2016 Program Fully Funded

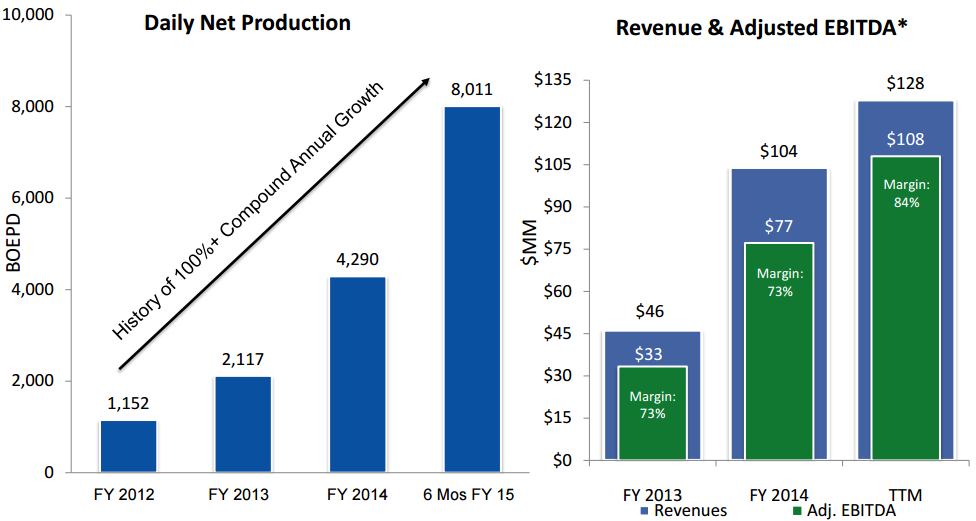

A combination of wells waiting completion and longer laterals have Synergy Resources (ticker: SYRG) projecting to exit Q4’15 (ending August 31) with volumes of 12,000 to 13,000 BOEPD. The company announced its Q3’15 volumes (three months ended May 31) averaged 8,026 BOEPD, representing a year-over-year increase of 95%.

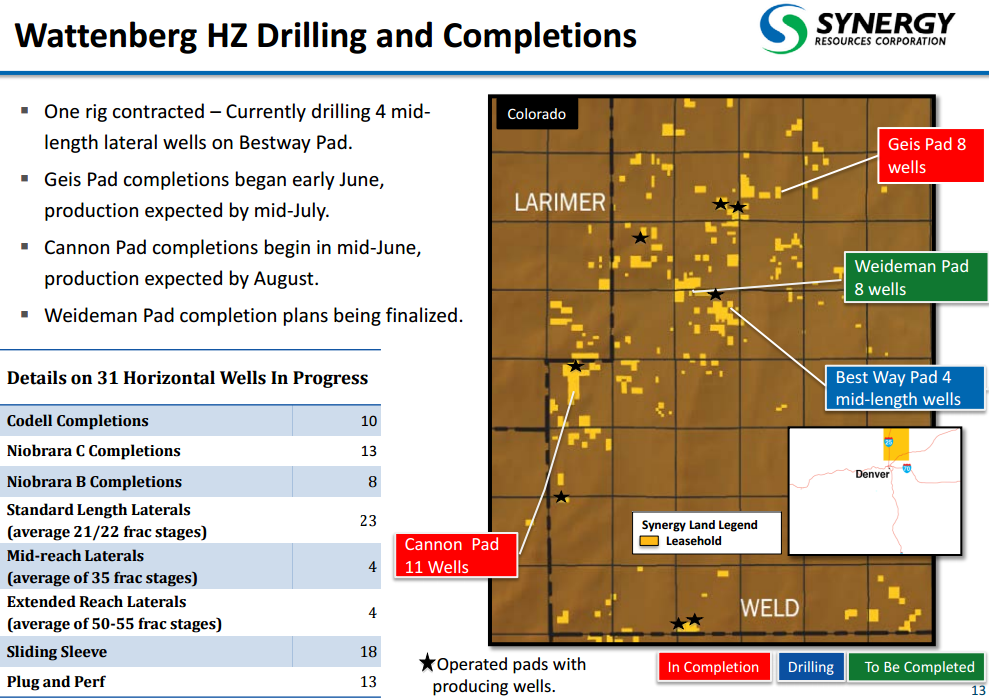

In its Q3’15 results announced on July 9, 2015, SYRG said 21 new wells were brought online in the quarter and 11 additional wells are awaiting completion. A total of 52 horizontal wells are currently operating in Synergy’s Wattenberg position, which spans 90,000 net acres and holds an additional 1,060 potential horizontal drilling locations.

The running room provides plenty of opportunity to continue its rapid growth rate; Synergy has roughly doubled production volumes on an annual basis since 2012. Its current guidance of 50% growth for 2015 is admittedly low. “We’re being conservative – it’s probably somewhere around 70%,” said Bill Scaff, co-Chief Executive Officer of Synergy Resources, in a conference call. “As we move forward, we can drill for the next two years, bring on a second rig probably in the first quarter of 2016 and continue to drill with two rigs for the next two years without having to go to the market for future cash. It’s all internally generated cash flow as we move forward.”

Balance Sheet a Synergy Staple

Stifel described Synergy’s balance sheet as “best-in-class” in a note covering last quarter’s earnings, and its numbers remain strong even though realized oil prices have nearly halved compared to its Q3’14 earnings. “We had over $17 million in EBITDA and $26 million in revenues, so there’s a 68% margin,” said Jon Kruljac, Vice President of Synergy. “We were at a 73% margin one year ago, so we’ve only lost five points of margin in the most recent quarter at a time when our commodity prices are down 48%.”

Its internally generated cash flow and efficient wells are providing considerable cash on hand for future developments of possible acquisitions. Synergy’s asset intensity, defined as the percentage of every EBITDA dollar required to maintain flat production rates, is only 28%. In EnerCom’s Weekly Benchmarking report, the median of 87 E&P peers is 69%. SYRG’s asset intensity is the sixth lowest overall. The numbers stack up favorably for Global Hunter Securities, which said, “After making the changes to our model, we still see SYRG’s debt-adjusted per share production growth at a ~38% CAGR through FY18, well above the E&P average of ~7%.”

Q3’15 Results

Synergy reported a net loss of $2.5 million ($0.02 per share) in the quarter, the result of a $3 million impairment charge from lower commodity prices. As of the end of June, management said it holds $140 million in cash and cash equivalents with total debt of $87 million, and a debt interest rate of 2.5%.

“We continue to have a high degree of operational flexibility with no long-term drilling contracts and nominal leasehold expiration issues in the Wattenberg Field facing this in next 12 months,” said Scaff. “This allows us to spend capital when and where we believe it is most efficient.”

Stage is Set for 2016

Synergy’s believes its estimated 2016 capital budget of $250 to $300 million is fully funded. About 80% of capital will be directed solely to development of its operated properties, and all wells will be completed in the plug n’ perf method until commodity prices recover.

On a fiscal basis, SYRG plans on a two-rig operated program. KLR Group expressed confidence that a third rig will be added to the fleet at some point throughout the year. Added emphasis will be placed on longer laterals in 2016, with lengths expected to reach 350,000 feet as opposed to the 2015 plan of 200,000 feet.

Wells from the Geis pad have just been turned in line, while its 11-well Cannon pad is currently under completion and will be online before the end of August. The eight wells on the Weideman pad will likely commence completion early in Q1’16. The Best Way pad is expected to be complete in the same time frame.

Its first Greenhorn well will be completed by the end of fiscal 2015. Management spoke about the prospect with cautious optimism in its Q2’15 call, saying neighboring operators are “tight-lipped” about their results. Additional detail from operators like Noble Energy (ticker: NBL) and Anadarko Petroleum (ticker: APC) may arise in their respective upcoming calls.

Global Hunter Securities placed SYRG’s projected enterprise value to EBITDA multiple in 2015 at 9.4x. KLR Group believes the track is already set for the years ahead. “Largely owing to a superior cash margin (lower expense structure), Synergy’s FY’17 capital yield (mid-cycle commodity prices) is ~160% versus its DJ Basin peers ~130% and the industry median capital yield of ~125%,” the firm said.