Tallgrass Energy Partners, LP (ticker: TEP) announced that it priced an offering of $500 million in aggregate principal amount of 5.5% senior unsecured notes due 2028 at an offering price equal to 100% of par. The offer has been made alongside Tallgrass Energy Finance Corp., a subsidiary of TEP.

The Notes offering is set to close September 15, 2017, subject to customary closing conditions. According to yesterday’s press release, TEP intends to use the net proceeds to repay outstanding borrowing under its existing senior secured revolving credit facility.

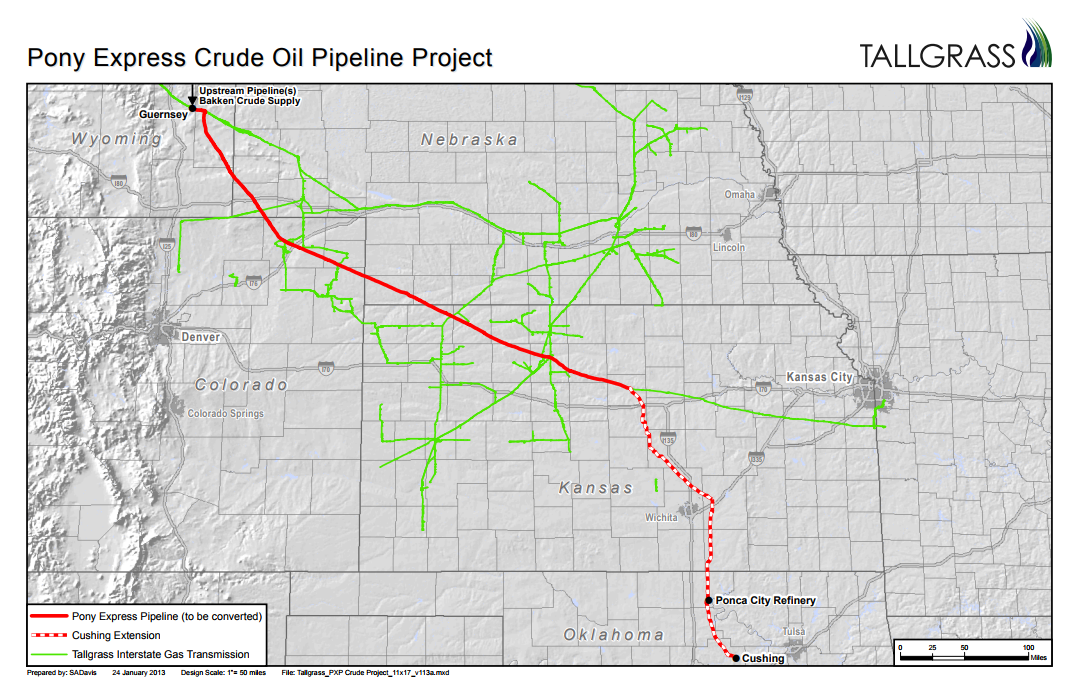

Tallgrass Energy Partners, LP three main segments of operation including crude oil transportation and logistics, natural gas transportation and logistics, and processing and logistics. The company owns and operates the Pony Express System, a crude oil pipeline connecting the Bakken Shale, Denver-Julesburg and Powder River Basins to Cushing, Oklahoma.

Source: Tall Grass Energy, LP