Targa Resources (ticker: TRGP) and Targa Resources Partners (ticker: NGLS) has officially acquired the midstream assets of both Atlas Energy (ticker: ATLS) and Atlas Pipeline Partners (ticker: APL). The non-midstream assets of ATLS will be spun off to Atlas Energy Group and will continue to trade under the ATLS ticker.

The transaction is valued at $7.7 billion, and includes $5.8 billion for Atlas Pipeline Partners and $1.9 billion for the ATLS midstream assets. The announcement was first made on October 13, 2014, and was finalized on February 27, 2015, after shareholders approved the merger. Per the terms of the spinoff, each ATLS unitholder receives $9.12 in cash and 0.1809 shares of TRGP for each ATLS share. Each APL untiholder will receive $1.26 in cash and 0.5846 shares of NGLS.

Targa’s New Empire

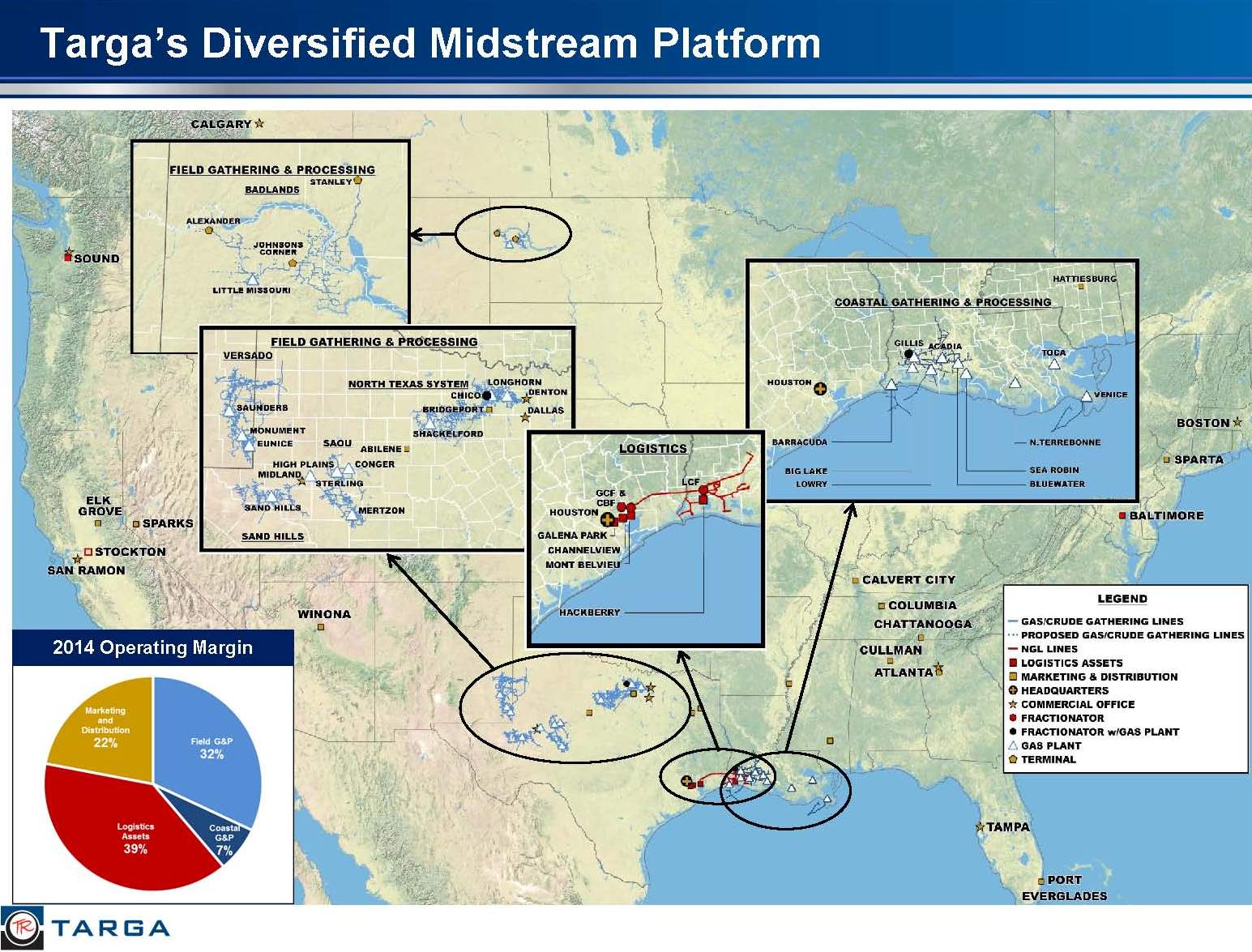

Targa Resources broadened its existing positions in the Permian, Bakken, Barnett, Louisiana Gulf Coast and Mont Belvieu markets to include Atlas’ positions in the Eagle Ford, Mississippi Lime and Woodford/SCOOP areas. “We have a leadership position in almost every basin, play, and market hub in which we participate,” said Joe Bob Perkins, Chief Executive Officer of Targa Resources, in an October conference call. “Where we participate is in the best basins and the best market hubs. It just doesn’t get any better than that.”

Perkins maintained the positive outlook in the company’s latest conference all on February 13, 2015. “The combination is better positioned than either partnership standalone,” he said, adding that TRGP added $430 million in financing and increased dividend payouts prior to closing the Atlas merger. “Our well received access to the capital market since the beginning of the year illustrates our financial strength even in challenging commodity markets,” he said.

The company was able to secure $670 million when the merger was first announced (above its initial expectation of $350 million) as part of $1.1 billion of total committed financing. NGLS created extra breathing room by increasing its revolver to $1.6 billion from $1.2 billion in January and believed it would have $800 million in liquidity once the transaction closed.

Targa management said the company’s debt-to-EBITDA ratio, in consideration with the Atlas assets, is expected to be within the high end of its targeted range of 3.0x to 4.0x. TGRP by itself was a 2.6x debt-to-EBITDA prior to the Atlas assumption.

Source: TRGP Q4’14 Presentation

Industry Insight

In the conference call, Perkins touched base on trends the company has noticed throughout the industry and reinforced the notion that the Permian will continue to be arguably the best performer in the United States despite the slowing of new development projects. Perkins said North Dakota is the area he “was most worried about,” considering the region’s differential issues are compounded by the lower oil prices. Average marketing prices in January 2015 for sweet and sour Williston grades were only $31.65 and $22.44, respectively, according to Plains Marketing. Prices in West Texas ranged from $40.62 to $44.46.

Even though Targa closed on one of the largest energy deals last year, management is not ruling out further M&A activity in 2015. If additions are made, it will not be to sugarcoat the company’s development progress, Perkins said.

“You never want to think of a M&A instead of organic,” he explained. “Organic will be done consistent with our customer needs and capital efficiently. My experience in cycles likes this is the first things that really pop up tend to be smaller and bolt-ons and… opportunities associated with the price dislocation. Later in the cycle, we know that there’ll be some larger things available and Targa is in good position to look at it.”

Perkins also said the long-term industry environment is largely up in the air and its E&P customers have all issued wide-ranging game plans. He elaborated: “When they get to the middle of the year, their outlook will be influenced by their own interpretation of supply and demand and what it will look like by the forward curves. By their own leverage position, broadly producers want to be living within their cash flow right now. So, that’s the difficult calculus, as large an uncertainty as through any cycle we’ve seen, but we’re also really early in the cycle.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication.