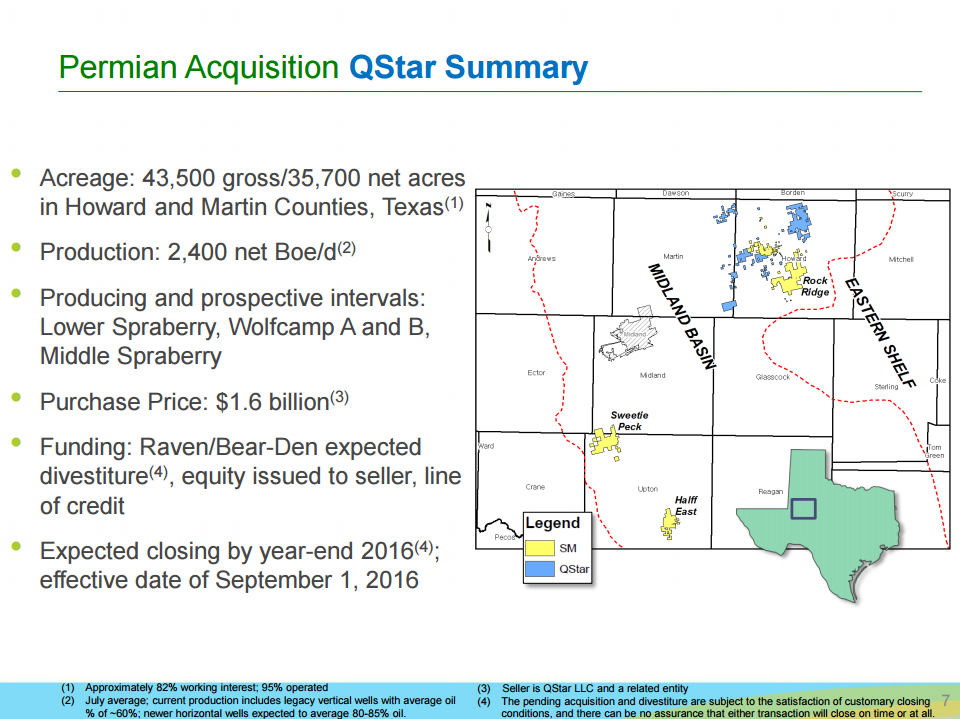

SM Energy adds 35,700 acres in the Midland for $1.6 billion

SM Energy Company (ticker: SM) announced Tuesday that it has entered into a definitive purchase agreement to acquire 35,700 net acres in Howard and Martin Counties in West Texas, expanding the company’s Midland Basin footprint to approximately 82,450 net acres. The acquired acreage complements, and is partially contiguous to, the company’s recently closed Howard County acreage acquisition and includes approximately 2,400 BOEPD net production, SM said in a press release.

The company purchased the Midland assets from QStar LLC, a portfolio company of EnCap Investments, for $1.1 billion in cash, plus 13.4 million shares of SM common stock valued at $500 million. On a per-acre-basis, SM Energy spent roughly $44,818 on Tuesday’s acquisition.

“Our preliminary plans for Midland Basin activity include adding a fourth rig during the fourth quarter of 2016 and increasing to six rigs in early 2017, thereby increasing our expected aggregate 2016 capital program before acquisitions to approximately $710 million,” SM Energy President and CEO Jay Ottoson said.

$0.8 billion divestment in the Williston to help fund Midland acquisition

In addition to its acquisition Tuesday, SM announced that it has entered into a definitive agreement with Oasis Petroleum (ticker: OAS) for the sale of its Williston Basin assets located outside of Divide County for $785 million.

The sale of the company’s Williston assets will go to fund the majority of the $1.1 billion cash consideration for its new Midland assets, SM said. The remainder will come from the company’s revolver, which has a borrowing base of $1.35 billion, aggregate commitments of $1.25 billion and was undrawn as of October 14, 2016.

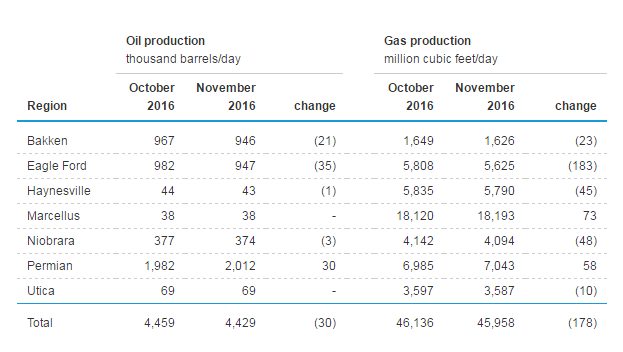

The company added in its press release that remains on-track with the planned sale of its non-operated assets in the Eagle Ford, which could be a source of funding for increased activity in the Permian over the coming years. The Permian is the only oil-producing region in the U.S. that the EIA expects will see an increase in production in November as output elsewhere in the country slows.

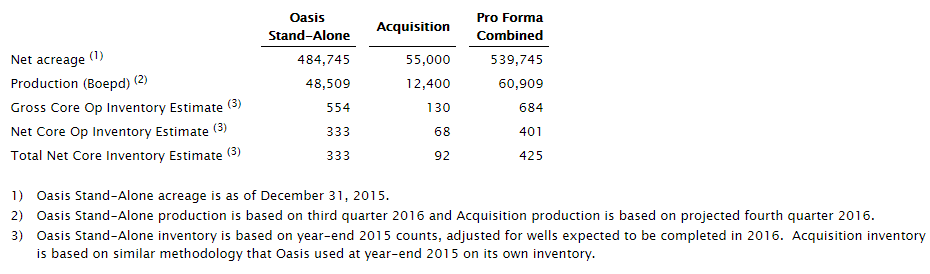

Oasis targets Williston production of 12.4 MBOEPD with acquisition

Talking about the acquisition of SM’s Williston assets Tuesday in its news release, Oasis Petroleum said that it hopes to produce 12.4 MBOEPD from the properties. The sale includes 55,000 net acres and an estimated 226 gross operated drilling locations. Oasis said the properties have an estimated 50.2 MMBOE of proved reserves, 63% of which are considered proved developed producing and 77% of which are oil.

To help fund the acquisition, Oasis announced an upsized stock offering today, originally offering 40 million shares before increasing the size of the offering to 48 million. The company expects to generate approximately $518.4 million in gross proceeds, which it will use to partially fund the SM Williston property acquisition, it said in a press release. Oasis has also granted its underwriters a 30-day option to purchase up to 7.2 million additional shares of its common stock.