Utica/Point Pleasant well sets Appalachia record

Range Resources (ticker: RRC) announced today its 2015 capital budget and initial results from its Utica/Point Pleasant well located in Washington County, Pennsylvania.

Range has set its 2015 capital budget at $1.3 billion, a decrease of 18% versus its 2014 capital budget. The company said that the decrease is a result of improving capital efficiencies from its Marcellus activities. According to the company’s Q3’14 quarterly report, Range will drill approximately 12% of its Marcellus wells in 2014 on existing pads, avoiding the estimated cost of $850,000 for building a new pad and road at each location. Drilling efficiencies also continued with the cost per lateral foot in the Marcellus decreasing by 15% in 2014 to $472 per lateral foot from $553 per lateral foot.

The 2015 capital budget includes approximately $1,065 million for drilling and recompletions, $155 million for leasehold and renewals, $55 million for pipeline tie-ins and facilities and $25 million for seismic and other costs. By division, the 2015 budget is approximately 92% directed to the Marcellus, 4% Southern Appalachia and 4% Midcontinent.

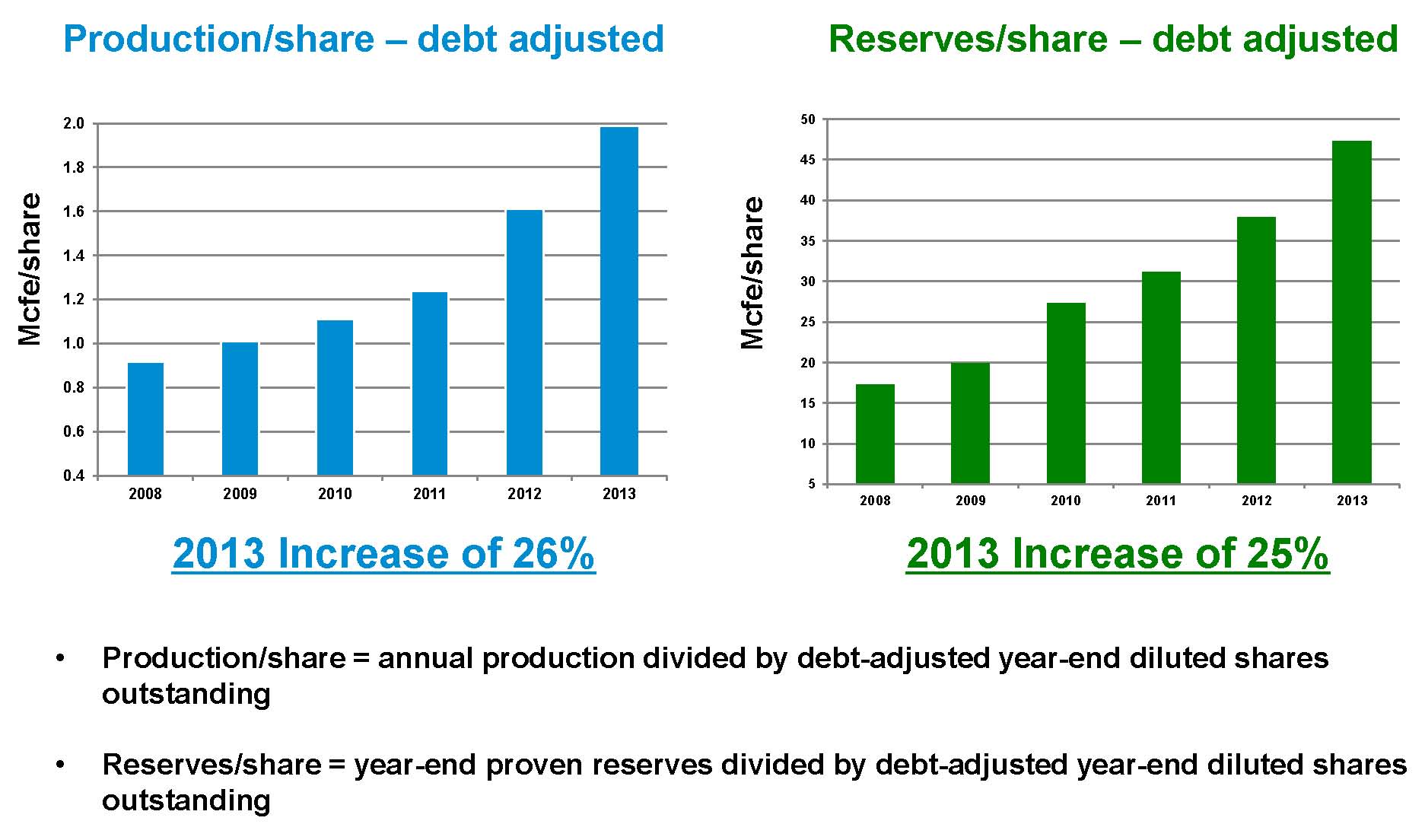

The company plans to continue to deliver line of sight production growth in the 20% to 25% range despite the reduction in its capital budget.

According to the company’s Q3’14, production growth for 2014 is targeted at 25% year-over-year. Average daily production for Q4 is expected to be approximately 1.35 Bcfe/d, with 30% liquids.

Range’s Utica/Point Pleasant well sets Appalachia record

The company also announced that its Utica/Point Pleasant well, which Range owns 87.5% of, and is located in Washington County, Pennsylvania, achieved an average 24-hour test rate of 59.0 MMcf/d against simulated pipeline pressure and conditions during the initial flow back. The well was drilled and cased to a true vertical depth of 11,693 feet with the 5,420 foot horizontal lateral completed with 32 frac stages. The initial production (IP) rate equates to a 10.9 MMcf/d IP rate per 1,000 foot of lateral. The company believes that this is a record for any horizon drilled in the Appalachian Basin and also represents the highest IP rate of any Utica well. The previous unofficial record was set by Magnum Hunter Resources (ticker: MHR) on its Stewart Winland 1300U well in October, which tested at 46.5 MMcf/d and was drilled in Tyler County, West Virginia.

Range has a current leasehold position of approximately 400,000 net acres in the southwest Pennsylvania area which it considers as prospective for the Utica/Point Pleasant. The well is currently shut-in for approximately 90 days while facilities are completed. Afterwards the well is expected to be produced under facility-constrained conditions.

Commenting on the announcements, Jeff Ventura, Range’s President, CEO and newly appointed Chairman of the Board, said “We are very excited about the initial test results of our Utica/Point Pleasant well. Given our 400,000 net acre acreage position in the area, coupled with existing well control and 3D seismic, we believe this translates into significant potential. Being able to drill additional Utica wells on the same locations as our Marcellus wells should further enhance our capital efficiency for many years to come.”

Closing on a Banner Year

In the company’s Q3’14, Range reported $616.62 million in total revenue and other income, representing a 39% year-over-year increase from $442.04 million in Q3’13. Range also reported total costs and expenses of $376.66 million, down 8% from $410.99 million in Q3’13. “[Our] capital efficiency improvement coupled with our favorable hedge position and strong balance sheet gives us confidence that we can deliver substantial shareholder value in 2015 despite the challenging commodity price environment,” said Ventura.

The company reported $350.3 million in net income ($2.10 per basic share) for the nine months ended September 30, 2014. RRC posted net income of $87.5 million ($0.53 per basic share) for the same period in 2013. Total costs and expenses declined by 2% despite the production increase.

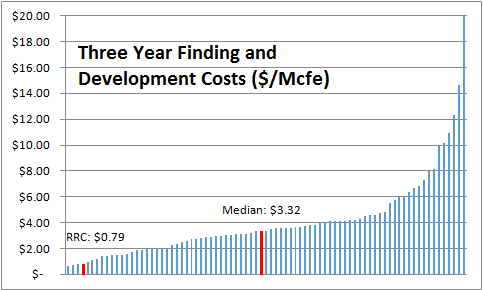

The ability to boost returns while maintaining expenditures has RRC well positioned for 2015. Range currently has a debt to market cap level of 33%, which is well below the median of 91% when compared to its 87 peers in EnerCom’s E&P Weekly database. Its finding and development costs (on a three-year basis) are the fourth-lowest in the entire group, with a cost of $0.79/Mcfe.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.