-

Plans US$7.1 Billion in Divestitures

-

Spending Cuts of 38%

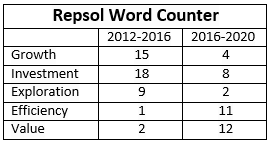

Madrid-based Repsol (ticker: REPYY) touted value creation, efficiency and a significant divestiture program in its 2016-2020 Strategic Plan, unveiled on October 15, 2015. The latest program starkly contrasts its 2012-2016 Strategic Plan, which focused on “high growth of Upstream” and a dedicated investment of more than €19 billion.

Repsol kicked off its divestiture program yesterday by selling $800 million of Alaska assets to

privately held Armstrong Oil & Gas, based in Denver. Click here for OAG360®’s feature article.

2012-2016 Plan: What was Accomplished

The landmark announcement from the company’s five-year plan was the $13 billion acquisition of Talisman Energy in December 2014, expanding Repsol’s presence to more than 50 countries worldwide. The merger achieved virtually all of the company’s growth goals; its production and reserves increased by 76% and 55%, respectively, and boosted Repsol’s footprint in North America. The company was also well-positioned to make the acquisition, as a subhead in a November 2014 press release said financial strength and debt was at a record low. A $6.3 billion divesture of its stake in YPF added to Repsol’s liquidity.

Commenting on the Talisman acquisition, Miguel Martinez, Chief Executive Officer of Repsol, said the company expected to be at 1.7x net debt to EBITDA in 2017.

Click here for Repsol’s 2012-2016 Strategic Plan Presentation

Click here for Repsol’s 2012-2016 Strategic Plan Presentation

2016-2020: A Game Change

The first bullet point in the newest strategic plan acknowledged the low oil price environment, and followed by stressing the importance of generating returns in a margin-restricted environment. The company detailed its commitment to the dividend and credit rating, and its five-year plan aims to break even on cash flow after dividends at Brent prices of $50/barrel.

Repsol intends to divest about $7.1 billion (€6.2 billion) in assets, ultimately padding its balance sheet and assuring dividend payouts. Repsol’s dividend currently equates to one euro/share annually, or 5.7% – second only to ENI (ticker: E) among European oil companies. The company anticipates selling the first half of its divestiture goal by year-end 2017 and the remaining half from 2018 to 2020. An additional $2.4 billion (€2.1 billion) are expected to be realized through synergies in 2018, as the company continues to integrate the Talisman purchase.

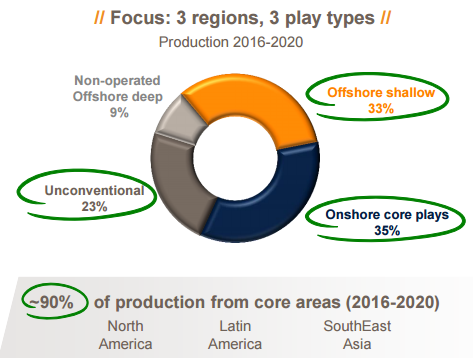

Moving forward, its upstream program will focus on North America, Latin America and Southeast Asia. The three regions are forecasted to provide 90% of company volumes through 2020. Latin America will account for the bulk in the near term, delivering an estimated 360 MBOEPD in 2016 (57% of volumes from the core areas). North America is expected to produce 180 MBOEPD from plays like the Duvernay, Eagle Ford, Marcellus and Midcontinent. Other operations exist in Africa, Europe, Russia and Brazil.

Click here for Repsol’s 2016-2020 Strategic Plan Presentation