From CNBC

Shell Oil is reportedly loading a supertanker in Louisiana, the first of its kind to leave that port with U.S. crude exports. The shipment via the Saudi Arabian-owned supertanker, capable of carrying 2 million barrels, signals the next phase in the U.S. transition to becoming a major energy exporter.

The first oil supertanker, capable of carrying 2 million barrels of crude, was being loaded in Louisiana this week, signaling the next phase in the U.S. transition to becoming a major energy exporter.

The tanker, ‘Shaden,’ was chartered by Shell Oil and is Saudi Arabian-flagged, according to a report by S&P Global Platts. The ship was due to leave the Louisiana Offshore Oil Port with a cargo of medium sour crude, sources told Platts. Shell declined to comment on the report.

“There’s a lot of different infrastructure projects that have been underway all over the Gulf Coast to facilitate the rise in U.S. production. We see that activity taking advantage of the rising interest globally in U.S. exports of all types, and the rising demand environment as well,” said Michael Cohen, Barclays head of energy commodities research.

U.S. oil exports have been growing since Congress reversed a 40-year-old law prohibiting most exports just over two years ago. As oil prices improved, U.S. oil production has also boomed, recently topping 10 million barrels a day, the highest since 1970.

The U.S. exported an average 1.4 million barrels a day of crude over the last four weeks, up from an average 605,000 barrels a day a year ago, according to government data.

“It’s a big deal for the industry because it develops additional logistics for our increasing oil production,” said Andrew Lipow, president of Lipow Oil Associates. Lipow said the ship looks set to sail on Feb. 18. “There’s an ever-increasing amount of logistics that are being used to export crude off the Gulf Coast to overseas markets.”

Lipow said there was another supertanker, named Anne, that took on a partial Occidental Petroleum cargo last year in a test at Ingleside, near Corpus Christi, Texas. But that tanker had to complete its loading off shore. In this case, the Shaden can be entirely loaded at LOOP before sailing, he said.

LOOP officials were unavailable for comment, but the port said on its website that it “has moored a VLCC and initiated its detailed test and checkout procedure.” The VLCC, or very large crude carrier, is owned by Saudi shipper Bahri and was expected to take the crude into the Shell refining system, according to Platts.

The U.S. Energy Information Administration recently said the U.S. should be a net energy exporter by 2022, moving up its forecast by four years. Recently becoming a net exporter of natural gas, the U.S. continues to import oil with 7.8 million barrels a day imported last week. Canada is the biggest source of imports. The U.S. oil industry also has a growing export business with an average 4.8 million barrels a day of gasoline and other refined products exported over the past four weeks.

Cohen said the LOOP has been working to export fuel by supertanker.

“These projects have been underway for several years and we expect more to move forward as U.S. production continues to grow and exceed the appetite for U.S. domestic refiners for that crude,” he said.

Cohen said bottlenecks in the U.S. system had been a concern but as they get worked out more U.S. crude can move offshore. “Now the question is whether we may see further significant discounts between Gulf Coast grades and Brent, in the balance of this year or next year as the refining system outside the U.S. adjusts to the reality of new types of exports of different quality,” he said.

For instance, in the futures market, the price of U.S. West Texas Intermediate crude has grown closer to Brent, at about $63 per barrel Tuesday. WTI futures were at $59.21 per barrel.

“It’s a lever to reduce the arbitrage opportunity. The exports act as a lever to narrow the arbitrage. As infrastructure gets built, the arbitrage may not be as large as it is right now,” he said.

Louisiana Port Tests Supertanker for U.S. Crude Exports

From Reuters

NEW YORK (Reuters) – The Louisiana Offshore Oil Port (LOOP), the largest privately owned crude terminal in the United States, said on Tuesday it had started to test loading and unloading of a supertanker, bringing it closer to being able to export crude oil.

LOOP said last year its U.S. Gulf Coast facility would have the capacity to load Very Large Crude Carriers (VLCCs), the largest oil tankers which can ship some 2 million barrels of oil, by early 2018.

Washington lifted a 40-year ban on oil exports two years ago, and since then tankers filled with U.S. crude have landed in more than 30 countries, ranging from massive economies like China and India to tiny Togo.

Gulf Coast terminals handle three-quarters of U.S. crude exports, but only LOOP can handle incoming supertankers. Most U.S. shipping channels are too shallow, although Port Corpus Christi, Texas, is undergoing improvements to deepen its channel.

Analysts believe operators will start to run into bottlenecks if exports rise to 3.5 million to 4 million barrels a day. Exports peaked at 2 million barrels a day (bpd) last year.

LOOP made only minor modifications to existing facilities to operate the port complex for both imports and exports, it said in a statement on its website. It has until now only imported crude oil.

“The configuration safely enables both loading and offloading of Very Large Crude Carriers (VLCCs) without multiple shuttle tanker movements,” the company said.

The vessel that is currently being used for tests is the ‘Shaden’, according to traders and Reuters vessel tracking data.

The supertanker previously loaded in Saudi Arabia’s export terminal at the port of Ras Tanura in December, according to Reuters data.

A spokesman for LOOP did not immediately respond to requests for comment as the offices were closed.

Unipec – China’s largest buyer of U.S. crude – has chartered the vessel to load in the U.S. Gulf Coast with Singapore as its destination and will be ready to load on Feb. 15, according to a fixture associated with it.

Unipec, the trading arm of Asia’s largest refiner, state-owned Sinopec, did not immediately respond to a request for comment.

LOOP Prepped for VLCC Exports Starting Last Summer

From Oil & Gas 360

On July 24, 2017 LOOP LLC announced its intentions to seek shipper interest in vessel loading services to complement its long-standing offloading services. LOOP said the new service provides connecting logistics from LOOP’s Clovelly Hub in Galliano, La., to its Deepwater Port, 18 miles offshore of Port Fourchon, La.

The company said it made only minor modifications to its existing facilities to operate the port complex bi-directionally.

The configuration safely enables both loading and offloading of Very Large Crude Carriers (VLCCs) without multiple shuttle tanker movements. LOOP said it had moored a VLCC and initiated detailed test and checkout procedure.

Background on LOOP

LOOP LLC owns and operates the nation’s only crude oil deepwater port, which includes three single-point mooring (SPM) buoys in the U.S. Gulf of Mexico, approximately 17 miles offshore of Louisiana. The SPMs can accommodate very large crude carriers, ultra-large crude carriers, medium-range Jones Act compliant tankers and floating production, storage and offloading deepwater facility shuttle tankers. LOOP also provides logistics services to pipelines that connect to regional and national pipeline networks and refining facilities. LOOP has more than 72 million barrels of crude oil storage capacity at its Clovelly Hub in Galliano, La.

February 1, 2018: Clovelly Hub capacity update

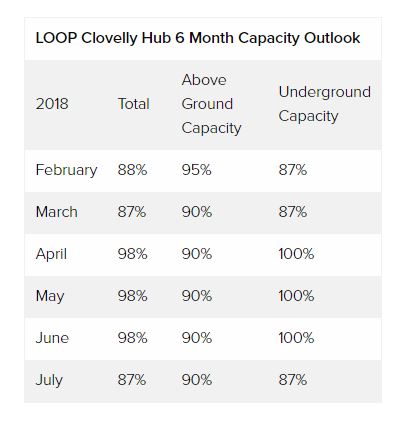

LOOP tracks the amount of capacity in service at the Clovelly Hub monthly. A six-month capacity forecast follows in the table below.

According to a breakdown by the EIA, The Very Large Crude Carrier (VLCC) and Ultra-Large Crude Carrier (ULCC) were added as the global oil trade expanded and larger vessels provided better economics for crude shipments. VLCCs are responsible for most crude oil shipments around the globe, including in the North Sea, home of the crude oil price benchmark Brent. A VLCC can carry between 1.9 million and 2.2 million barrels of a WTI type crude oil.

There are a small number of ULCC vessels currently in use, as their size requires special facilities limiting the number of places where these vessels can load and offload. These massive vessels can carry around 2 million barrels to 3.7 million barrels of crude oil. The only U.S. port that can handle such large vessels while fully loaded is the Louisiana Offshore Oil Port (LOOP), EIA said.