Sanchez Energy Corporation (ticker: SN), based in Houston, Texas, expects to double production in 2014 compared to 2013 and is allocating 90% of expenditures to development in the Eagle Ford Shale. Its growing knowledge of the shale is reducing capital costs, which were reduced by $50 million in an update in March 2014. SN expects to drill and complete 70 wells in fiscal 2014 on a budget of $600 million to $650 million. Approximately 90% of the wells will be drilled from pads and efficiency has increased through fewer drilling days and increased fracing times.

“Moving forward, we will maintain our unrelenting focus on reducing well costs, thereby enhancing the expected return across all of our acreage positions,” said Tony Sanchez, III, President and Chief Executive Officer of Sanchez Energy, in the earnings release.

Sanchez Achieves Company Records in Q1’14 Earnings

Sanchez recorded revenues of $134.6 million (334% increase year over year, 3% quarterly increase) in its Q1’14 earnings release on May 7, 2014. Quarterly production of 1,691 MBOE, or 18,784 BOEPD (72% crude oil), is a slight decrease from Q4’13 totals, but management said the company is currently producing 20,000 BOEPD. Crude is expected to account for 75% of the stream for future operations. The company generated $3.4 million in net income for the quarter with adjusted net income per common share at $0.19. Adjusted EBITDA was up 358% year over year and reached $96.2 million.

Eagle Ford Overview

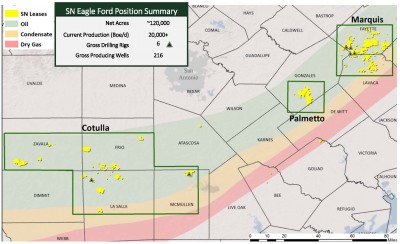

Sanchez prepared to exploit the Eagle Ford by garnering 69,000 net acres through strategic acquisitions. Now, SN is running six rigs (five operated) across its properties and has 216 gross producing wells. An additional 19 wells were being completed at the time of its earnings release. The company has drilled 172 gross wells (80% of its total) since Q1’13 as part of its aggressive development. Production on a BOEPD basis is up 376% for the same period while well costs have decreased by 30%.

Source: Sanchez May 2014 Presentation

Sanchez spud 26 wells (19 operated) in Q1’14 and completed 24 (17 operated) – the majority coming online late in the quarter. An additional 12 wells are expected to be brought online by the end of May with the number climbing to 15 to 20 wells by the end of June. The company plans on spudding and completing 68 net wells in the fiscal year in the Eagle Ford. Downspacing in the Palmetto has been reduced to 40 acres from 60 acres.

Three gross rigs are running in the Marquis block, where Sanchez anticipates spending roughly half of its 2014 drilling budget to spud 35 net wells. SN holds roughly 69,000 net acres in the Marquis and management believes it has de-risked between 35,000 to 45,000 acres of the region. The Marquis is also prospective for new wells. “Recent mapping shows the potential of a minimum of 101 new locations at a conservative 120 acre spacing assumption that were not previously identified,” said Chris Heinson, Chief Operating Officer of Sanchez Energy.

The Tuscaloosa Marine Shale is also in SN’s plans and will account for 10% of its announced budget. The company is currently running one rig in the area and will spud its first operated well later in May 2014. The company plans on spudding four more gross wells before year end and will participate in 10 to 15 wells with a minority interest. Goodrich Petroleum (ticker: GDP), the largest operator in the TMS, produced two wells with a peak 24-hour rate of greater than 1,200 BOEPD within the last year.

Efficiency Opening Doors

Sanchez management said an example of increased efficiencies include 12.8 days to spud to total depth for a 17,000 foot measured depth well (a company record), inclusive of intermediate casing. A three well pad in the Wycross was drilled at less than $3 million per well.

Production costs are dropping due to previously stated pad drilling, extended laterals and zipper fracs. SN management holds its technique in high regard and declined to divulge specific information in a conference call with investors and analysts. Management did, however, place emphasis on the balance sheet and the areas of its laterals. “We don’t think there are any additional cost charges other than few extra days where necessary,” said Sanchez III in the conference call. “What is absolutely critical is staying within our targeted zone in terms of length.”

Effective costs are making areas more viable. Sanchez III said: “Our drilling completion costs per well have been consistently around $6 million for the past two quarters. The implications of our lower cost structure immediate across all of our assets and that what we previously considered marginal of our second tier areas have now become competitive for capital on an internal rate of return basis.”

Source: SN May 2014 Presentation

Stage is Set, Expansion Probable

New formations are becoming prospective for future operations, particularly in the Marquis and Cotulla blocks. The company is evaluating six appraisal wells in the Cotulla focused on the Upper Eagle Ford, and management said Austin Chalk prospects in the Marquis will be drilled in the second half of fiscal 2014. Potential drilling locations may increase as more areas are de-risked.

Acquisitions are still occurring, but are done quietly. Sanchez II said: “we’re not reporting on a regular basis where we’re adding acreage and at what price and that’s purely for competitive reasons and I don’t think that’s going to change. So the short answer is, yes, we’re adding acreage and picking it up, but we’re not going to be specific right now as to where that acreage is being added.”

Guidance rates for Q2’14 are 19 – 21 MBOEPD, which would represent a sequential quarter increase of roughly 6%. Guidance for full year 2014 was reaffirmed at 21-23 MBOEPD – 16% higher than Q1’14 production. SN has hedged roughly half of its production through 2015.

The company enters Q2’14 with liquidity of $436 million with $111 million in cash on hand and plans on maintaining its quarterly dividend rate of $4.2 million.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.