Rice Energy (ticker: RICE), an independent E&P focused purely in the Appalachia, commenced an initial public offering (IPO) for its midstream unit on December 17, 2014. Rice Midstream Partners LP will trade on the New York Stock Exchange under the ticker RMP. Rice was a privately held company less than one year ago and now has two entities listed on the NYSE, following an IPO in January and the completion of its midstream spinoff today.

Rice management has spoken of its MLP intent for the past few months, including during its Q2’14 conference call in August.

“We believe MLP structure is more suitable for these assets’ risk and cash flow profile and, therefore, would be more appropriately eliminating these assets’ value,” said Grayson Lisenby, Chief Financial Officer, in its most recent Q3’14 conference call. “The MLP also provides a better vehicle to fund midstream development, pursue third-party opportunities and monetize Rice Midstream assets while retaining operational control. And we think operating our midstream has been a huge differentiator for our upstream development to-date.”

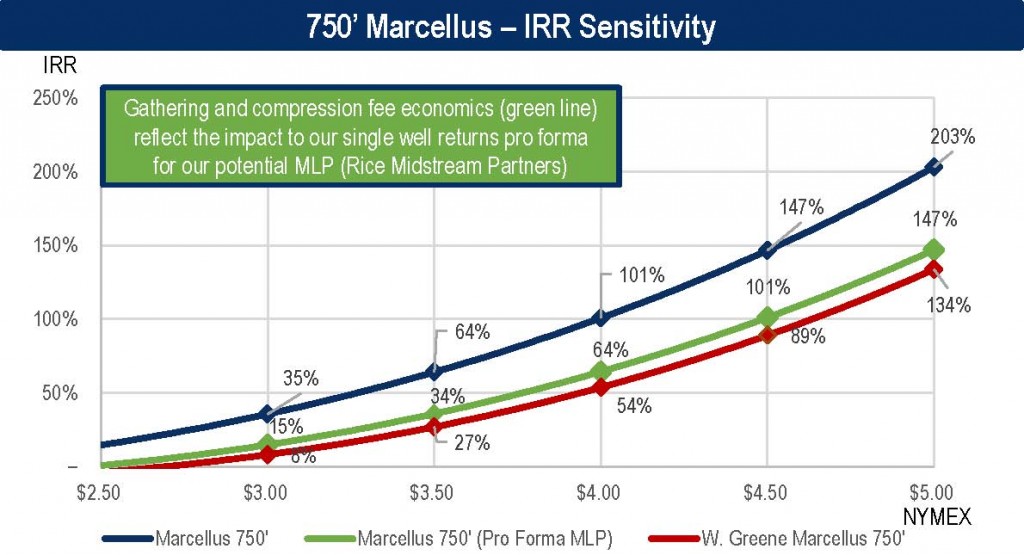

Source: RICE Q3’14 Presentation

Rice Midstream Debut

RMP offered the public 25 million common units with an additional 30 day option for 3.75 million units, amounting to 43% and 50% of the company, respectively. Rice Energy will retain ownership of the remaining interest. The price was expected to be $19.00 to $21.00, but was later revised to $16.50 and resulted in net proceeds of $383.7 million ($413.9 million if the additional units are allotted).

The units closed at $16.30 in its first day of trading.

Source: RICE Q3’14 Presentation

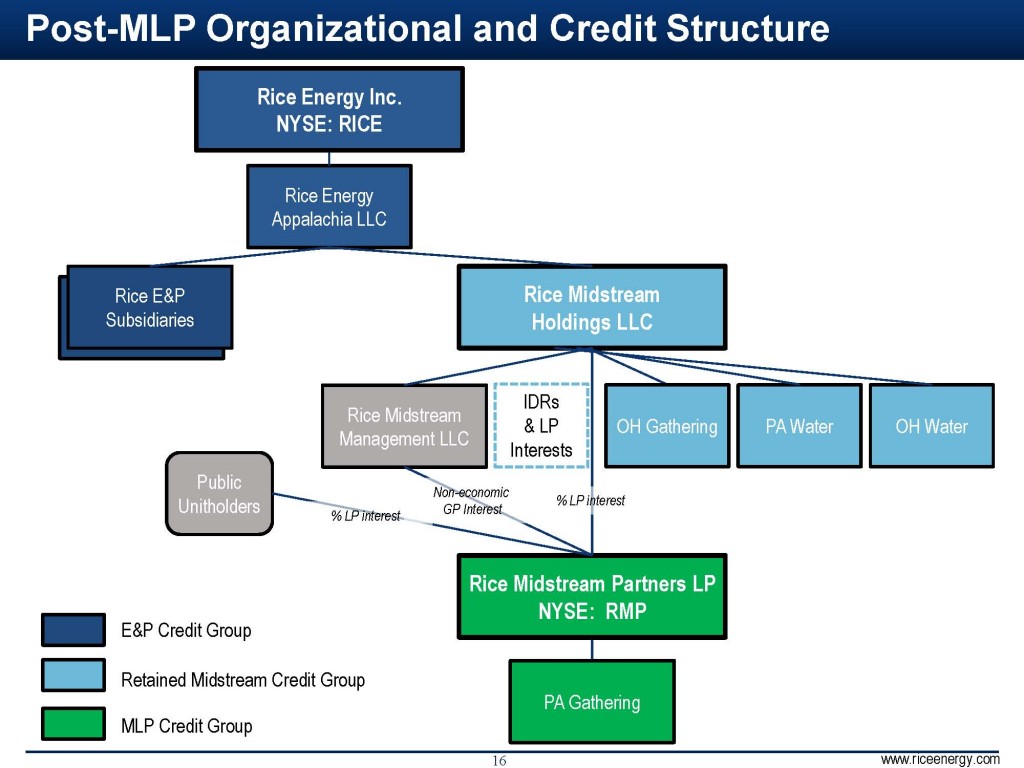

Lisenby detailed the MLP’s assets in the Q3’14 call, saying: “Our announced MLP will fund the dropped Pennsylvania gathering assets with its own credit facility. And second, all retained midstream assets consisting of Ohio gathering, Pennsylvania and Ohio Water will be placed under a new wholly-owned midstream entity and funded with a new midstream credit facility. This midstream entity will charge Rice E&P a gathering fee, similar to what we’ll have in place with the gathering assets designated for the MLP.”

The midstream assets acquired by Rice within the last year has opened up exposure to Gulf Coast pricing. Management said Appalachia gas spot prices traded at a $1.50/Mcf discount to the Henry Hub in September, but its transportation services allowed each Mcf to be shipped for $0.45/Mcf, resulting in uplift of more than $1.00/Mcf. The company expects 50% of its volume to receive Gulf Coast pricing in Q4’14, increasing to 60% of volumes in 2015.

Capital One Securities issued a review of the Marcellus/Utica in a note on December 17, 2014, following their conference in New Orleans. It reads: “The precipitous decline in oil pricing that preceded the conference continued throughout its duration. As a result, gassy names in the Utica and Marcellus began to look more attractive than their oily peers on a relative basis. While oil producers have been and will continue to be slashing CAPEX and corresponding growth plans, names like GPOR, RICE, REXX, and RRC can continue to post reasonable (20% – 25% growth for RRC) and in some cases tremendous (around 100% for GPOR and RICE) growth for 2015. Differentials in the play put it at a disadvantage to Rockies producers for existing production, but for companies with sufficient firm transport in place the impact is muted. Pricing and take-away from the Northeast basins will continue to drive the bus for another couple of years, but with giant wells like RRC’s most recent result in PA’s deep Utica (59 MMcfe/d IP) the economics here will win out over time.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.