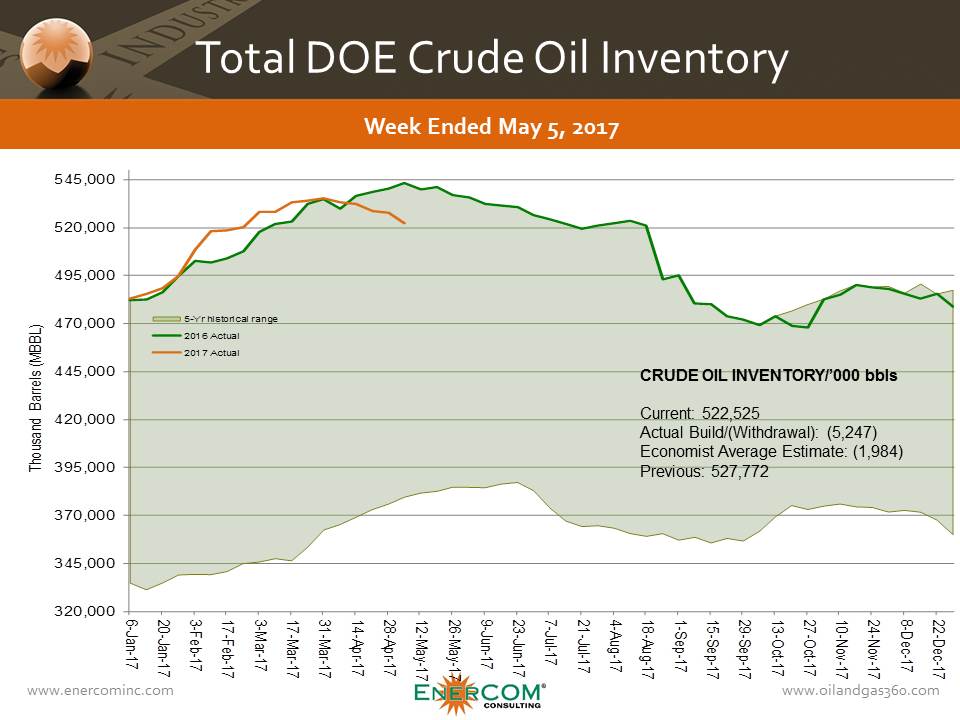

U.S. crude oil stocks at this point in 2017 have dropped below the record highs of 2016. But inventories are still high. So in the face of predicted increasing oil production from shale in 2017, rebalancing inventories will be difficult, if it is even possible.

However, a rebalance is still plausible according to an RBC Capital Markets report that identified several possible ways a drawdown of inventories could be in the cards.

By the numbers

According to the EIA, the current crude oil inventory is over 522.5 million barrels. This is 4% below the 543.4 million barrels in storage at this time last year, but is still 19% more than the five-year average for this point in the year. The present resurgence in drilling activity suggests that U.S. production will soon increase, driving inventories higher.

Increased refinery runs are quickest way

According to RBC, refinery runs are the primary driver of inventory drawdowns, but they are the worst way to sustain a rebalancing. Refinery runs have picked up since the price recovery, and are currently more than 1 MMBOPD higher than typical historic levels. While this accelerated rate can certainly drain inventories quickly, it only changes the problem, it does not solve it RBC says.

Refineries going full-bore will certainly relieve the crude oil glut, but would create a surplus of gasoline and other products leading to a backlog of those products and less need for crude to be processed in refineries.

However, this is less of a factor than it was in the past.

RBC reports that U.S. gasoline exports have reached record levels in the last few months. The U.S. is exporting gasoline about 250 MBPD faster than average, providing a second draw on inventories. Most of these exports are to Central and South America, particularly Mexico. Mexican refinery runs are decreasing steadily, leaving a vacuum for U.S. refined products.

Decreasing imports: the preferred driver of change

Decreasing U.S. imports will also reduce the inventory glut, and is RBC’s preferred driver of change. Decreasing the amount of oil moving into the U.S. will make working through the current inventory significantly easier.

U.S. imports of crude oil have risen since the price downturn, as OPEC producers increased production.

While imports have been trending lower in recent months, the startup of the Dakota Access Pipeline may change this trend. DAPL will transport oil from the Bakken to the Gulf Coast, replacing rail transport to the East Coast. The decrease in light oil to East Coast refiners may result in increased imports of comparable West African crude. According to RBC, the easiest way to remedy this situation would be to transport oil from the Gulf Coast inventories to the undersupplied East Coast, but this would require the use of Jones Act tankers.

One widely acknowledged consequence of the Jones Act is that the US-built fleet is considerably older than the global, non-US built fleet, Maritime Executive reported.

The top ten shipowners are tanker companies or the tanker arms of oil majors, the magazine reported in a March 2016 article. “The current most valuable U.S. operated fleet is that of American Shipping Co., a Norwegian public company controlling a fleet of ten MR2 tankers built at Philly Shipyard and leased out to OSG, which charters them to Jones Act qualifying companies. VesselsValue estimates this fleet is worth $830 million. The second most valuable US fleet belongs to new entrant American Petroleum Tankers, a subsidiary of Kinder Morgan Terminals, with its fleet operated by Crowley Maritime. This fleet will be supplemented by the MR tankers currently on the orderbook of NASSCO. However, in the last twelve months the US orderbook has been very quiet, with no bulker, tankers or gas carrier orders placed.”

Increase U.S. crude exports would decentralize the oil glut

A sure way to eliminate or at least chip away at U.S. crude inventories is to export crude elsewhere.

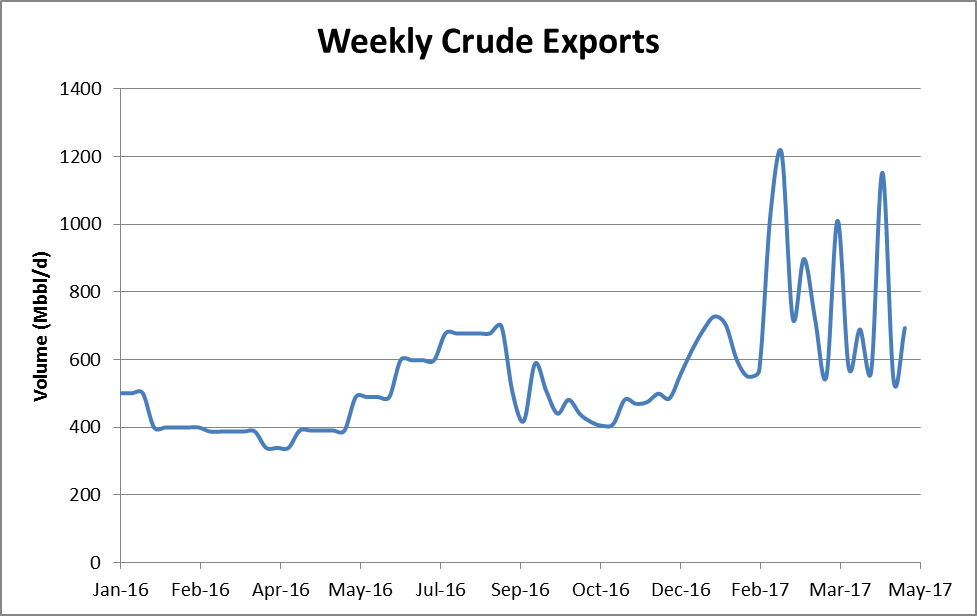

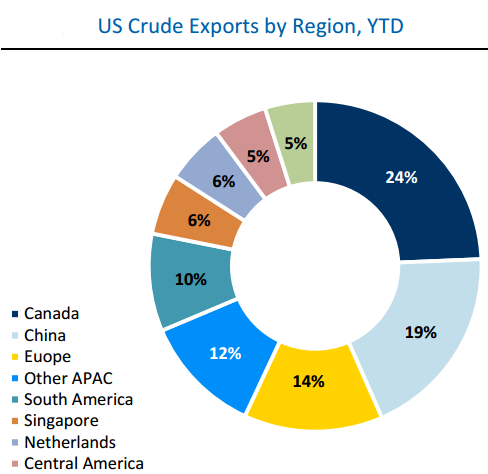

Exports have increased significantly since the U.S. repealed its 40-year-old crude oil export ban in late 2015. Crude exports this year have averaged 820 MBOPD, up 320 MBOPD from last year’s export levels.

Significant volumes have gone to Singapore and the Netherlands, other storage hubs. Exports to these locations are the result of arbitrage opportunities, rather than a fundamental change in demand. This explains the significant variability in weekly exports of crude from the U.S.

Nevertheless, any exports would help relieve the U.S. glut, and likely help overall crude prices, as oil traders are closely watching the U.S. supply situation.

IEA weighs in today

The IEA put out its monthly Oil Market Report May 16.

“Looking at 2Q17, if we assume that April’s OPEC crude oil production level of 31.8 mb/d is maintained, and nothing changes elsewhere in the balance, there is an implied stock draw of 0.7 mb/d. Adopting the same scenario approach for the second half of 2017, the stock draws are likely to be even greater,” the IEA said.

“Even if this turns out to be the case, stocks at the end of 2017 might not have fallen to the five-year average, suggesting that much work remains to be done in the second half of 2017 to drain them further. In addition to production cuts and steady demand growth, a major contribution to falling crude stocks in the next few months will be a ramp-up in global crude oil runs. Starting in March, refinery activity is building up and by July global crude throughputs will have increased by 2.7 mb/d.”

The IEA declared U.S. crude oil production to be the most closely watched data point on the supply side, echoing many other energy analysts.

“In February, it increased again, this time by nearly 200 kb/d and, at 9.03 mb/d, was the highest since March last year. After bottoming out in September, output has increased by nearly 465 kb/d. In line with stronger recent performance from the U.S. shale sector we have revised upwards our expectation throughout 2017 and we now expect total US crude production to exit the year 790 kb/d higher than at the end of 2016, which is an upward revision of 100 kb/d since last month’s report.

“Such is the diversity and dynamism of the US shale sector that our numbers are likely to be a moving target as 2017 progresses. The overall outlook for the non-OPEC countries, eleven of which are voluntarily cutting production to support OPEC, shows growth in 2017 of nearly 600 kb/d, an increase on the 490 kb/d seen in last month’s report.

“While compliance with the agreed production cuts by OPEC and the eleven non-OPEC countries has generally been strong, we need to keep a close eye on Libya and Nigeria where there are signs that production might be rising sustainably. According to preliminary data, Libyan production reached 800 kb/d in May, the highest level since 2014, and any significant increase clearly offsets cutbacks by other OPEC and non-OPEC countries.

“As for demand, we have left unchanged our headline growth number for 2017 at 1.3 mb/d,” the report said.