Total + Tellurian to develop integrated gas project together

Total (ticker: TOT) is acquiring approximately 23% of Tellurian Investments, an early stage U.S. LNG export project that was founded by former Cheniere Energy (ticker: LNG) CEO Charif Souki and former BG COO Martin Houston. The transaction is at $5.85 per share for an amount of $207 million.

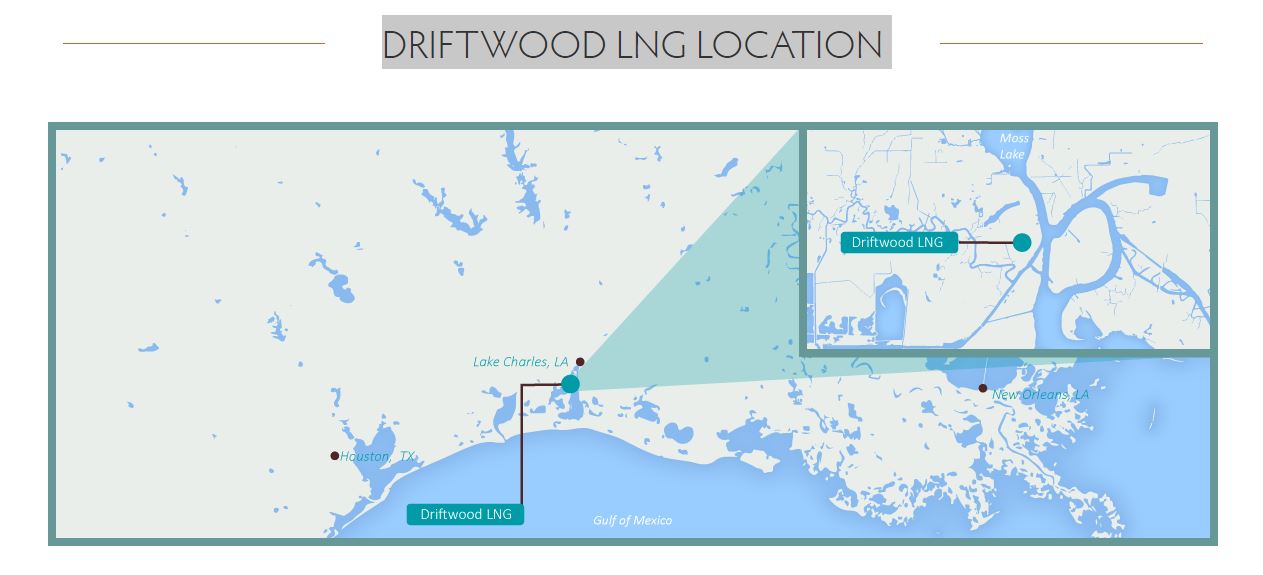

Driftwood LNG is Tellurian’s planned LNG export project in Louisiana that is currently in the engineering design and pre-filing phase. The Federal Energy Regulatory Commission (FERC) approved Driftwood LNG’s pre-filing request on June 6, 2016. Tellurian expects to commence construction of Driftwood LNG in 2018 and produce LNG in 2022, it said in a press release. The companies said the scope of the investment covers “the acquisition of competitive gas production in the U.S. to the delivery of LNG to international markets from the Driftwood LNG terminal.”

Tellurian President and CEO Meg Gentle said Tellurian was happy to have one of the major global LNG operators as a shareholder. Total President of Gas, Renewables and Power Philippe Sauquet said, “Investing in Tellurian at an early stage will give us the opportunity to potentially strengthen our mid and long term LNG portfolio thanks to a very cost competitive project.”

Total’s 2015 LNG production was 10.2 million tons. Total said its objective is to double its liquefaction capacity to around 20 Mt/y and increase its LNG trading portfolio to 15 Mt/y by 2020.

GE also an investor in Tellurian

Last month, Tellurian and GE announced that GE had made a $25 million preferred equity investment in Tellurian.

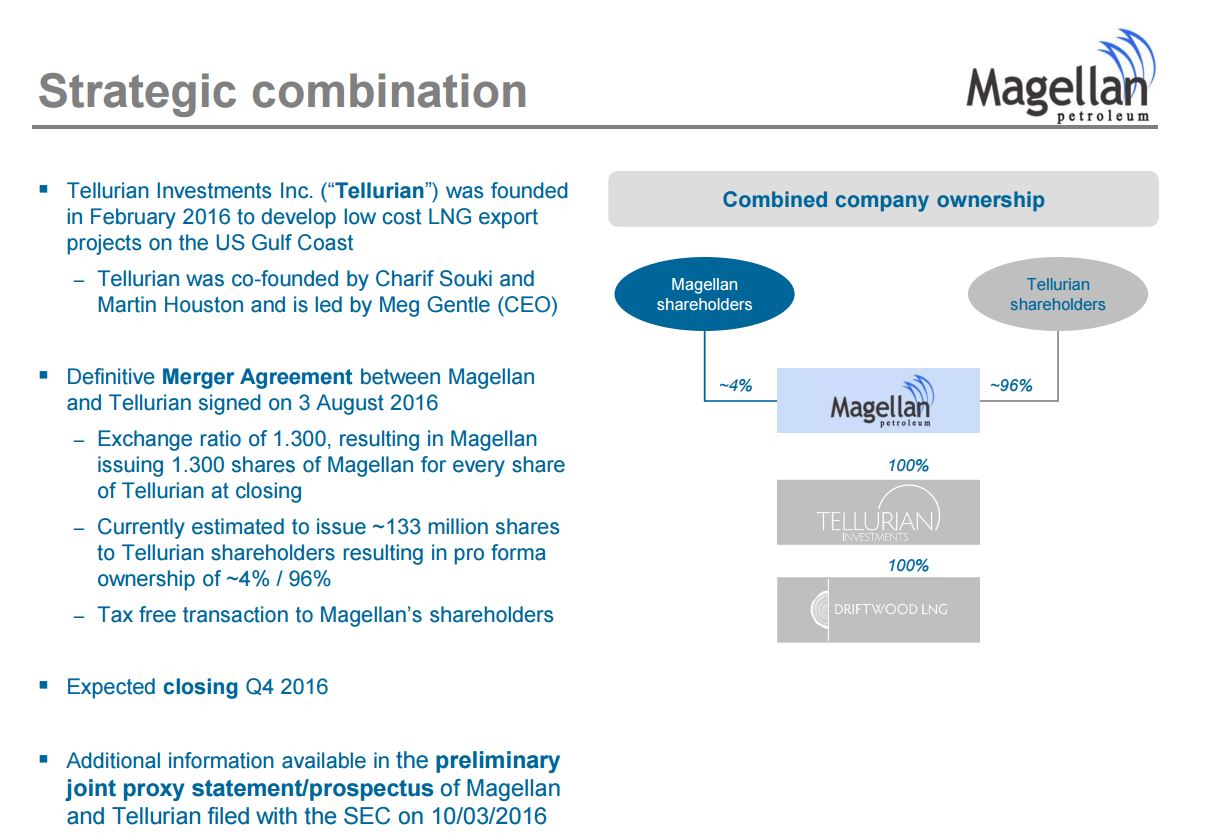

Magellan+Tellurian reverse merger expected to close Q1 of ’17

In August, Magellan Petroleum and Tellurian announced an agreement to enter into a reverse merger of Tellurian into Magellan, with Tellurian being the surviving entity. In today’s press release, Tellurian said it expects the deal to close in Q1 of 2017. Magellan’s shares trade on Nasdaq under the symbol MPET.