The Days of “Show Up and Fix It” are Over: Lindsay

Ninety-six year old Tulsa-based Helmerich & Payne (ticker: HP) reported its third quarter results today and on the conference call CEO John Lindsay expressed confidence that the company will be able to respond the industry demand for not just more rigs, but answer the need for much better rigs.

“We believe that we are uniquely positioned to grow market share in the increasingly complex drilling environment that unconventional shale plays will require going forward,” Lindsay said.

“The complexity of horizontal shale wells demands advanced technology solutions to drive high levels of performance and reliability,” Lindsay continued. “Shale customers have high expectations and well complexity is increasing as a result of extended laterals.

“The industry has long held to a ‘show-up-and-fix-it’ model when dealing with rig equipment downtime. Our model is preemptive and predictive, developing systems that utilize predictive analytics, reduce non-productive time, enhance reliability and optimize operational performance.”

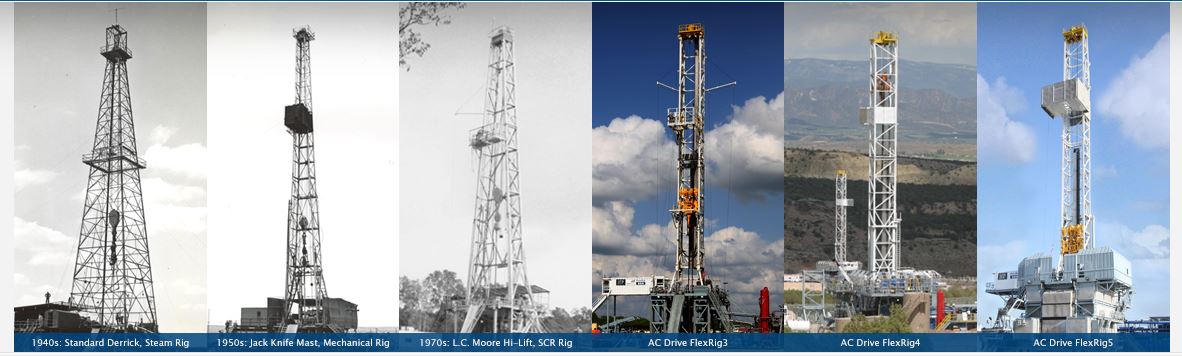

As of July 28, 2016, the company’s existing fleet includes 348 land rigs in the U.S., 28 international land rigs, and nine offshore platform rigs. During this fiscal year, the company is expected to add two new company-designed and operated FlexRigs®, both under long-term contracts with customers. This would increase its global fleet of AC drive FlexRigs to 373.

For the U.S. land segment, the company expects revenue days to increase by roughly 3% to 7% from the previous quarter. Average rig revenue per day is expected to be roughly $24,000 while average rig expense per day is expected to decrease to roughly $13,300. As of July 28, the U.S. land segment has approximately 91 contracted rigs that are generating revenue, including 72 under term contracts, and 257 idle rigs, the company said.

John Lindsay answered analysts’ questions on the conference call:

Q: You said is that customers remain optimistic, as indicated by the 14 rigs you put back into the market at the spot rate. Have you seen any change in incoming calls or in the phrasing of conversations from those interested in adding rigs in the back half of the year? Are customers just as interested in coming back or are you seeing more delays until later in the year or even 2017?

HP: In general, our customers are staying disciplined in their focus on performance and reliability. It seems that many of our larger customers are more focused on a September, October, November, timeframe. While we’ve had some new customers and put a few rigs to work, there is also some concern and lower confidence due to the recent lower oil prices.

Q: When you think forward into 2017 and 2018, would you be able to slowly restart new construction in the organization? And then if so, what rig design would you focus on?

HP: We definitely have the capability; we are utilizing that manufacturing capability today, as we have throughout the downturn, to upgrade the fleet in order to meet challenges. We could definitely start back up and get our manufacturing capability up and running. It wasn’t that long ago that we just delivered our last new build.

However, it will require a stronger market that can deliver much higher day rates than what we see today.

Most likely we would build FlexRig 5s and some other ideas we have but there is not the market to build those tower rigs into currently. We’d be very well positioned to respond to an improving market that required more AC Drive Rigs or at least higher-quality AC Drive Rigs.

Q: There’s been a lot of comments this earning season about E&P customers needing to get prepared to pay up for services. I wanted to get your thoughts on how to think about pricing power and what would be required to lift day rates.

HP: Pricing is going to be highly competitive coming off of bottom. At the same time, the drilling environment is becoming more and more complex and contractors are having to upgrade rigs. This in and of itself could potentially drive higher rates, not right off the bottom, but maybe early in the cycle.

Of course, this cycle is much different than previous ones because legacy rigs really aren’t playing a role. They are drilling but they are not targeting the more complex well designs. I believe over 70% of the mechanical rigs that have been reactivated since the bottom of the cycle are going to vertical work.

I do think pricing will kick in at a much lower rig count than what we’ve seen historically.

Q: You mentioned that spot pricing is 35% lower than the peak in late 2014 while pricing in 2009 was down 30%. Are we at a point now where pricing is going to stabilize?

HP: Coming right off of bottom, the market’s going to be highly competitive and there will be some irrational pricing. Eventually that will work itself out, after a number of rigs are put to work. When you see early examples of companies with low rates and low performing rigs, that’s not a good combination when you’re drilling the types of wells that are being drilled out there.