Moscow insists on payment up front

Late last week, the EU, Russia and Ukraine struck a long awaited deal to supply Russian gas to Ukraine and Europe this winter.

“EU officials said both Russia and Ukraine had bargained hard for commitments from the Western bloc,” according to Reuters, “with Moscow looking for EU cash to help Ukraine pay off debts to Gazprom (ticker: GAZP) and the Kiev authorities anxious to get a deal that they could present to domestic voters as not overpaying for vital Russian supplies.”

“EU officials said both Russia and Ukraine had bargained hard for commitments from the Western bloc,” according to Reuters, “with Moscow looking for EU cash to help Ukraine pay off debts to Gazprom (ticker: GAZP) and the Kiev authorities anxious to get a deal that they could present to domestic voters as not overpaying for vital Russian supplies.”

Moscow said Ukraine would pay $378 per 1,000 cubic meters to the end of 2014 and $365 in the first quarter of 2015 and that Kiev’s debt of $1.45 billion would be paid immediately and a further $1.65 billion paid by the end of the year. Ukraine’s Naftogaz company has set aside $3.1 billion in a special escrow account to pay the debt, Reuters reported.

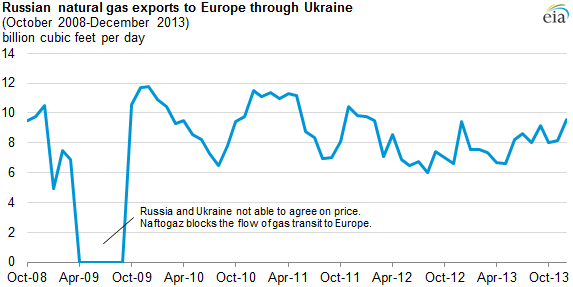

Russia provides around a third of the European Union’s natural gas, roughly half of which is pumped via Ukraine. Ukraine gets about half of its own natural gas from Russia each winter. Natural gas sales generate about 20% of Russia’s budget annually. Russian Energy Minister Alexander Novak insisted Ukraine pay up front for new deliveries.

Two major pipeline systems carry Russian gas through Ukraine to Western Europe—the Bratstvo (Brotherhood) and Soyuz (Union) pipelines, according to the EIA. The Bratstvo pipeline crosses from Ukraine to Slovakia and splits in two to supply northern and southern European countries. The Soyuz pipeline links Russian pipelines to natural gas networks in Central Asia and supplies additional volumes to central and northern Europe. The Trans-Balkan Pipeline delivers Russian natural gas to the Balkan countries and Turkey through Ukraine.

In the past, as much as 80% of Russian natural gas exports to Europe transited Ukraine. This number has fallen to 50%-60% since the Nord Stream pipeline, a direct link between Russia and Germany under the Baltic Sea, came online in 2011, according to EIA data.

EU members plus Turkey, Norway, Switzerland, and the non-EU Balkan states, consumed 18.7 trillion cubic feet (Tcf) of natural gas in 2013, according to EIA data. Russia supplied 30% (5.7 Tcf) of this volume, with a significant amount flowing through Ukraine. EIA estimates that 16% (3.0 Tcf) of the total natural gas consumed in Europe passed through Ukraine’s pipeline network, based on data reported by Gazprom and Eastern Bloc Energy.

The 400,000 BOPD southern leg of the Druzhba oil pipeline transports Russian crude oil through Ukraine to supply most of the oil consumed by Slovakia, Hungary, Czech Republic, and Bosnia. In 2013, about 300,000 BOPD of throughput transited the pipeline. Russian crude oil and petroleum products also transit Ukraine by rail for export out of Ukrainian ports. More than half of the Ukraine’s primary energy supply comes from its uranium and coal resources, with consumption fueled by natural gas (about 40%), coal (about 28%), and nuclear (about 18%), EIA figures show.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.