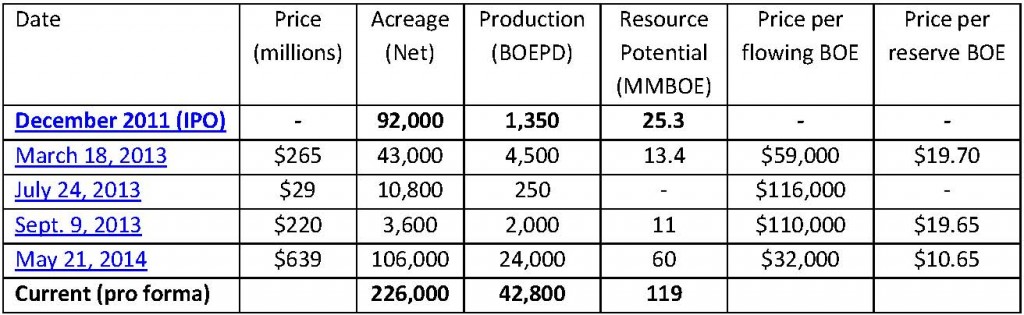

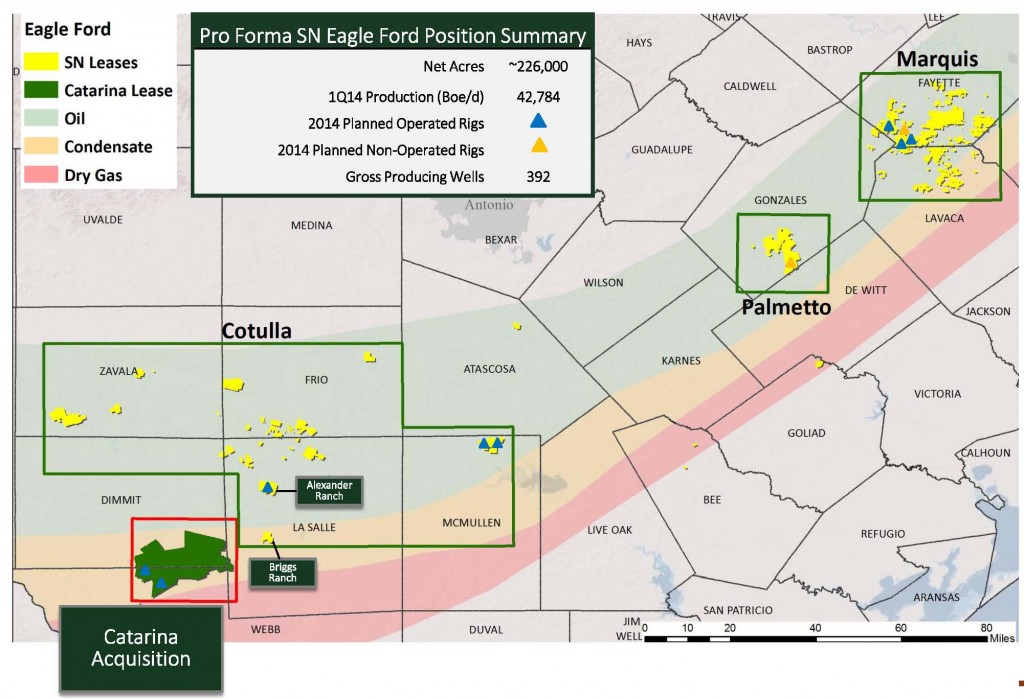

Sanchez Energy Corporation (ticker: SN), based in Houston, Texas, announced a landmark acquisition in its Eagle Ford focus area on May 21, 2014. Sanchez will acquire 106,000 contiguous net acres in the Dimmit, LaSalle and Webb Counties of Texas from Royal Dutch Shell (ticker: RDS.B) for $639 million. The region, which is comprised of acreage Sanchez has named “Catarina,” produced 24 MBOEPD (60% liquids) in Q1’14 and proved reserves are listed at 60 MMBOE.

The Catarina acreage roughly doubles the company’s overall position in the Eagle Ford. Pro forma for the transaction, SN holds 226,000 net acres (113% more than before the transaction) with current production of 42.8 MBOEPD (128% higher than 1Q14). Sanchez’s proved reserves increased approximately 100% to 119 MMBOE from the company’s 2013 year end proved reserves of 59 MMBOE.

Click here for the company’s Catarina Transaction Presentation.

Sanchez’s initial internal estimates place total resource potential from the Catarina at 500 MMBOE. Anadarko Petroleum (ticker: APC) is a neighboring operator and has placed EURs on their acreage at greater than 600 MBOE per well.

In a conference call with investors and analysts, Tony Sanchez, III, President and Chief Executive Officer of Sanchez Energy, said: “This transaction is a catalyst in our strategy to grow through both the drill bit and prudent asset acquisitions. As important, this transaction plays to our demonstrated strengths and track record of making opportunistic acquisitions and using our proven focus and technical capabilities to improve operating results.”

Source: SN May 2014 Presentation

Sanchez and the Evolution of the Eagle Ford

Sanchez had strategically built up acreage in the Eagle Ford through separate transactions, most notably since 2013. Results from the play prompted the company to grow both materially and organically. Its downspacing program in the Palmetto region has been reduced to 40 acres from 60 acres. Despite the multiple acquisitions, SN management said roughly 60% of its 2013 production growth was completed organically. Significant acquisitions are listed above.

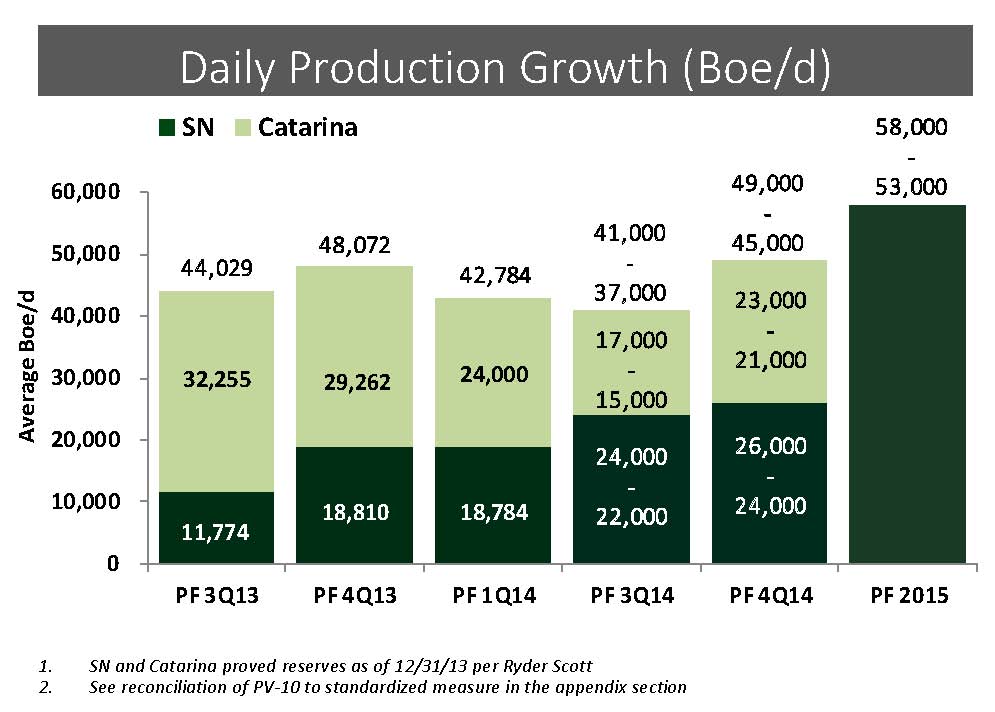

Prior to the transaction, management expected 2014 production to double rates from 2013. Now, with the Catarina in its inventory, current rates of 42.8 MBOEPD are approximately twice Sanchez’s estimated 2014 exit rate of 21 MBOEPD to 23 MBOEPD. Guidance in 2015 estimates production of 53 MBOEPD to 58 MBOEPD.

Source: SN May 2014 Presentation

The Eagle Ford is one of the most prolific hydrocarbon plays in the United States. According to the Texas Railroad Commission, current play production is greater than 800 MBOEPD and nearly 10,000 drilling permits have been issued since 2012. Large operators are jumping into the region with both feet. EnCana Corporation (ticker: ECA) purchased 45,500 net acres in May 2014 for $3.1 billion and Devon Energy (ticker: DVN) spent $6 billion in November 2013 to acquire 82,000 net acres.

Catarina Details

The new assets include 176 operated producing wells and current production is estimated at 20 MBOEPD. Shell had not drilled any new wells in the current year – therefore, SN forecasts a natural decline until Q3’14 when operations will begin to show a positive impact in terms of production increases. Roughly 60% of the properties (36 MMBOE) are classified as proved developed reserves.

Sanchez plans on immediately exploiting 22 wells that have been drilled and cased but are awaiting completion. Another 27 wells are set with surface casing intact. A total of 200 wells locations have been identified and 800 additional locations are expected to be added through appraisal drilling. The existing de-risked wells are expected to last for four years under SN’s current 50 well per year program, which will involve two to three rigs. In the conference call, Sanchez management said most of Shell’s previous wells were drilled into the Upper Eagle Ford, leaving the Lower Eagle Ford in particular a key piece of SN’s future operations.

The 200 Catarina locations are based on 75 to 100 acre spacing. As previously stated, the Palmetto play to the northeast of Catarina is being downspaced to 40 acres, implying initial Catarina spacing may be conservative.

Source: SN May 2014 Presentation

Based on SN’s preliminary unaudited estimates, revenues less direct operating expenses from the acquired properties were approximately $270 million in 2013 and approximately $289 million for the twelve months ended March 31, 2014. Sanchez’s entire revenue less direct operating expenses from Q1’14 was $135 million.

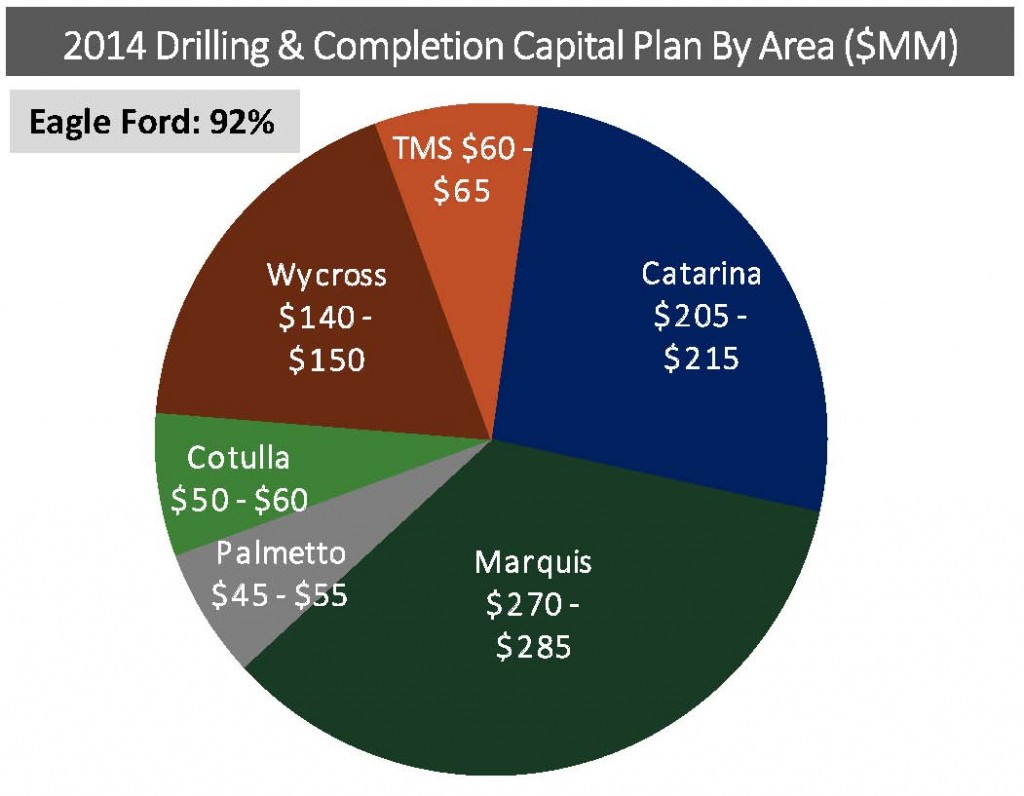

Adjusted Plans

Sanchez will fund the acquisition fully from increased debt commitments, which have been raised to $950 million from $325 million in its recent quarterly earnings release. Its capital plan has climbed to $840 million to $900 million (roughly 30% higher than initial 2014 guidance) and includes six months of the acquired assets, additional leasing and facility increases. During the acquisition conference call, Mike Long, Chief Financial Officer of Sanchez Energy, confirmed that the company is focused on managing its debt to remain near the 2X debt to EBITDA ratio. Furthermore, the company confirmed that the new acquisition will result in “no change to our capital plans for any of our legacy assets,” according to CEO Tony Sanchez.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. A member of EnerCom, Inc. has a long only position in Shell.

Analyst Commentary

Johnson Rice & Company Note (05.21.14)

In addition to the oil and gas assets, Sanchez is getting significant production/midstream infrastructure as part of the deal. While the assets increase Sanchez’s gas exposure (2015 estimate of 52% oil/25% gas/23% NGL, vs 72% oil/13% gas/15% NGL pre-deal), the Company was uniquely positioned to target this asset since its legacy assets were already so weighted to black oil, while a number of other operators are pursuing acquisitions to get more oily. The deal appears attractively priced at less than $11.00/boe of proved reserves and $35,000-$40,000 per daily flowing boe (depending on the production period used) and is highly accretive to EPS, CFPS, production per share and reserves per share, leading to an increased 2015 EBITDA estimate of ~$796 million (up from our prior SN stand-alone estimate of $559 million). Sanchez is trading at an attractive forward 2015 EV/EBITDA multiple of just 4.6x (current EV/EBITDA of 3.6x, assuming debt is used to finance the transaction), in-line with the Eagle Ford peer group despite having a higher 2015 growth rate than its peers (78% vs 17% with acquisition; 34% vs 17% on SN stand-alone basis). We re-iterate our Focus List rating on the stock.