Synergy Resources Corporation (ticker: SYRG) is a domestic oil and natural gas exploration and production company with 392,000 gross (286,000 net) acres under lease. Synergy’s core area of operations and all of its production comes from the Denver-Julesburg Basin, which encompasses Colorado, Wyoming, Kansas and Nebraska.

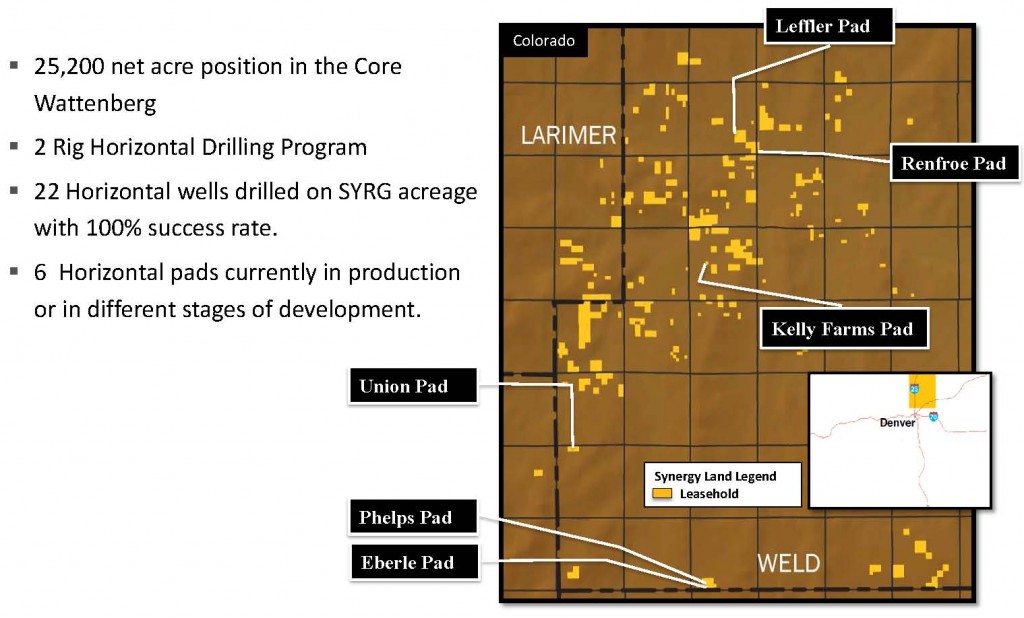

The company’s core operations are focused on the Wattenberg Field. Currently, two rigs are running in the region and are targeting the Codell and Niobrara A, B and C formations. Two deeper formations, the Greenhorn and J-Sand, are considered prospective. A horizontal program was initiated in May 2013 and has contributed to production growth of 90% (3,917 BOEPD from 2,067 BOEPD) on a year-over-year basis, according to its Q2’14 earnings release.

Synergy Resources presented at EnerCom’s London Oil & Gas Conference™ 6 on June 10, 2014. Click here for the webcast. The company’s Q3’14 earnings call for the period ended May 31, 2014, is scheduled for July 9, 2014.

Phelps Pad Results

The Phelps pad (90% working interest) was completed in March and five wells have been turned to production. The wells averaged a 30-day production rate of 544 BOEPD (76% oil) and consisted of 24 frac stages apiece. A Codell well returned 668 BOEPD in the same time period – the best of the group. The sixth well of the pad is targeting the Codell is expected to be completed in the near future, according to management. Expenditures for each well were listed at approximately $4 million.

“We took what we learned on the first pad and tried something different with the next, and we’re pleased with the initial results,” said Jon Kruljac, Vice President of Synergy Resources, in an exclusive interview with Oil & Gas 360®. “We’ll compare and contrast results on several more pads before we can draw a conclusion in the future – maybe six months from now.”

A June 24, 2014 note from SunTrust Robinson Humphrey said, “As well costs increased only 8% versus the previous pad for a 20-81% increase in first 30-day performance; we view the result as solid.”

“As far as a learning curve is concerned, I believe we’re still in the middle of the lesson,” said Kruljac.

Operations Update

The same rig used to drill the Phelps is now completing the Eberle pad (95% WI). Similar to the Phelps, the Eberle will consist of six wells with three targeting the Codell. Two of the wells (one Niobrara and one Codell) are extended reach laterals with lengths of 7,000 feet and will receive 40 to 45 frac stages. The remaining four wells will each receive approximately 25 stages. Production is expected to commence as early as August. The Kelly Farms pad (four wells, 60% WI) is in the drilling phase and is expected to be brought online around the same time frame. Management said the Eberle, Kelly Farms and Union pads have been drilled to allow up to 24 wells per 640 acre section.

A rig will be moved to the Kiehn lease in July and SYRG has 13 wells (100% working interest) permitted to be drilled. The Wiedeman pad has eight permitted wells, including four with extended reach laterals of more than 9,000 feet. Drilling is scheduled to commence on the Weld 152 pad (61% WI) in July.

In its current quarter, flooding issues forced SYRG to shut in 19 vertical non-operated wells for 10 days, and 12 of the wells remain shut. DCP Midstream (ticker: DPM) also performed maintenance on plants in northeast Colorado, impacting production from “some of its horizontal wells,” said SYRG. Kruljac said all wells are expected to be back online by the end of the quarter.

“Overall, midstream is going to remain challenged but we don’t believe it will be any worse,” he said. “Incoming infrastructure, including plant maintenance and six-inch lines that will be looped around the Greeley plant, will help in the northern portion of the field for the second half of the year.”

Q3’14 Catalysts

Synergy is in discussions to add a third rig as early as August to drill the Wiedeman pad. The company’s second rig was added in January 2014, meaning its rig count will have jumped to three from one compared to one year ago at this time of writing. In all, Synergy management expects to add 22 horizontal wells to its reserve report for the end of the 2014 fiscal year. Estimates in its Q2’14 release placed 2014 operations to drill a total of 34 operated horizontals. Production is expected to exceed 5,000 BOEPD by the end of fiscal 2014, which would represent a 25% increase compared to Q2’14 totals.

The ramped up operations are beginning to show on Synergy’s well inventory. The company announced its mid-year reserve base for the six months ending February 28, 2014 was evaluated at 19.7 MMBOE – an increase of 43% compared to its year-end 2013 totals. The increase reflected a PV10 value of $326 million, up from the previous estimate of $236 million.

In addition, the Union pad (six wells, 91% WI) is in early production. The company said its Renfroe pad has been online for nine months and produced an average rate of 260 BOEPD in its first 180 days of production. Revenues from Renfroe are on pace to pay back well costs in less than 13 months. The Leffler pad will have six-month production rates available in late July. Test results from the Buffalo Run well will determine SYRG’s further actions in its Wattenberg extension field. In addition to its operated projects, SYRG will add four net horizontal non-operated wells to production by September – the start of SYRG’s Q1’15 quarter.

Despite the ramp up in operations, SYRG management believes its $189 million expenditures program will be funded by its increased borrowing base along with cash flow from operations.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.