Total S.A. (ticker: TOT) closed the acquisition signed on August 21, 2017, adding around one billion BOE 2P reserves, mainly in OECD countries. The acquisition also increases Total’s production by 160 MBOEPD in 2018, and the company expects to ramp up production to 200 MBOEPD by early 2020. According to Total, this deal makes the company the second-largest operator in the North Sea with a projected output of 500 MBOEPD by 2020.

The effective date of the transaction was March 8, 2018. Under the agreed terms, A.P. Moller-Maersk will receive a consideration of $4.95 billion in Total shares (around 97.5 million shares based on average share price of the 20 business days prior the signing date of August 21, 2017) and Total will assume $2.5 billion of Maersk Oil’s debt.

When the deal was announced in August, Maersk said it planned to return a “material portion of the value of the received Total S.A. shares” to shareholders in 2018 and 2019.

Getting out of oil

On the Maersk Oil website the following message appeared:

To Maersk Oil’s loyal audience:

Please note that as of today, this website will be closed due to the acquisition in August 2017 of Maersk Oil by @Total, one of the world’s leading energy companies. You can read more here.

All future content related to our operations will be accessible via Total’s external channels. Thanks for your engagement and we encourage you to continue to follow our activities via http://www.ep.total.com/en.

“With the completion of the Maersk Oil transaction, we have taken a significant step in our strategy to focus A.P. Moller-Maersk on container shipping, ports and logistics,” said Søren Skou, the CEO of A.P. Moller-Maersk.

Key assets of Maersk Oil sold to Total

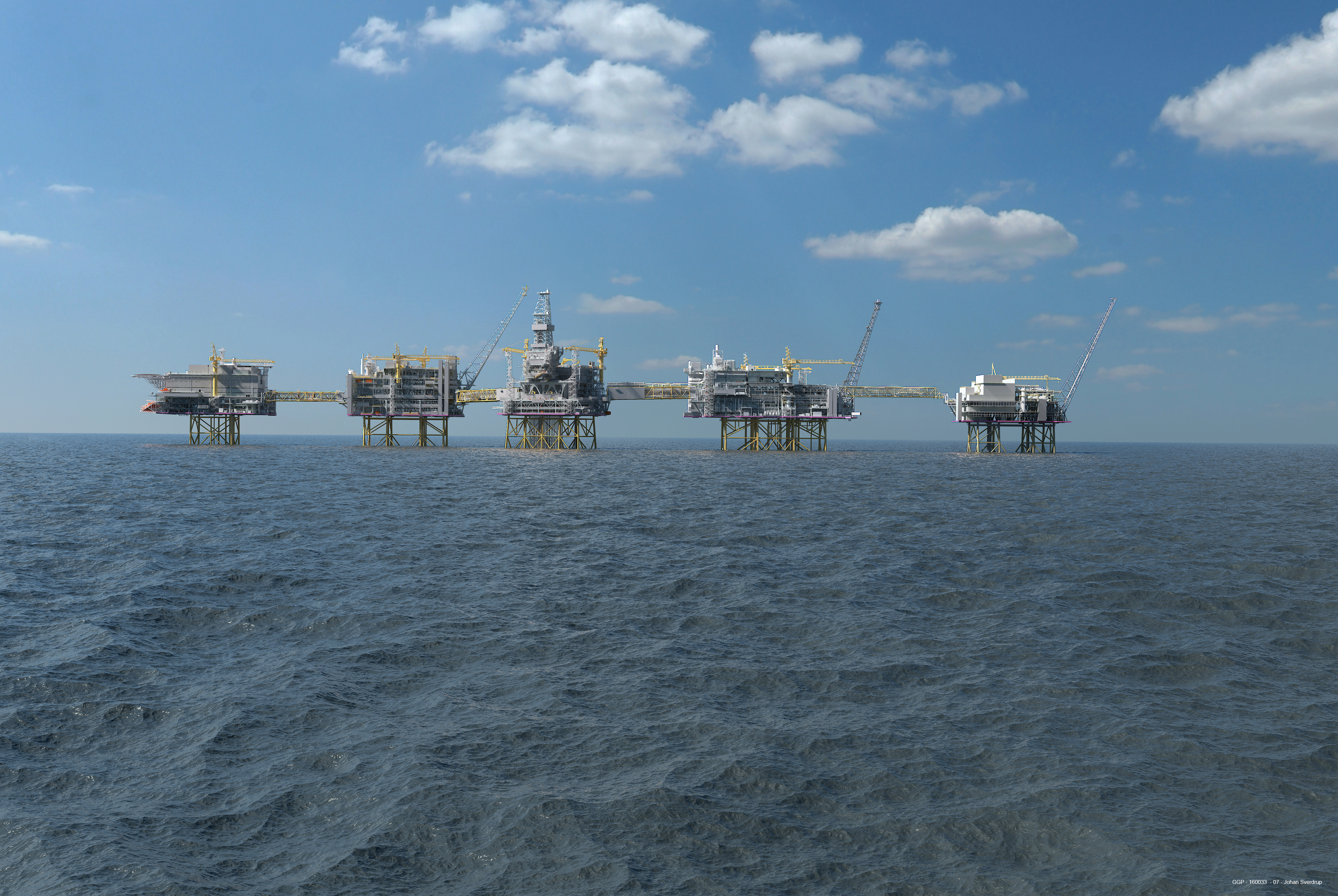

North Sea

- 8.44 % of the Johan Sverdrup oil field in Norway

- start-up planned in 2019

- Phase 1: production capacity of 440,000 BOEPD

- Phase 2: expansion to 660,000 BOEPD

- 49.99 % of the Culzean gas field in the U.K.

- start-up planned in 2019

- production capacity of 100,000 BOEPD

- 31.2 % of the Tyra producing gas field in Denmark

- start-up of redevelopment phase planned after 2020

- redevelopment enabling a production capacity of 55,000 BOEPD

Source: Total

United States

- 25% of the Jack producing oil field

- production capacity of 50,000 BOEPD

Algeria

- 12.25% of the El-Merk, Hassi Berkine producing oil fields

- production capacity of 400,000 BOEPD