, there’s really only one more major pipeline to come on and that’s Rover, and Rover should be on sometime in the third quarter. So, when you look at infrastructure concerns for Range, they should be behind us. And in fact, if you look in the 2019, we should be in a significantly enhanced and better positioned than we have been and that we won’t be waiting on pipeline projects or expecting pipeline projects, our acreage will be predominantly held, so we’ll have really that much more flexibility as we get into 2019, and it’s great having all those infrastructure projects behind us. We’re now looking at realizations, we’ve been able to increase our expectation for what our NGL barrel will be to the top end of the Range, our gas differentials are coming in, its almost NYMEX pricing, we’re getting condensate for near NYMEX pricing, so it’s great to be in that position where a lot of those infrastructure constraints are behind us and then we get a high quality inventory with the optionality of being able to drill the liquids rich part as NGL prices are, like I said, levels we haven’t seen since 2014 coupled with a really high quality gas acreage.

Q: And then I know this may be tough to quantify, but how should we think about the upside, or I guess downside to maintenance CapEx? Based on the capital efficiencies that you’re capturing via longer laterals and other opportunities? It sounded like the numbers in your plan were fairly conservative.

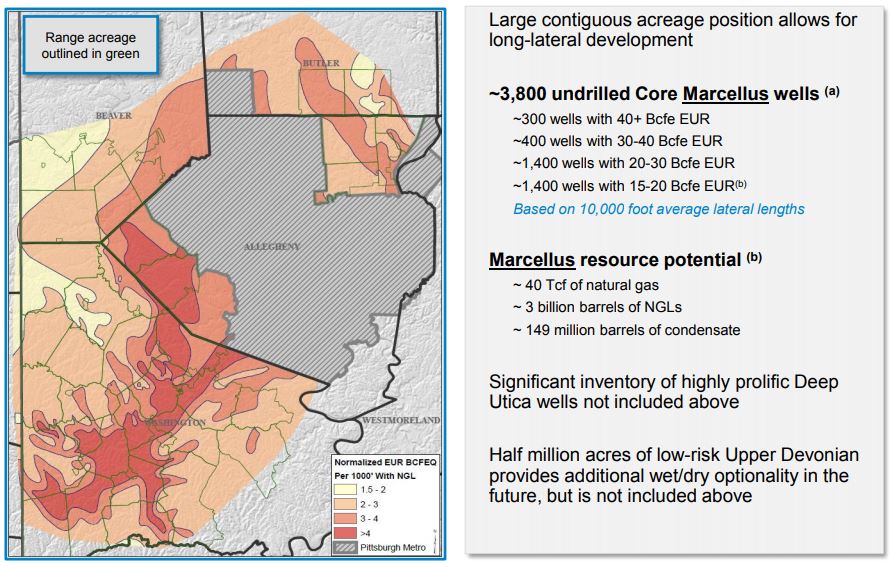

Range Resources’ President & CEO, Jeffrey L. Ventura: Yeah, I mean, don’t know that like you cited, we haven’t quantified it yet to put it out to the market. But clearly, that five-year outlook – we tried to put together something we could meet or beat so we made what we think are reasonable to conservative assumptions really across the board. And lateral lengths, we put in at 10,000 feet, not that that’s our expectation, but that – clearly we’ve been able to achieve that and do that. What you’ve seen for the last several years is lateral lengths continue to migrate longer. Dennis said, we’ve actually stepped out with some really long laterals. So our expectation is that – lateral lengths will increase with time, therefore capital efficiency will get better with time, which should affect maintenance capital in a positive way.

The Oil and Gas Conference®

Range Resources is presenting at EnerCom’s The Oil & Gas Conference® at the Denver Downtown Westin Hotel, Denver, Colo. Aug. 19-22, 2018. EnerCom expects to have more than 80 presenting oil and gas companies and more than 2000 financial professionals attending this year’s conference.

To learn more about the conference and presenter schedule please visit the conference website here.