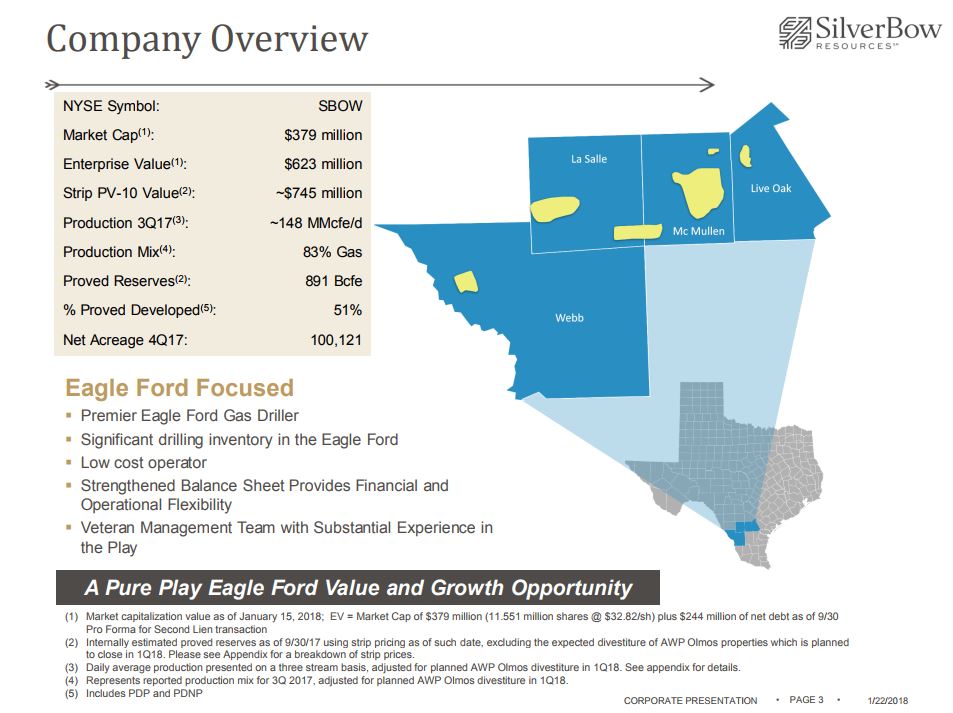

SilverBow Resources, Inc. (ticker: SBOW) recently announced its 2018 capital program of $245-$265 million. For 2018, SilverBow said that total company production is projected to average 175-195 MMcfe/d, an increase of approximately 25-40% from 2017 levels. This projection has been adjusted to include small noncore divestitures in 2017 and the Olmos divestiture planned for the first quarter 2018.

2018 capital program overview

- 70% of capital expenditures allocated towards drilling and completions

- Planned addition of second rig in second quarter

- 30-32 net wells drilled in 2018, compared to approximately 18 net wells in 2017

SilverBow CEO Sean Woolverton said, “Our team did a tremendous job executing on multiple fronts in 2017, including prosecuting a successful delineation drilling campaign, adding over 35,000 high-graded acres to our leasehold position at an attractive cost and increasing our liquidity to approximately $250 million. On the success of our 2017 activities, we have elected to add a second rig to our drilling program early in the second quarter.”

Woolverton added, “Our focus for 2018 now shifts to development as we plan to exploit our Eagle Ford asset base with a commitment to becoming a low-cost operator in the region. With our strong balance sheet, growing production and increasing cash flow, we have significant liquidity to fund our investments in production growth and inventory. Importantly, our business plan is fully funded with a decreasing leverage ratio and significant financial flexibility as we look to achieve positive cash flow in late 2019.”

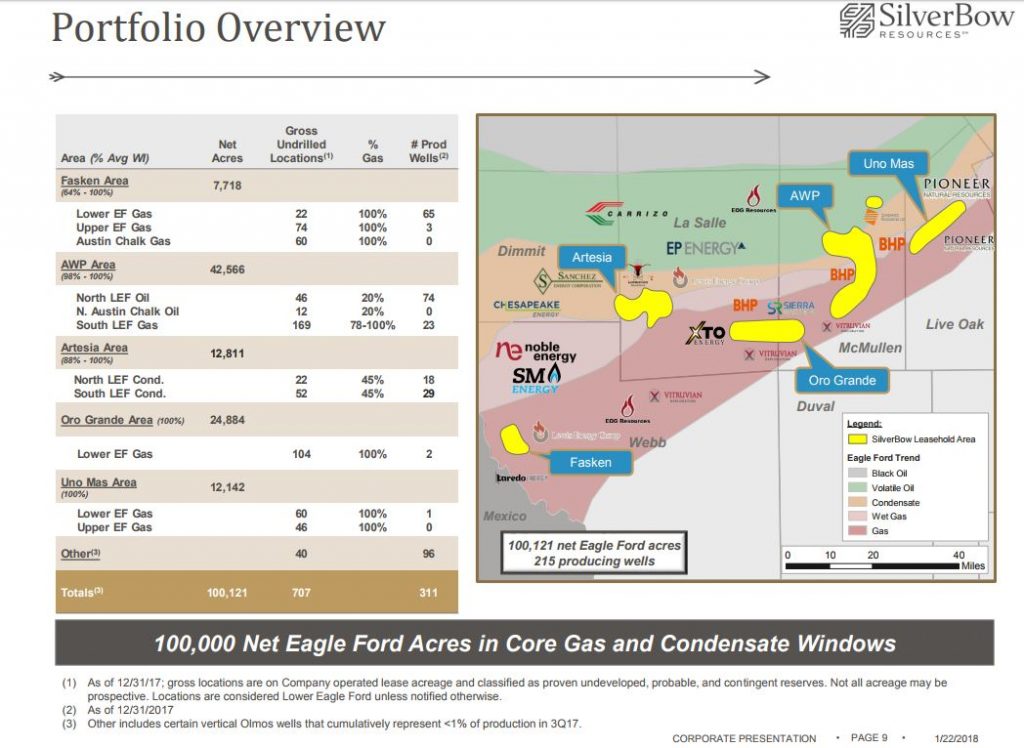

The 2018 capital budget of $245 to $265 million provides for 30 to 32 net operated wells drilled compared to approximately 18 net operated wells in 2017. Approximately 70% of the 2018 capital budget is allocated towards drilling and completion capital, driven primarily by activity in Fasken (13 net wells drilled), AWP (7 net wells drilled) and Oro Grande (5 net wells drilled).

Due to the timing of the back-end loaded drilling and completions program, the company will bring 25 to 26 net wells to sales in 2018, compared to approximately 22 net wells in 2017. The company plans to end 2018 with an inventory of 10 to 12 drilled but uncompleted wells (DUCs) compared to 6 DUCs at the end of 2017.

This drilling program provides for average production of 175-195 MMcfe/d in 2018, as adjusted for small divestitures in 2017 and the planned Olmos divestiture in the first quarter of 2018. These noncore properties contributed approximately 10.5 MMcfe/d of production in 2017 through September 30.

SilverBow expects further improvements in drilling and completion efficiencies in 2018 given the increased activity level combined with a greater focus on pad drilling. The company continues to focus on longer laterals and optimized completions.

The company expanded its Eagle Ford footprint by over 50% in 2017, through a combination of an aggressive leasing campaign and strategically acquiring bolt-on producing acreage in SilverBow’s core AWP area.

The company spent approximately $50 million on acquiring over 35,000 acres, primarily throughout the gas and rich gas windows of the Eagle Ford. SilverBow anticipates spending 20-25% of the 2018 drilling and completions budget on this acquired acreage. Additionally, the company plans to continue acquiring acreage in the core of its Eagle Ford leasehold positions during 2018 and has budgeted approximately $20-$30 million for core leasehold additions and extensions. The company does not budget for acquisitions.

The 2018 budget is expected to be fully funded through cash flow from operations and available borrowing capacity within the company’s revolving credit facility. As of September 30, 2017, SilverBow had approximately $250 million of available liquidity, pro forma for the December 2017 second lien senior notes.