Kinder Morgan (ticker: KMI) subsidiary Kinder Morgan Canada Limited (TSX: KML) has agreed to the purchase of the Trans Mountain Pipeline system and the expansion project (TMEP) by the Government of Canada for C$4.5 billion, the company said in a press release this morning.

Kinder Morgan said it will work with the Government of Canada to seek a third-party buyer for the Trans Mountain Pipeline system and TMEP through July 22, 2018.

Kinder Morgan delivered a shock to Canada’s energy industry in April when it announced it would shut down work on the Trans Mountain pipeline projects spurred by strong political opposition from British Columbia and a threat to block the project inside the province.

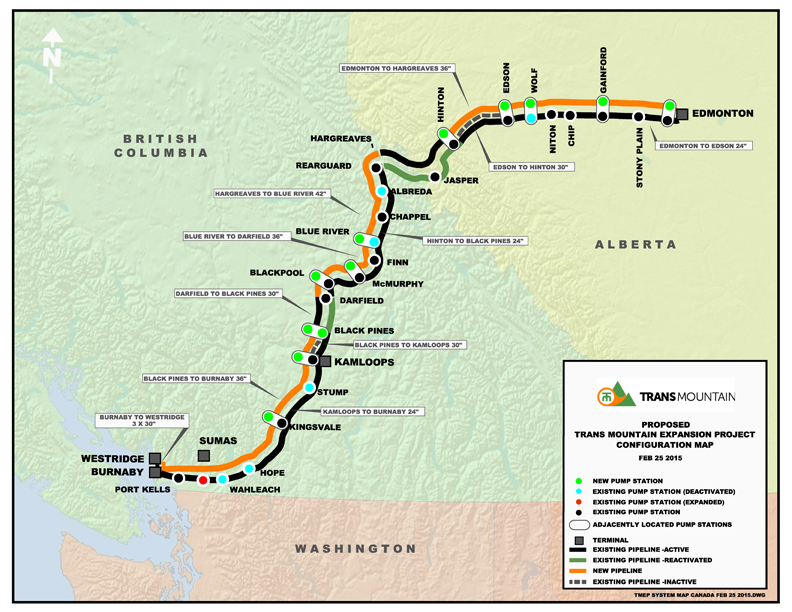

The Trans Mountain Expansion Project is one of the most important Canadian pipeline projects in the current landscape. The project objective is to bring oil from Alberta to a terminal facility near Vancouver. With a capacity of 590 MBOPD, the line would represent a major new takeaway source for Canadian oil sands operators. The vast majority of this new takeaway would be exported to Asian markets, an opportunity that Canada’s oil producers have long sought. Canada has as well, often commenting that its present situation has it tethered to one export customer–the U.S.–forcing producers to accept significant price differentials for the heavy oil and only one place to ship it.

April’s announcement of work suspension on the pipeline project sparked Alberta Premier Notley to offer to buy the project from the company, but no definitive plan came together. Meantime Canada’s federal government offered to reimburse Kinder Morgan for lost revenue and other expenses caused by the delays.

As part of the agreement, the Canadian government has agreed to fund the resumption of TMEP planning and construction work by guaranteeing TMEP’s advances under a separate Federal Government recourse credit facility until the transaction closes.

Kinder Morgan said it expects the parties to close the transaction late in the third quarter or early in the fourth quarter of 2018, subject to KML shareholder and applicable regulatory approvals. In its press release, Canada said it expects the deal to close in August 2018.

Finance Minister Bill Morneau and Natural Resources Minister Jim Carr issued Canada’s press release saying the agreement with Kinder Morgan was done to secure the timely completion of the Trans Mountain Expansion Project.

The Ministers said that the agreement will guarantee the resumption of work for the summer construction season, protecting thousands of jobs in Alberta and British Columbia. Federal loan guarantees will ensure that construction continues through the 2018 season, eliminating the uncertainty for families whose financial security relies on this project going ahead this year, the release said.

The Government of Canada said it would purchase Kinder Morgan’s Trans Mountain Expansion Project and related pipeline and terminal assets for C$4.5 billion.

“This investment represents a fair price for Canadians and for shareholders of the company, and will allow the project to proceed under the ownership of a Crown corporation. The core assets required to build the Trans Mountain Expansion Project have significant commercial value, and this transaction represents a sound investment opportunity,” Canada said in its news release.

“It is not, however, the intention of the Government of Canada to be a long-term owner of this project. At the appropriate time, Canada will work with investors to transfer the project and related assets to a new owner or owners, in a way that ensures the project’s construction and operation will proceed in a manner that protects the public interest.

Canada’s government said it would extend federal indemnity to protect any prospective new owner from costs associated with politically motivated delays.

The federal government said the province of Alberta will also contribute to get the project built, and that Alberta’s contribution would act as an emergency fund and would only come into play if required due to unforeseen circumstances. In return, Alberta will receive value commensurate to their contribution, through equity or profit-sharing.

The release emphasized that Canada’s reason for taking this action was that “completion of the Trans Mountain Expansion Project will deliver long-term economic benefits to Canadians – protecting jobs, ensuring that Canada’s resources can get to world markets safely and efficiently, and preserving Canada’s reputation as a good place to do business.”

KMI EBITDA

“For KMI, despite losing the EBITDA associated with the Trans Mountain system, we still expect to meet or exceed our 2018 distributable cash flow (DCF) per share target. The transaction will also have a positive impact on our consolidated balance sheet, as we expect KMI’s approximately 70 percent share of after tax proceeds to be approximately US$2.0 billion. Additionally, we continue to expect a 2018 annualized dividend of $0.80 per share, followed by $1.00 per share in 2019 and $1.25 per share in 2020, a growth rate of 25 percent annually,” said KMI Chief Executive Officer, and KML Chairman and CEO, Steve Kean. “We will provide additional financial guidance after the transaction closes.”

“Assuming that KMI can invest $2.0 billion per year at an average capital-to-Adjusted EBITDA multiple of approximately 7.0 times (versus the on-average 6.0 times for our backlog as of the first quarter of this year) those investments would yield KMI incremental annual EBITDA of over $300 million, representing greater than 4 percent annual EBITDA growth,” Kean said.