Fattens Resolute’s Delaware footprint 28%, adds 112 Wolfcamp A and B locations

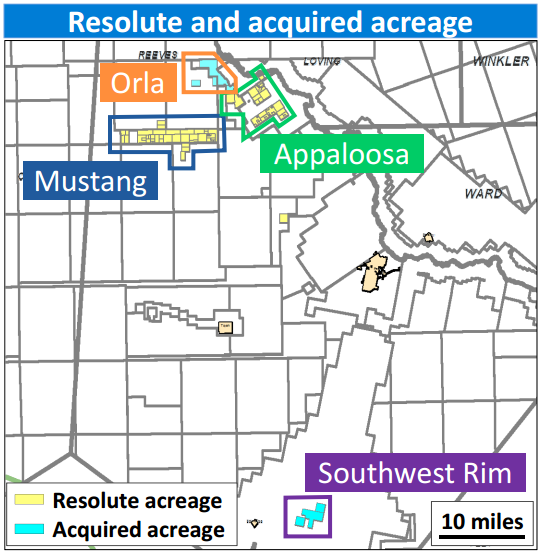

Resolute Energy (ticker: REN) announced today the acquisition of 4,600 net Delaware basin acres for $160 million. In addition to the acreage, Resolute also acquired 800 BOEPD of production, six drilled but uncompleted wells and one well currently being drilled. The transaction will increase Resolute’s Reeves County holdings by 28% to 21,000 net acres. The acquisition is scheduled to close on May 15, 2017.

About half of the acquired acreage is adjacent to Resolute’s existing acreage. The company estimates that this acreage can support 112 gross locations targeting the Wolfcamp A and B, with additional drilling potential for targeting the Wolfcamp X/Y and C. All the existing wells in the transaction are located in this section of acreage.

The second half of the acquired acreage is farther south in Reeves county. This acreage is near multiple successful Wolfcamp wells and is believed by Resolute to have excellent development potential.

This acquisition has accelerated Resolute’s development plan for its Reeves county acreage. The company expects to complete the DUC wells immediately after transaction close. A third rig may be added later in the year to support development.

Spacing tests targeting 16-24 wells/section

Resolute’s Delaware basin activity is currently focused on producing from the Wolfcamp A and B formations. Significant infill drilling potential exists, though, and is currently being tested by the company. While current drilling plans prescribe a total of eight wells per section, Resolute is testing spacing of 16 to 24 wells per section. Future drilling may target the Wolfcamp X/Y, C and D.

The contiguous nature of the acquired acreage will allow the drilling of longer laterals, improving economics. On current nearby Resolute acreage, a 7,500’ lateral well will produce an IRR of about 60%, while a 10,000’ lateral well has an IRR of 125%.