HOUSTON – The Texas oil and gas exploration and production economy enjoyed a year of recovery in 2021 on the heels of nearly two years of contraction, according to the Texas Alliance of Energy Producers’ Texas Petro Index (TPI).

Source: World Oil

“The Texas upstream oil and gas industry endured a punishing two-year contraction, the second year of which was at the hands of COVID, which finally came to an end with the January 2021 trough in the Texas Petro Index,” said Alliance Petroleum Economist Karr Ingham, who created the TPI and maintains it monthly. “The index has been steadily on the rise since then with higher prices, a growing rig count, and a return to at least modest growth in industry employment.”

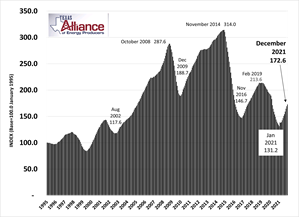

The December 2021 Texas Petro Index improved to 172.6, up from 169.1 in November, and up 28.8% from the December 2020 TPI of 134.0. The TPI reached its cyclical low point of 131.2 in January 2021, and has increased by 31.6% since then, marking an 11-month and counting expansion. The Texas Petro Index remains well below its pre-contraction level, however; the December 2021 TPI is about 19% below the most recent cyclical peak of 213.6 from February 2019 (Figure 1).

“Assuming continued steady growth in upstream activity levels in Texas in the coming year, the TPI is on track to reach and surpass its previous peak in late 2022,” Ingham said.

The Texas Petro Index achieved its all-time high of 314.0 in November 2014 but is unlikely to reach that level again due to the extraordinary increases in efficiency and productivity.

“Simply put, fewer rigs, employees, and other resources are required to produce record and growing volumes of crude oil and natural gas,” Ingham said. “Even as production continues to grow, other upstream indicators remain well below prior levels, keeping the index in check.”

Serving as an indicator of the state of the upstream oil and gas economy in Texas and an industry business cycle analysis, the Texas Petro Index is based at 100.0 in January 1995.

All components of the Texas Petro Index were trending upward during 2021, driven primarily by crude oil price recovery following the sharp declines of 2020.

- Crude oil prices (posted WTI) averaged nearly $50 per barrel in 2021 compared to $35.74 in 2020, a 40% year-over-year increase. By year-end, the December monthly average of $67.47 was up by over 56% compared to December 2020. Monthly posted crude oil prices averaged as high as $77.12 in October 2021, after averaging as low as $14.68 in April 2020. The 2021 fourth quarter average crude oil price was the highest since the third quarter 2014.

- Natural gas prices paid to producers averaged $5.79/MMBtu for the year, the highest annual average since 2008. While natural gas prices were already trending higher in 2021, the upward price spike in February 2021 in response to Winter Storm Uri pushed the average significantly higher. Even at that, said Ingham, natural gas prices were moving upward to the highest levels since 2014 in the second half of the year.

-

The Texas statewide rig count has increased each month since the record low 105 rigs at work on average in August 2020. The December 2021 monthly average rig count of 275 reflects the addition of 170 rigs since then, and the count continues to climb. The Texas rig count remains well below the 533 rigs at work on average in October and November 2018, and the 904 rigs at work on average in November 2014.

- Over 8,700 original drilling permits were issued in 2021, an increase of nearly 40% compared to the 2021 annual total, which was the lowest in the entire history of the TPI analysis dating back to 1995.

- Nearly 18,600 direct upstream oil and gas jobs have been added thus far in the current expansion, including nearly 16,500 over the last year. However, that follows the loss of over 83,000 jobs over the course of the entire contraction, 63,000 of which were shed during 2020 alone. As of December, estimated upstream industry employment in Texas was 175,925, compared to the low point of 157,330 in September 2020, and the most recent cyclical employment peak of over 240,000 jobs in December 2018. Direct upstream oil and gas employment in Texas achieved its all-time high of over 307,000 jobs in December 2014.

- Crude oil production is increasing in Texas, exceeding 5 million bpd in December according to preliminary estimates. Crude oil production reached record levels in early 2020 at over 5.4 million bpd before declining by 22% from March to May, a decline of nearly 1.2 million bpd. Assuming continued upside price support and steady growth in production, Texas crude oil production is on target to surpass prior peaks and move into record territory once again sometime in the second half of 2022.

- Permian Basin crude oil production recovered the COVID losses of 2020 and is now setting records again. December Permian production averaged 4.92 million bpd, a new daily production record exceeding the 4.91 million barrels per day in March 2020. Texas Permian Production (RRC districts 7C, 8, and 8A) according to preliminary estimates in December 2021 surpassed 4 million barrels per day for the first time, surpassing the previous record of 3.78 million barrels per day in March 2020.

- Daily natural gas production in Texas moved into record territory in November 2021 at over 30.6 billion cubic feet per month according to updated production estimates, surpassing the prior daily production record of 30.5 Bcf/month from January 2020. Natural gas production in Texas set a new annual record in 2021 as well at an estimated 10.7 trillion cubic feet.

- Texas crude oil production comprised an estimated 43% of total US crude oil production in 2021, and an estimated 32% of natural gas production. US crude oil production is not expected to reach record levels at any point in 2022, and US dry natural gas production is expected to reach a record daily level by December 2022. That means production gains in Texas are outpacing the US, and that the Texas share of both crude oil production and natural gas production will continue to increase in 2022.

“Record or near-record production for crude oil and natural gas in Texas, while other upstream indicators are nowhere near record levels, tells a fantastic story about what Texas oil and gas producers from large to small have been able to achieve,” said Ingham. “While we may wish for higher rig counts, industry employment, and payrolls, the purpose of any economy is to meet the wants and needs of its consumers.”

The US oil and natural gas industry, led by Texas, continues to do an extraordinary job of providing abundant and affordable energy to power the economy and the daily lives and work of US households and businesses, he said.