NBL, PDCE, REN, WPX and EOG are county’s best producers

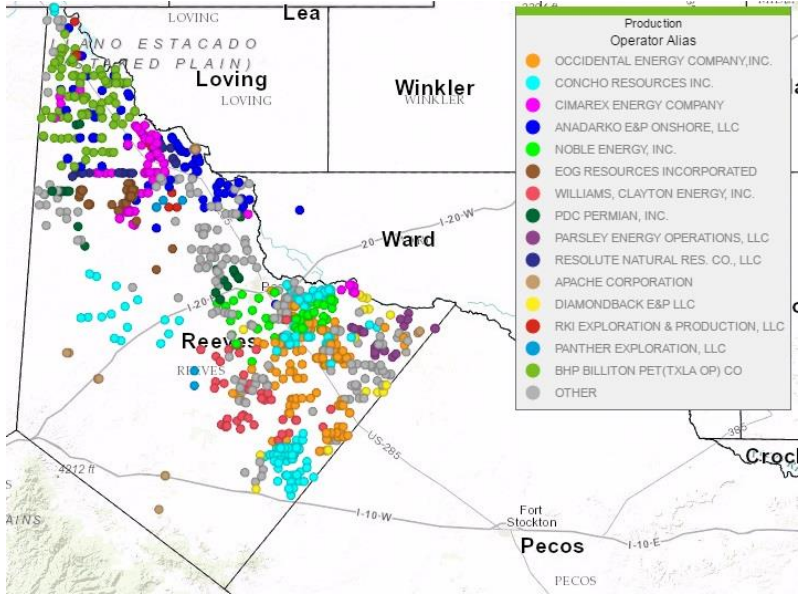

Reeves County, Texas is currently the most active county in the U.S. by rig count, as it lies near the heart of the massively popular Delaware Basin. Capital One released a “deep dive” into this county today, identifying the best producers in the area.

According to Baker Hughes, there are 58 rigs currently drilling in Reeves County, 6.4% of the total U.S. wells online currently. According to IHS, a total of 130 wells have been drilled in the county since the beginning of January and have at least six months of production data.

According to Capital One, the top five operators in the basin are:

- Noble Energy (ticker: NBL),

- PDC Energy (ticker: PDCE),

- Resolute Energy (ticker: REN),

- WPX Energy (ticker: WPX) and

- EOG Resources (ticker: EOG).

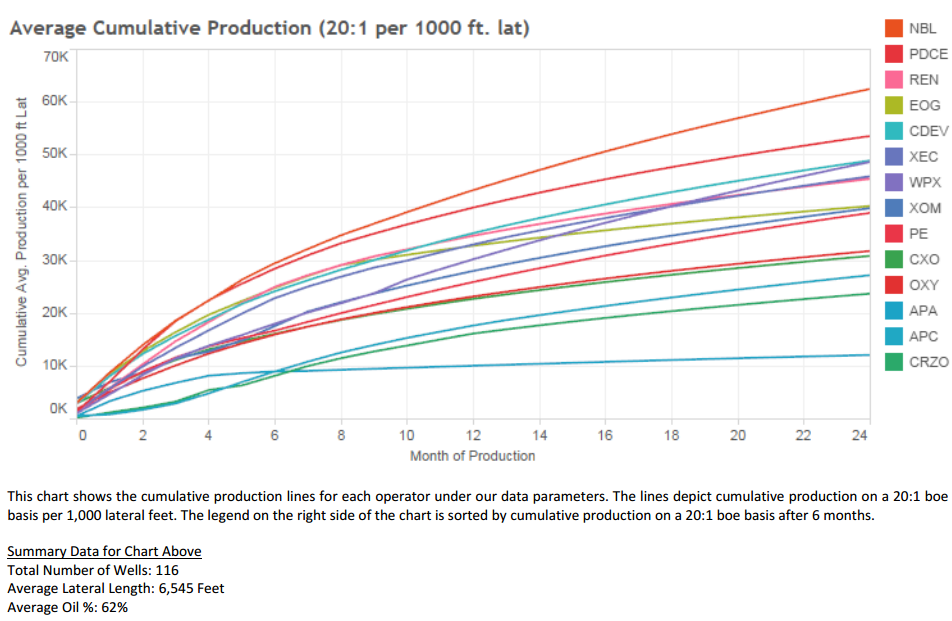

This ranking is based on average 6-month cumulative production per 1000’ lateral for all wells drilled in the county since January 1, 2016.

Importantly, Capital One calculates BOE on a 20:1 basis, rather than the standard 6:1 basis. This is done to examine the economics of these wells rather than the equivalent energy output.

It is notable that there are not many wells to base this conclusion on. Only 26 wells from five top companies combined meet the criteria for production history. WPX, in particular, has only drilled two wells in Reeves County since the beginning of last year that have at least six months of production data.

According to IHS, Noble Energy’s Calamity Jane 2101H has had the best six month production of any recent well in Reeves County. This well was brought online in the second quarter of 2016, with a reported maximum IP rate of 2,541 BOEPD. Over the first six months of production Calamity Jane produced about 1,020 BOPD. Noble, Cimarex (ticker: XEC), PDC and Resolute account for the top ten best wells in the basin.

Long laterals no guarantee of success

When expressed as BOE/1000’lateral, it seems that longer laterals do not necessarily ensure that a well will be more productive. The 1st, 2nd and 4th best producers in the basin each have average lateral lengths below 6’000. On the other hand, Resolute and EOG, the 3rd and 5th best producers, have the longest average wells in the basin.

The individual well results reflect this result. The best well in the basin has a 4,859’ lateral. The 7th best well, drilled by PDC, has merely a 1,900’ lateral. This is truly tiny in the age of 10,000’ lateral wells. However, this ranking is only based on 20:1 BOE produced per 1,000’ lateral over the first six months of operation. Companies often turn to longer laterals as a cost saving measure, as it is often cheaper to drill one long well instead of two shorter wells.

EnerCom posts weekly data comparisons for approximately 200 publicly traded E&P companies. The chart below looks at some of the 35 data points that EnerCom publishes on a weekly basis, specifically for the five Delaware basin operators in the Capital One report.

| Market Cap | TTM Prod | Debt / | P/CFPS | Stock Performance |

|

| ($MM) | (MBoe/d) | Mkt Cap | 2017 | 6-Months | |

| EOG Resources Inc | $54,667 | 981.3 | 13% | 8.7x | 4% |

| Noble Energy Inc | $13,602 | 420.6 | 53% | 5.1x | -13% |

| PDC Energy Inc | $3,504 | 60.8 | 30% | 3.9x | -16% |

| Resolute Energy Corp | $912 | 14.2 | 58% | 3.3x | 59% |

| WPX Energy Inc | $4,863 | 84.8 | 53% | 4.6x | 1% |