Reuters

ABERDEEN, Scotland – Total (TOTF.PA) beat forecasts on Thursday by keeping net adjusted fourth-quarter profit steady at $3.2 billion despite low oil prices and fulfilled a pledge to boost dividends, lifting the French energy firm’s shares.

The stock rose about 3% before easing off its highs as the company bucked a trend in the industry which has seen profits tumble in the last three months of 2019. Analysts had expected Total’s net profit to slip to $2.7 billion.

“This performance is better than that of our rivals in terms of resisting low oil prices,” CEO Patrick Pouyanne told journalists, adding Total was rewarding investors with a 6% increase in the final dividend for 2019 to 0.68 euros per share.

“Taking into account the strong visibility on cash flow, the group will continue to increase the dividend with the guidance of 5% to 6% per year,” the company said in its statement.

Total bought back $1.75 billion in shares in 2019 and plans to buy back $2 billion more in 2020.

Pouyanne said the group had reported solid results including debt-adjusted cash flow (DACF) of $7.4 billion, up more than 20% from a year earlier.

“While some peers buckled last week to a synchronized slowdown in their commodity prices and margins, Total has bucked that trend with flat year-on-year net income,” Bernstein analysts wrote, adding that net income and net operating income were both ahead of forecasts.

The analysts, which rate the stock “outperform”, said liquefied natural gas (LNG) margins “also beat our expectations as the company proved immune to low spot gas prices despite market concerns”.

LNG prices have been under pressure as new projects have kept the market well supplied, while oil prices LCOc1 have tumbled to around $55 per barrel from last year’s peak in April of almost $75.

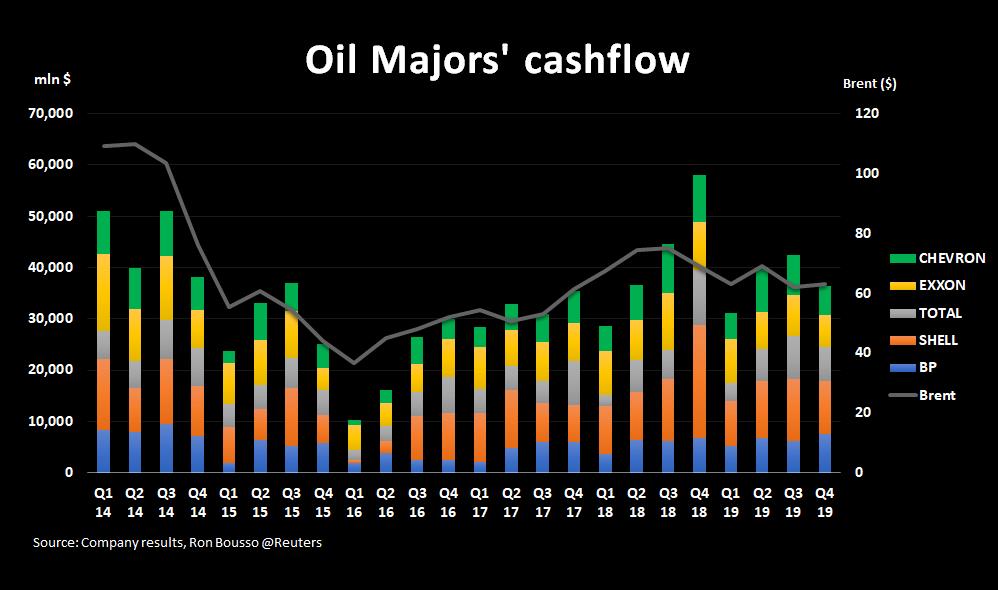

Rivals have seen fourth-quarter profits slide on lower prices. BP (BP.L) reported a 26% drop on Tuesday while Royal Dutch Shell (RDSa.L) last month said its profits had halved.

(Graphic: Majors cashflow Total, here)

LNG OUTPUT

Total’s oil and gas production grew by 9% in 2019 thanks to project start-ups and ramp-ups, while its LNG business doubled, boosting cash flow.

“One of the reasons our results resisted the low oil environment was because of the strong LNG output which grew 50%,” Pouyanne said.

He said exceptional production growth was unlikely to continue in the years to come and output growth for 2020 was seen at 2% to 4%, a more typical level in the industry.

The chief executive said Total was expanding in the low carbon energy business and was on track to meet its goal of producing 25 gigawatts (GW) of renewable electricity by 2025, helped by solar projects in Qatar and India.

Total, which kept its capital expenditure target steady for 2020 at $18 billion, said it was on track to achieve its target of $5 billion in divestments during 2019 and 2020.

Total said it had sold its 27.5% interest in Fosmax LNG, which operates France’s Fos Cavaou LNG terminal, to Engie (ENGIE.PA) unit Elengy for about $260 million.

Total is on track to achieve its divestment target with transactions worth $3 billion so far, Jefferies analysts said.

(Graphic: Total Results, here)

[contextly_sidebar id=”SIV32NbVKEji3lJUQ4wPnWLX6tpP1YBv”]