Sen. Murkowski: Obama Administration at Fault for “Project Killer” Regulations

Statoil (ticker: STO) is closing the door on its Alaska operations, the company announced in a press release on November 17, 2015. The Norway-based exploration and production company plans to shut its office in Anchorage and will walk away from 16 operated and 50 non-operated leases in the Chukchi Sea.

The announcement comes less than two months after another supermajor, Royal Dutch Shell (ticker: RDS.B), exited the region based on an exploration well that was deemed uncommercial in the current commodity environment. In a Shell-issued release, the company cited high costs, potentially modest returns and “the challenging and unpredictable federal regulatory environment” as the main reasons behind its decision.

Similarly, STO said that the leases were simply “no longer considered competitive within Statoil’s global portfolio.” Several other companies, including BP plc (ticker: BP), Chevron (ticker: CVX) and ExxonMobil (ticker: XOM) have delayed Arctic explorations.

Industry Casts Further Blame on the Obama Administration

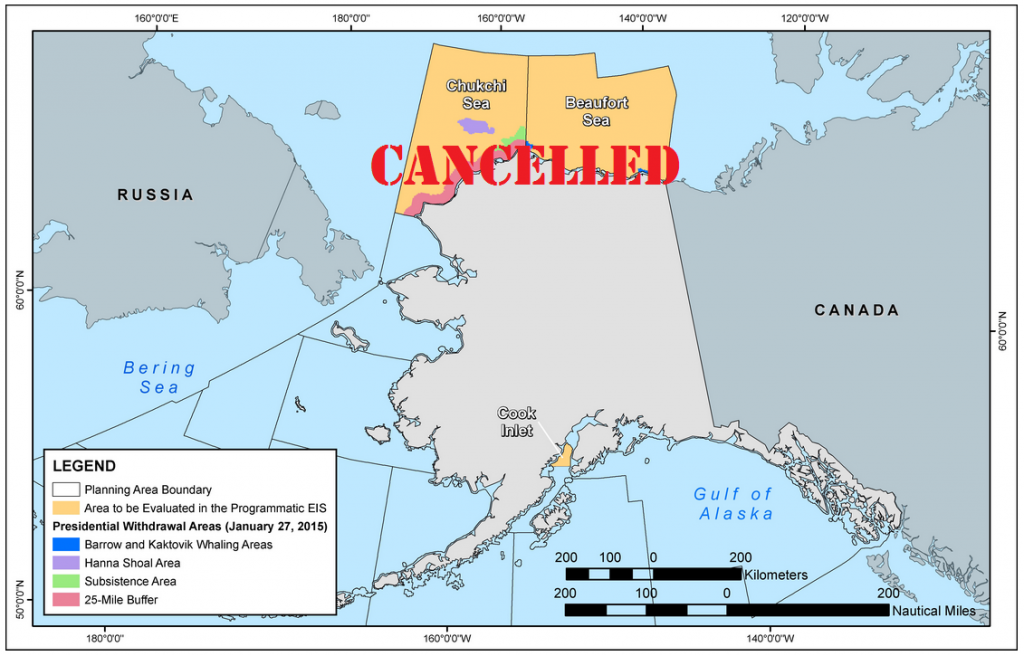

Criticism of President Obama’s energy agenda has been rampant from industry backers in the last month, with the greatest issue obviously stemming from his veto of the Keystone XL pipeline. A decision from the Department of the Interior last month received much less fanfare, but effectively caps Alaska’s potential development. Citing “current market conditions and low industry interest,” the DOI canceled Arctic offshore lease sales through 2017 and denied lease suspension requests from Shell and Statoil, who were hopeful for some leniency.

Pro-energy figures in Alaska voiced disappointment and displeasure. Governor Bill Walker called the decision a “loss of hope,” while the Alaska Oil & Gas Association said it was “a sobering day.” Others were more pointed in their words, with Congressman Don Young calling the decision “hypocritical” and saying the state may sue the DOI. The American Petroleum Institute heaped blame on the Obama administration, accusing Alaska’s offshore operations of being undermined by an unpredictable permitting process. “Investment decisions have been directly thwarted by the policy decisions of the administration related to Alaskan Outer Continental Shelf development, and lease extensions are clearly justified under the circumstances,” alleged the Institute.

Lisa Murkowski, Senator of Alaska, took her turn following Statoil’s announcement. “Low oil prices may have contributed to Statoil’s decision, but the real project killer was this administration’s refusal to grant lease extensions; its imposition of a complicated, drawn-out, and ever-changing regulatory process; and its cancellation of future lease sales that have stifled energy production in Alaska,” reported a statement on her web site.

Statoil’s History in Alaska

Statoil is no stranger to operating in the Arctic; it holds offshore operations in the North Sea, Russia and Canada. Its footprint in Canada is on the rise following the purchase of six exploratory blocks last week, all of which are nearby previous discoveries like the Bay du Nord, Harpoon and Mizzen wells. The Bay du Nord is believed to hold 600 MMBO.

Its Alaska track record is a different story. STO first entered the region in February 2008 by winning its 16 operated leases located northwest of Prudhoe Bay. ConocoPhillips (ticker: COP) won 50 of those leases, and STO acquired a 25% working interest in the blocks two years later as part of a joint development plan. The companies spoke highly of their collaboration, calling the region a “new frontier.”

Statoil, however, is leaving behind that frontier without drilling a single exploration well. ConocoPhillips first planned to commence exploratory drilling in 2012 and then pushed the date back to 2014. The company has now stalled explorations indefinitely due to “federal regulatory uncertainty,” according to its site. “Once those requirements are understood, we will reevaluate our Chukchi Sea drilling plans.”

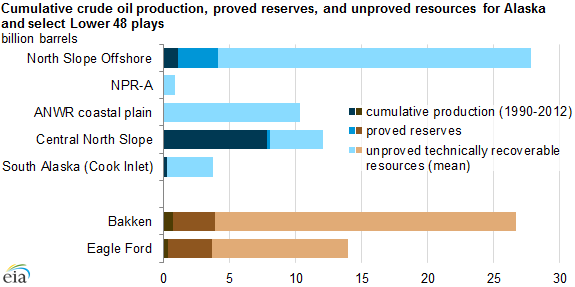

Federal estimates believe the region holds reserves of 24,000 MMBO and 104 Tcf of natural gas.

Onshore Still Producing

The regulatory hurdles offshore have not dampened ConocoPhillips’ onshore operations, as the company reported average 2014 production of 184 MBOEPD – the most of any regional operator. COP continues to place new projects online and expects new volumes to offset the declines through 2017.

Alaska’s oil and gas production has been on the decline since 1991 due to a challenging environment and lack of infrastructure, but companies like COP still believe the region holds significant opportunity. One of those companies is privately-held Armstrong Oil & Gas, who outbid Conoco on blocks in a North Slope lease sale in 2014. Armstrong made a splash in October by ponying up $800 million to increase its stake in projects operated by Repsol (ticker: REPYY).

Alaska’s oil and gas production has been on the decline since 1991 due to a challenging environment and lack of infrastructure, but companies like COP still believe the region holds significant opportunity. One of those companies is privately-held Armstrong Oil & Gas, who outbid Conoco on blocks in a North Slope lease sale in 2014. Armstrong made a splash in October by ponying up $800 million to increase its stake in projects operated by Repsol (ticker: REPYY).

Bill Armstrong, president of Armstrong Oil & Gas, believes the move represents a shift where smaller independents are working in areas previously dominated by majors. Amstrong’s track record includes 16 consecutive successful wildcat and appraisal wells in the last four years, including developing fields that are now being exploited by industry heavyweights like ENI (ticker: E) and Pioneer Natural Resources (ticker: PXD).