Earthstone Energy to Present at The Oil and Gas Conference

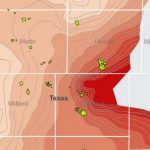

Earthstone Energy, Inc. (NYSE: ESTE) Company Overview The Woodlands, Texas-based E&P company is focused on development and production of oil and natural gas with current operations in the Midland Basin (~26,700 core net acres) and the Eagle Ford (~16,000 core net acres). The company has 195 gross producing wells and reported almost 10,000 BOEPD production in Q1. Summary Q1-2018 Revenue: