Delaware acquisition complete, doubles Rosehill Resources’ Delaware acreage

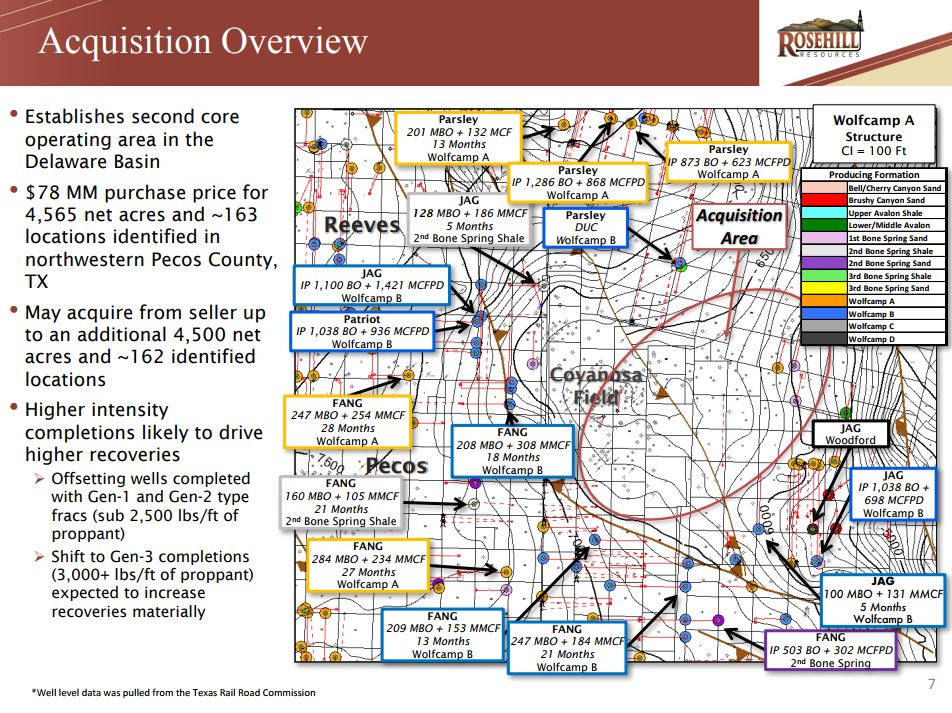

Rosehill Resources Inc. (ticker: ROSE) has completed its previously announced acquisition of 4,565 net acres and certain producing oil and gas properties in the Southern Delaware basin for $78 million.

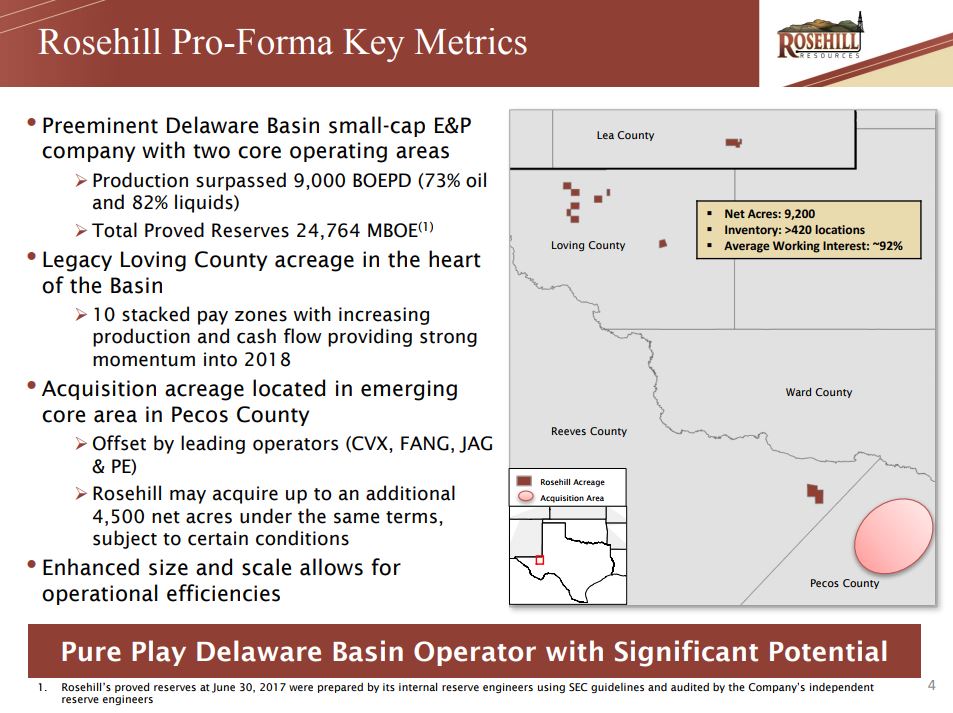

This transaction nearly doubles the company’s total net acreage to 9,200 net acres, with the potential for additional acreage acquisitions through March 8, 2018, under the terms of the agreement.

Additionally, the company announced its 2018 guidance and preliminary 2019 forecast.

For a detailed breakdown of the deal, see Oil & Gas 360®’s initial coverage.

Highlights

- Acquisition acreage has a high average working interest of approximately 86% with all acreage held by production or by lease term through at least 2020

- Increases horizontal drilling potential by over 160 gross locations on the initial acreage, with opportunities in multiple Wolfcamp A, Wolfcamp B, and Bone Spring horizons. Additional upside potential from deeper Wolfcamp and Woodford horizons, and from shallower Avalon horizons

- Establishes second core operating area in the Delaware Basin in northwestern Pecos County and enhanced size and scale allows for operational efficiencies

- Contiguous acreage position enables 7,500 to 10,000 foot laterals, which can significantly improve well economics

- 2018 production and Adjusted EBITDAX guidance up over 175% and 225%, respectively, compared to the midpoint of 2017 guidance

- Preliminary 2019 production and Adjusted EBITDAX forecast provides growth of 50% over midpoint of 2018 guidance

- 2018 capital investment program of $350 million to $375 million (approximately 80-85% to fund drilling and completion)

- Surpassed 9,000 net BOEPD of production in early December (73% oil and 82% total liquids), while continuing completion and first production activities on six additional wells

Rosehill President and CEO Alan Townsend said, “We are excited to close the acquisition of the initial identified acreage in Pecos County. This acquisition provides meaningful growth to our portfolio by nearly doubling our acreage and drilling locations, with further growth through additional acreage purchases from the seller over the next 90 days. We are very encouraged by continued improvement in offset operator results and our geological assessment indicates an anomalously thick Wolfcamp A/B interval in and around the acquisition area.”

Townsend added, “We continue to see strong early results from our operational activities in Loving County. Our recent production rate of over 9,000 BOEPD, has us on target to surpass 10,000 net BOEPD as we enter into 2018.

“We believe there is tremendous upside in our Delaware Basin assets and we remain focused on delivering value-adding growth by executing on our plan. Our operational plan for 2018 and preliminary forecast for 2019 is fully funded within existing liquidity and anticipated growth in our borrowing base.”

Acquisition financing – additional funds available for more acreage

The company secured financing for the transaction from certain private funds and accounts managed by EIG Global Energy Partners, LLC. The financing package includes a $100 million senior secured second lien note and $150 million of redeemable Series B preferred stock, with an additional $50 million in redeemable Series B preferred stock to be issued at the company’s option.

The proceeds were used to fund the acquisition of the initial identified 4,565 net acres, to fully repay all amounts outstanding under the company’s revolving credit facility, and to pay related financing costs. The remaining proceeds will be used to fund any portion of the additional acreage the company may acquire as part of the transaction and to fund capital development.

The secured second lien note has an interest rate of 10% per annum to be paid quarterly in cash and was issued at 97% of par. The note matures in January 2023 and can be prepaid at Rosehill’s option.

The Series B preferred stock has a dividend rate of 10% per annum to be paid quarterly in cash, with a company option to pay the dividend in kind up to 40% of the first four quarterly dividends. The Series B preferred stock is redeemable at any time at Rosehill’s option at various return thresholds and at EIG’s option after the sixth year outstanding and under other certain circumstances at the same return thresholds.

KLR Group, LLC acted as financial advisor to the company. Vinson & Elkins L.L.P. acted as legal counsel to the company in connection with the acquisition and related financing, and Haynes & Boone, LLP acted as legal counsel to the company in connection with related revolving credit facility matters. Kirkland & Ellis LLP acted as legal counsel to EIG.

2018 guidance and preliminary 2019 forecast

Rosehill’s projections for the fiscal years ended December 31, 2018 and 2019 are provided below. The 2018 guidance assumes the company will utilize a two-rig drilling program for the first three quarters of 2018, with a third rig to be added during the fourth quarter, and a dedicated frac crew for the full year.

The preliminary 2019 forecast assumes the company will continue to utilize a three-rig drilling program and a dedicated frac crew. The company expects to drill between 50 and 54 wells in 2018, completing between 42 and 46 wells. The company expects to enter 2018 with six to eight drilled uncompleted wells (DUCs) and to exit 2018 with 12 to 16 DUCs.

A presentation updated with additional details regarding the closing of the acquisition is available here.

An exclusive Oil & Gas 360® video with Alan Townsend from the 2017 EnerCom conference may be viewed here.