Energy infrastructure is becoming increasingly important as the United States steps into the role of the world’s largest producer, pumping about 55 quadrillion Btu (about 27.5 MMBOEPD) of petroleum and natural gas in 2014. The growth of production has outstripped that of infrastructure, bringing the importance of midstream companies to center stage since the shale revolution.

Speaking with Oil & Gas 360® in an exclusive interview is Mike Howard, chairman and Chief Executive Officer of Howard Energy Partners, a private, San Antonio-based midstream provider in the Eagle Ford Shale region of South Texas, as well as in the Marcellus Shale region in Pennsylvania. Mr. Howard has 20 years of experience developing and managing midstream companies, serving as the President of Midstream for Energy Transfer Partners (ticker: ETP) prior to founding Howard Energy Partners.

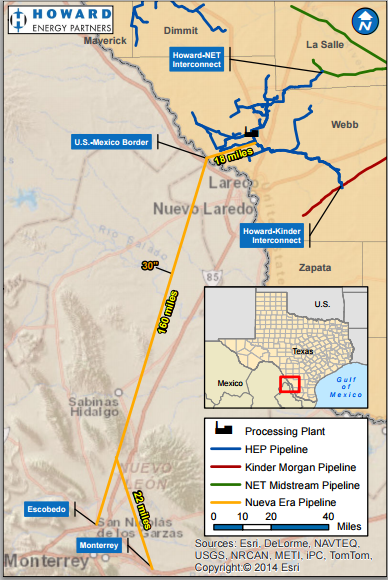

Most recently, Howard Energy Partners announced the construction of a 200-mile pipeline to connect its natural gas hub in Webb County, Texas, to the natural gas infrastructure in Mexico.

In addition to speaking about the exciting prospects associated with the new pipeline to Mexico, Mr. Howard shared his insight into how the midstream sector has evolved since he got his start, what midstream companies can do to remain competitive in today’s price environment, policy viewpoints and the possibility of going public.

OAG360: Mr. Howard, what drew you into the pipeline industry?

HOWARD: It’s kind of a story dating all the way back to my days in Texas when I was attending Texas A&M, Kingsville. I went to school to become a chemical engineer and I had learned of the oil and gas business from an uncle of mine who graduated from the same university. I didn’t really know what I wanted to be in the oil and gas business, but I got an internship at a natural gas processing plant that was not very far from the university. I was able to work at that processing plant and put myself through school learning the natural gas processing business. The natural gas processing led to pipeline led to, you know, any number of the business lines within midstream, and so it dates back to 1993 for my first internship.

OAG360: So you’ve been in the industry for a long time now. What’s changed since you started?

HOWARD: What’s fascinating about the industry is, back when I started, we were a production company and the pipeline business just supported the producers within the production company. I started with Union Pacific Resources and they were known as a relatively large driller of natural gas back then. Horizontal drilling was brand new, and they were really exploiting the Austin Chalk area. Our job as the midstream guys inside of a production company was just to keep up with the drilling program.

Through the years and as the MLP space has grown and the way we finance midstream companies has changed, no longer do we compete for capital from the drill bit. So the producers have their way of getting capital and the midstream companies have a different source of capital, but it used to be all one source of capital. Most midstream companies are now capitalized as MLPs. Since we now have our own source of capital, I think that makes infrastructure little more competitive than it used to be.

OAG360: Speaking on competitiveness, what can midstream companies (MLPs especially) do in the current price environment to stay competitive?

HOWARD: What Howard Energy has done specifically is looked for diversity of cash flow. It’s just like how you want to manage your retirement investment portfolio; you want to be diversified in all of your assets. We have taken the same approach.

We have gathering and processing, deep water port facilities, bulk liquid storage facilities, liquid processing facilities, as well as treating, processing, compression and all the other services within those particular business lines. So it’s our perspective that, as you move away from the drill bit, there are still midstream business lines that produce good revenue through down times. Obviously gathering and processing is our core business because of the size of the capital required to support that business, but we have a lot of other business lines. Right now in the downturn, we’re doing quite well and have been able to stay very liquid so when an opportunity comes up, we’ll be able to capitalize on it.

OAG360: Are there any assets in particular that you expect to see significant growth in the future?

HOWARD: It’s funny… I would have said this back in 2009, but I’m a big fan of the dry gas, high volume plays that are still out here to be developed and that sit right up against markets. We all know about the Haynesville, Barnett and Fayetteville, but their markets aren’t necessarily next door to the production zones. The two that are on my mind the most these days are anything with high volume, dry gas content in the Marcellus and Utica. Also, anything in South Texas, like the lean Eagle Ford, that hasn’t been drilled much yet. It’s been drilled in our area, Webb County, just a little bit by Swift Energy (ticker: SFY) but not as a whole. It hasn’t been exploited like it could be.

We have two of the largest demand centers at the borders of both of those places. The Northeast natural gas demand is right on the border of Pennsylvania. Mexico, which is a huge demand player, is right up against the border of Texas on our Nueva Era pipeline that we just announced.

So in this price environment, we’re able to move away from things that were generating a lot of value before. Rich natural gas, for example, contains ethane, propane and butane, but the prices of those commodities are pretty low right now so you’re not seeing the uplift you have been getting for the last four or five years.

So that’s been our focus here lately; we’re natural gas people whether it be rich or lean. We like oil and believe it will continue to be important to us, but in this particular commodity market with everything suppressed, our main focus is going to be on high volume lean natural gases.

OAG360: What’s the most exciting aspect of your Nueva Era pipeline project in Mexico?

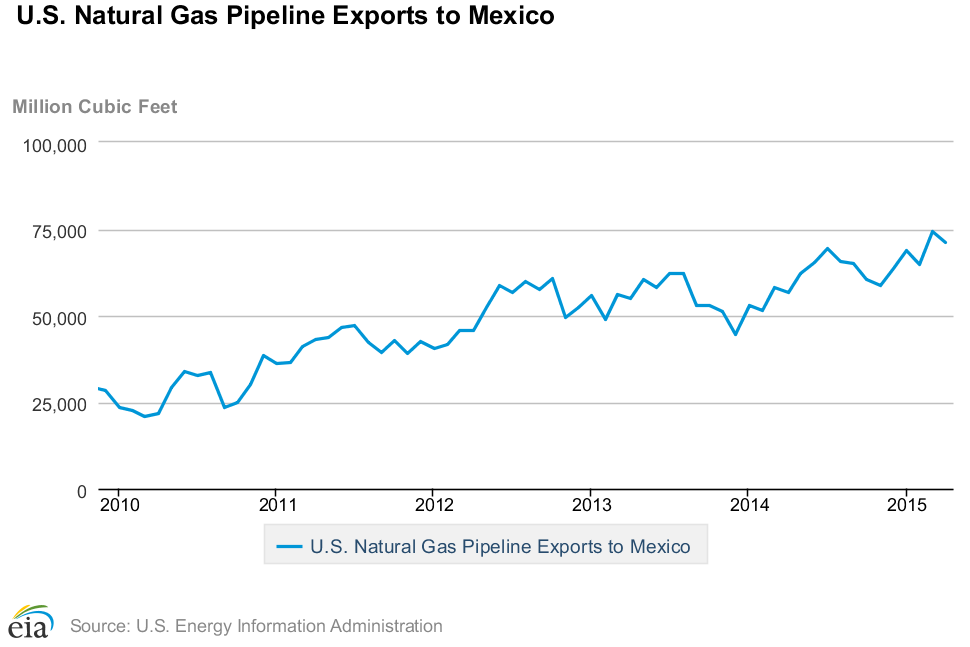

HOWARD: Well, Mexico is already the largest natural gas consumer as an industry. They’re pretty consolidated; the CFE (Comision Federal de Electricidad) is the national electricity provider and Pemex (Petroleos Mexicanos) is the national oil company. Traditionally, Pemex has supplied the molecules to the CFE to fuel their power plants or other industries.

Well now with the reforms going on, CFE can actually go contract for these volumes themselves directly from the United States. We sit in a perfect position considering we’re just six miles away from the border. We transport a tremendous amount of natural gas and we want to connect the largest industry to one of the largest producing basins directly. We believe it’s a natural fit and that we’re more competitive, price-wise, than the other pipelines. We think that part of Mexico’s portfolio of energy should come directly from the producing regions.

OAG360: How has Mexico’s reform and Pemex’s reduced impact affected your business?

HOWARD: It’s been great.

It allows for more trading to happen across the border with multiple parties. It helps with geography synergies, where there are areas in need of pipelines just like the Nueva Era. Our pipeline goes from Webb County through Columbia into Monterey, and there’s no pipeline into that area.

When you loop a pipeline, you never want to loop it in the same ditch. You want to loop it in a different geographic area because, when drilling does happen in Mexico, you at least have a backbone, or a main highway where they can access their production and get it to market more quickly. This is obviously much more beneficial than drilling the well and having to lay a pipeline 200 miles somewhere. That’s a twofold reason why we really like it.

OAG360: How is your international business different from what you’re doing domestically in the U.S.?

HOWARD: Well, Mexico nationalized their hydrocarbons in 1938 and has not caught up with the U.S. industry. So they have not had the experience in technology, capital and education, so there’s not as much competition for all of those services today. So being a first mover in Mexico is not dissimilar to being a first mover, say, in the Marcellus when it was brand new in 2009.

Being a first mover has its advantages. You get to develop the groundwork on how they develop their technology and education, and if you could be on the leading edge of that, we think that puts us at an added advantage. We can constantly be providing Mexico with a more competitively priced molecule and not have some of the competitive stresses we have in the U.S. with all the money on the market chasing midstream deals.

OAG360: You discussed the advantages of being a first mover in Mexico. Can you discuss the advantages of your financial partnership with Enlink Midstream (ticker: ENLK) and Alinda Capital Partners?

HOWARD: Well when I started the company back in 2011, there were about 25 players out there that were similar to us in that we were private equity-backed, small midstream players. Now there’s over 100. Because of the success of those first 25, more private equity is poured into the market.

What’s different now is that private equity companies will invest and have to meet an investment horizon. They will typically be in an investment for anywhere from three to seven years, and then they have to sell. Howard Energy was created to be a long term player. We’ve never had just one sponsor, we’ve always had multiple sponsors. Enlink and their predecessor, Crosstex, has been by far our strongest supporter and they’ve been with us since day one.

When your capital structure is flexible in long term thinking, it gives us the ability to think long term. We’re not trying to beat a three to seven year horizon, cash out and then go start up another company in another basin. We’re building a long term, viable business that will be providing these services for years and years to come. So our advantage is we have all the financial strength of the small companies but we have the sophistication and the internal horsepower to be a very large company.

OAG360: Aside from your financial structure and your first-mover mentality in Mexico, what else sets Howard Energy Partners apart from its peers?

HOWARD: We are very heavily engineering and operations focused. We are not run by a financial or commercial leader that doesn’t have experience of execution. Our people, whether it be myself or my colleagues, have lots of years of executing very large projects. We have former investment bankers, legal counsel and accountants all internally who have been in the business for many years.

So we have a very deep bench of experience in this company where most companies of our size have a very limited bench that use outside resources to just get them through so they can flip another company. Our experience is very deep – that makes us move very quickly and we execute on very complicated projects. For example, in 2012 we built a 200 MMcf/d cryogenic plant, and in 2013 we built a deep water port facility in Brownsville, Texas. We also started up a natural gas liquids processing facility, which was the first of its kind in South Texas.

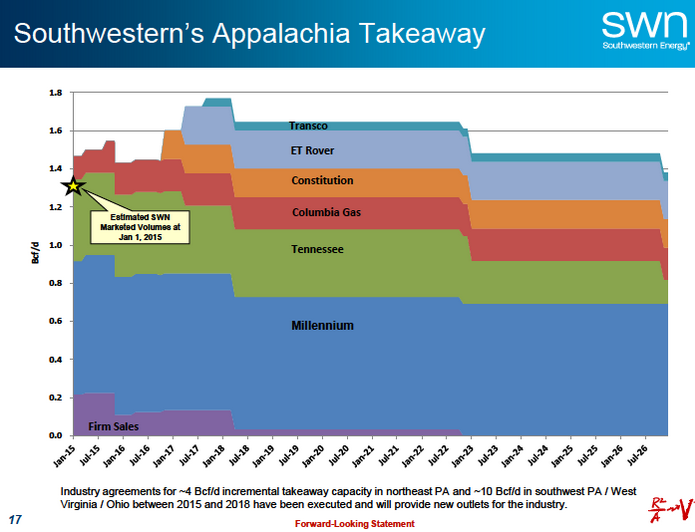

If you look at our most recent acquisitions in Pennsylvania, we were able to move very quickly for Southwestern Energy (ticker: SWN). They needed someone to come in and buy those assets and they needed someone who was trusted and held a lot of experience. They chose us because they know who we are and trusted our deep expertise.

Assets purchased by Howard Energy Partners from SWN in March 2015 for $500 million… Source: SWN April 2015 Presentation

OAG360: Does that financial structure, combined with the experience, assist in helping you move quickly on these opportunities?

HOWARD: Absolutely. Most people receive about $100 to $300 million in commitment. We have spent well over $1 billion on assets in the last four years and our commitment is really endless. We can continue to raise capital with our current providers or go to new providers if we all agree that is the right thing to do.

So it sets us up to be very flexible and to continue to grow. You don’t have to think about “Oh no, let’s not spend that money. Let’s exit so we can get the next round of capital and go do something else.” Our money continues to be reinvested in the company to grow the company.

OAG360: A policy question, if you don’t mind: What are your thoughts on the Keystone XL, and why has that been held up when we have so many pipelines that crisscross the country already?

HOWARD: You know, that’s a fascinating political question. It’s unfortunate that it gets locked up like that. Thank goodness that we have creative financial structures in this country and creative regulators that are allowing existing pipes to convert service and accomplish the same thing that Keystone XL would have accomplished.

If you are constrained to the political winds of any administration, that’s a very dangerous place to put your country. I think a free market can solve that problem. Actually, that’s what is happening because Keystone XL can become irrelevant if railroads or existing pipelines can become better solutions. Somebody could even come in and anchor a pipeline a different way, so there’s a lot of ways around that particular issue. I’m hopeful that as long as we continue to be a free market in the natural gas and oil business that we’ll continue to solve those problems and provide the most competitively priced hydrocarbon in the world.

OAG360: How would your business be affected by the lifting of the U.S. crude export ban?

HOWARD: From our perspective, we installed a natural gas liquids, or basically a condensate stabilization process, in South Texas in 2013. We did that in anticipation of condensate being exported as long as it’s been processed and we have a facility right along the Gulf Coast that satisfies the requirements of processing.

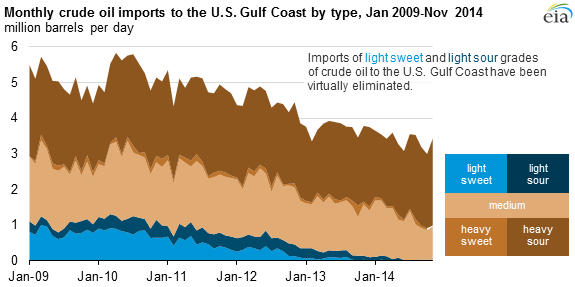

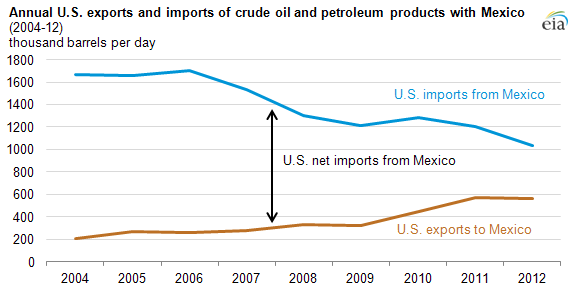

So we’ve been a fan of exports for quite some time now, and not just for condensate exports, but from an oil standpoint as well. As the U.S. has learned to extract these tight oil shales, our refineries are not necessarily set up to run this kind of product. We’ve traditionally imported the very heavy hydrocarbon oil from Venezuela or Saudi Arabia.

As our refineries retool to a more domestic supply and other countries can benefit from our lean production, it goes to further make us independent as a country. So if exports can solve the problem of having to import so much heavy oil, it’s a great story for us. It just makes us more politically independent and puts us in a better financial situation as a country.

OAG360: Howard Energy Partners is a private company, but would you ever consider going public?

HOWARD: It’s funny, I get asked that a lot and I think it’s a natural progression of a company of our size to do that someday. Nothing is imminent, but someday it will probably make sense. Personally, we started this company with no vision of going public because I’ve been a part of a publicly traded company my entire career, so it’s kind of nice being private.

OAG360: What do you like better about being in a private company?

HOWARD: Well, being a public company requires you to meet all S.E.C. requirements. That includes reporting requirements via a phone call once a quarter with your investors, or you have to be in the public eye a lot more often, giving speeches, that sort of thing.

Right now, I basically worry about three investors: management, Enlink and Alinda. When you become public, you’ll have hundreds of investors, and you have to be as attentive to those hundreds of investors as I am with my three right now. It’s just the additional strain that it puts on an organization. But, it’s also a good source of capital to access and it helps you grow beyond where you are, so sometimes you have to take the good with the bad.

OAG360: Mr. Howard, thank you very much for joining us today, we really appreciate your insight.

HOWARD: Thank you.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.