Renewables continue growth

Renewable sources of energy continue to grow in importance both inside the U.S. and internationally. Solar energy makes up an important portion of the overall renewable energy mix, but the growth in total capacity has slowed along with installation.

Historically, Europe has been a strong source of demand for solar energy, but its growth in solar energy declined this year, according to the Energy Information Administration. China, the world-leader in solar energy installation, also saw demand stall out this year as financial instability took hold inside the country.

Inside the U.S., now the second largest demand market, companies like Tesla (ticker: TSLA) and SolarCity (ticker: SCTY) are making a push for use of solar-powered batteries in the home, but even as companies make the case for greater use of solar energy, growth in capacity has slowed significantly since 2008. Despite the sluggish market growth, analysts indicate that the overall solar market is still quite healthy.

Growth of 16% in 2015 to 46.4 GW, and an additional 14% in 2016 to 52.9 GW: Raymond James

A note released by Raymond James today to coincide with the Solar Power International (SPI), North America’s largest solar trade show, showed that the solar energy market is likely at its healthiest since the global financial crisis, despite solar stocks largely underperforming. The KWT solar index is down approximately 15% year-to-date, with the bulk of the losses coming since the oil price meltdown that began in June, but Raymond James believes there is a disconnect in the market.

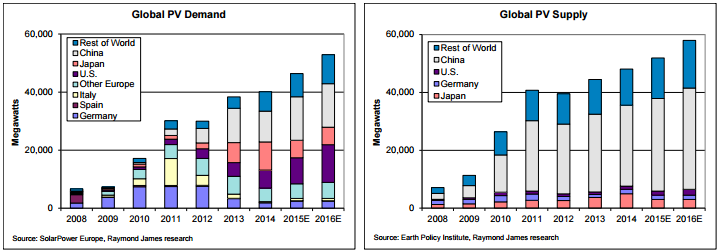

Solar photovoltaic (PV) installations in 2014 totaled 40.1 GW, up just 5% from 2013, with weaker-than-expected demand in China being largely responsible for the sluggish growth. Despite the weakness in growth from 2013 to 2014, Raymond James analyst Pavel Molchanov expects global demand to grow 16% in 2015 to 46.4 GW, and then to grow an additional 14% in 2016 to 52.9 GW.

Molchanov expects the bulk of this growth to continue to come out of China, the world’s largest PV market. China missed its growth target of 14 GW last year, installing just 10.6 GW, due to strain on the downstream of China’s domestic PV value chain, especially for distributed PV, says Molchanov. Raymond James projects growth of 15.0 GW in PV for China in 2015, below the government’s goal of 17.8, but still representing nearly a third of total global demand.

While not expected to grow as much as China in absolute terms, the United States – the world’s second largest demand market for PV, surpassing Japan in 2015 – is forecast to grow by 45%, or 9.0 GW, through the end of 2015. “Demand is clearly being ‘pulled in’ ahead of the drop in the federal Investment Tax Credit (ITC) from 30% to 10%,” says Molchanov. “The ‘land rush’ will surely be aggressive in 2016, especially in the second half.” Despite the rapid growth it projects, the analyst also notes that solar power still makes up less than 1% of the power market.

Other notable markets included in the Raymond James analysis included Europe, which saw a decline in PV installations to 7.0 GW in 2014 – less than a third of 2011 levels – and Africa. Although cumulative PV installations in Africa total under 1.0 GW, or less than China’s monthly installation, Mochanov points out that several GW-scale projects are in the works in Egypt, Nigeria and Zambia, and says the continent offers a “intriguing long-term theme to watch.”

Solar production utilization rates trend lower

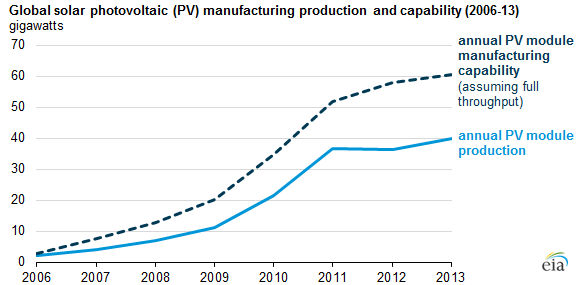

Sluggish growth in PV installation has also dragged down the solar manufacturing utilization rates in recent years, according to data from the Energy Information Administration (EIA). Growth in the PV module production capability has slowed significantly in recent years to 4% annually from 2011 to 2013, after increasing at an average of 78% from 2006 to 2011.

The utilization rate of PV module manufacturing facilities peaked in 2011, according to the EIA, when production was 36.6 GW and capability was 52 GW, putting utilization at 70%. Production capability outstripped throughput in the years following 2011, declining to 66% in 2013.

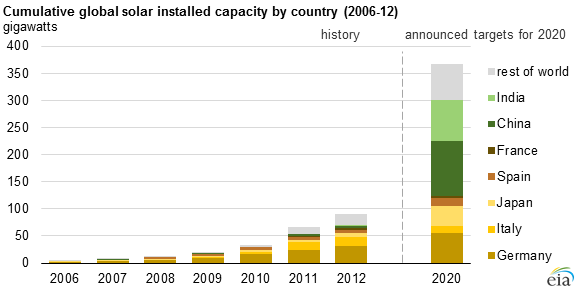

The market reaction to the lower utilization rates has been to consolidate and downsize PV manufacturing companies. For example, Germany reported to the International Energy Agency (IEA) that there were a total of 11,000 employees working in 40 PV companies operating in the country at the end of 2013, compared with 32,000 employees in 62 companies at the end of 2008. A similar trend was reported in China, where PV module and cell manufactures decreased in number to 100 from 300 in the same time period.

Even as the global PV industry consolidates, the major consumers of solar energy continue to set their sights higher for future installation goals. More than 50 countries have established national solar targets, amounting to more than 350 GW by the year 2020. Reaching that goal would require average annual installments of 40 GW from 2013 to 2020, which the EIA notes is well within the current 60 GW capacity.