Chinese Oil & Gas Industry Remains a Major Player

At last week’s EnerCom conference, Dr. Lei Wang, a postgraduate researcher in Petroleum Engineering at the Colorado School of Mines, presented an overview of China’s crude oil and natural gas industry and discussed important ongoing energy trends in the country.

China, currently the fourth largest petroleum producer in the world, is a major contributor to global supply, producing 1.53 Bbbl of crude oil and 4.67 Tcf of natural gas domestically in 2015. More than 95% of all production comes from three state-owned oil companies known colloquially as the “Three Barrels.” The three companies are CNPC (Chinese National Petroleum Company), CNOOC (Chinese National Offshore Oil Company), and Sinopec (officially, China Petroleum and Chemical Corporation).

Expenditures by the “Three Barrels” and their percentage of the national fiscal expenditure have been decreasing in recent years. As a result, Chinese imports of oil and gas exceeded 60% and 30% of consumption in 2015 due to the economy growing faster than domestic production.

Meanwhile, demand for crude oil and natural gas has been consistently rising in China and this overall trend is expected to continue. In the last decade, Chinese oil consumption grew almost linearly at 4-6% while gas consumption has averaged a 10% annual increase. By 2040, demand for crude oil and natural gas is projected to increase 45% to 5.76 Bbbl and 310% to 27.5 Tcf, respectively. Economic growth has increased car ownership and vehicle miles driven, upping gasoline demand. The country’s commitment to reducing CO2 emissions will raise the percentage of electricity generated from natural gas from 2% to 12% over the next 25 years.

Wang concluded his overview by stating that “current energy development plans and taxation policies in China are creating more favorable environments for international firms to help develop oil and gas resources there.” Because the country “lacks project development skills and state-of-the-art technologies,” however, greater involvement with experienced international professionals and joint R&D with international companies on deep water, unconventional, and Enhanced Oil Recovery projects will be necessary.

Lessons from the Capital Cycle

A panel held on Wednesday discussed the capital cycle. Featured speakers William DeArman, Principal at upstream and midstream-focused private equity firm Tailwater Capital; Jacob Strauss, Vice President at diversified private equity firm Warburg Pincus LLC; and Kelton Glasscock, SVP & Head of Energy Americas at DNB ASA, a Norwegian bank, ran the panel.

The discussion touched on investment strategies and funding developments in the industry as well as each presenting firm’s overall investing philosophy. The main theme was that the price cycle has forced the industry be more flexible and find new opportunities for investment, although the qualities which the firms look for in a potential investment remain the same.

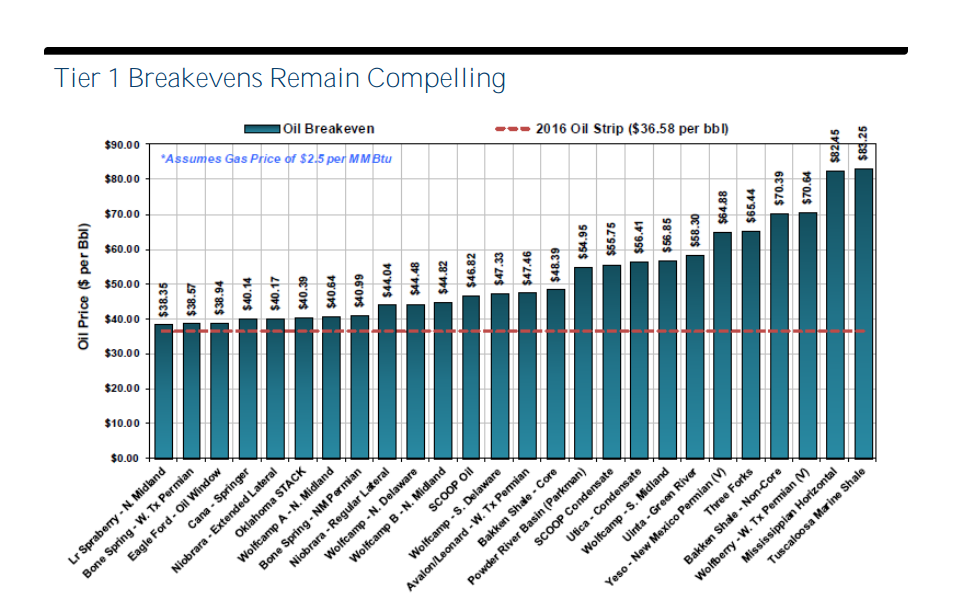

All the presenters agreed that tier one assets located throughout U.S basins and high-quality management teams remain vital to any investment decision seeking the best return at $40 oil. “As a non-op, we want to be behind someone drilling their 500th well instead of their tenth well and it’s important to be in the core as opposed to trying to stretch,” said DeArmand.

The importance of relationships in evaluating prospective companies was something all the presenters agreed was key. “I always tell my young bankers that the first ‘C’ of credit [stands for] ‘character’,” said Glasscock. “While credit metrics need to be in place, we also need to understand the company’s strategy and expect that both lending the balance sheet and getting ancillary business are part of the relationship.”

“Obviously the rock needs to be good but people come before you find the rock,” said Strauss. “If you look at long-term returns to capital in the industry, they’re basically around 10% regardless of the commodity cycle and it’s really those great people on management teams that are able to produce returns that are standard deviations over the rest.”

Insights from Private Oil & Gas Companies

Thursday saw the second of two panels on private oil and gas companies. Great Western Oil & Gas, Laramie Energy, and Jonah Energy discussed their current operations and strategic plans. Speakers included Jonah CFO David Honeyfield, Laramie Chairman and CEO Bob Boswell, and Great Western Vice President of Finance Michael Walker. Both Honeyfield and Boswell also have experience as Chief Executives at public companies.

Great Western: Western decline-focused DJ Producer, Monobore Pioneer

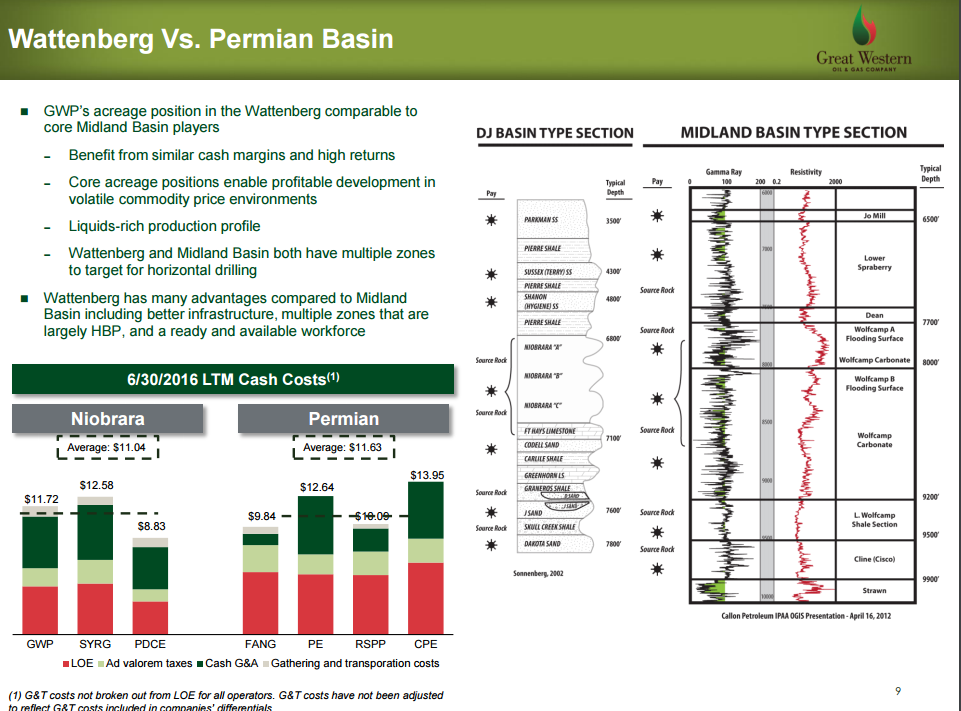

Great Western’s position focuses on the western flank of the Core Wattenberg, a commingled sweet spot between gas and oil heavy horizons.

The geology provides multiple zones for horizontal drilling to target while the gas mix provides lift to oil. The economics of the position are comparable to those of core Midland Basin players and allow for profitable development in volatile commodity price environments, Walker said.

Walker’s presentation discussed key technologies Great Western has utilized in the Niobrara to drive cost improvements. “We pioneered the use of monobore drilling in the area, which allows greater flexibility and larger pumps deeper in the lateral, and we were also an early adapter of plug and perf completions technology, allowing for more consistent stimulation and precise targeting,” said Walker. The company’s well bore targeting is able to deal with the complex geology and numerous faults in the formation, he said.

Laramie: Gas-focused Piceance Producer with Infrastructure Assets

All of Laramie’s 367,027 gross acres are located in the Piceance basin of Western Colorado, one of the top five gas fields in the country. The company’s experience in the basin has allowed it to pursue a “manufacturing-style drilling program” in the words of CEO Bob Boswell, based on vertical and directional wells.

Completions savings have been realized from proppantless slickwater fracs. Most produced gas goes westward on pipelines with unconstrained takeaway, keeping gas differentials low. In addition to compression and dehydration assets, the company owns its own water storage, and salt water desalinization infrastructure, as its second largest expense is salt water disposal.

Jonah: Gas-focused Rockies Producer with the Purest Measure of Operating Performance

Jonah’s assets include 118,000 acres in Sublette County of Southwestern Wyoming, where the eponymous natural gas field is located, as well as acreage in the Mid-Continent region. The company’s strategic thesis is to acquire undercapitalized assets and then mobilize capital to fully realize their value through implantation of an operating formula that CFO David Honeyfield called “repeatable and execution-based.”

In his presentation, Honeyfield called attention to Jonah’s high average feet drilled per day, which he believes is the “the purest measure of operating performance.” The company’s ongoing hedging program is central to insulating returns and mitigating volatility, while production of 310 MMcfe/d allows the focus to remain on free cash flow generation to maintain high liquidity and pay off debt.