Company Has $38 Billion in Future Projects

TransCanada Corporation (ticker: TRP) reported net income of $387 million, or $0.55 per share, on revenues of $2,874 million in its Q1’15 earnings release issued on May 1, 2015. Compared to Q1’14, revenue was steady while net income declined by about 6%. The company declared a $0.52 dividend for the quarter ended June 30, 2015, up from its previous dividend of $0.48 per share. The company anticipates increasing its dividend at a compounded annual growth rate of 8% to 10% through 2017, equating to roughly 35% of cash flow.

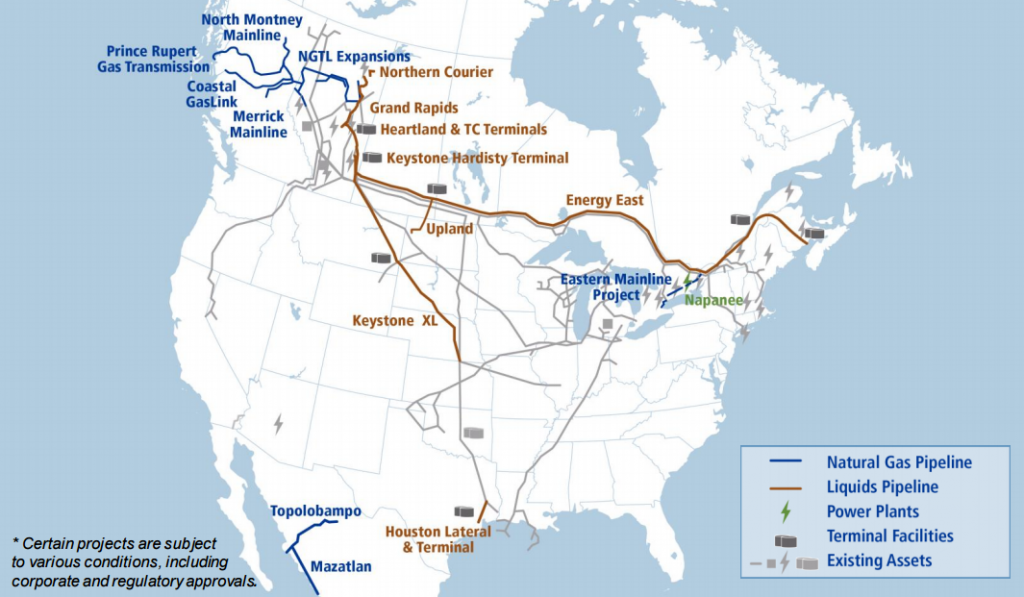

TRP management said the depressed power prices affected net income in the quarter, but its diverse portfolio helped offset the lower commodity environment. Don Marchand, Chief Financial Officer of TransCanada, called the low energy prices “unsustainable in the medium-term to long-term” in a conference call following the release. TransCanada’s network, based entirely in North America, includes more than 42,100 miles of natural gas pipelines and ownership/interest in more than 10,900 megawatts of power generation. Its network alone provides roughly 20% of all North American demand.

Project Update

TransCanada’s massive footprint and impending projects are laid out entirely in its 61-page news release, but updates on the largest projects include:

- North Montney Mainline. The National Energy Board (NEB) issued approval of the $1.7 billion project last month. Initial capacity of the pipeline is 2.4 Bcf/d and will run about 187 miles across British Columbia.

- NGTL Pipeline Expansion. North Montney is part of this $6.7 British Columbia infrastructure development, but two other expansions are currently under review by various government agencies and commissions. Permit decisions on proposed projects like Coastal GasLink (470 miles) and PRGT (559 miles) are expected in Q2’15. The projects primarily revolve around the development of the Pacific NorthWest LNG export terminal – an estimated $11 billion project operated primarily by Petronas.

- Energy East Pipeline. The project will be adjusted to accommodate an endangered species in the northeast region, and amendments are expected to be submitted to the NEB in Q4’15. The projected $12 billion project has already secured binding long term contracts of 1.0 MMBOPD (1.1 MMBOPD of initial capacity).

- Keystone XL. The lightning rod topic of the oil and gas industry remains in neutral after being vetoed by President Obama in February. TRP says it has invested $2.4 billion into the project thus far. Russ Girling, President and Chief Executive Officer of TransCanada, maintained optimism in his prepared remarks. “I believe that the facts will prevail at the end of the day, and we will eventually receive a permit and Keystone XL will be built,” he said. “Our shippers continue to be 100% supportive of the project, and despite the dip in oil prices, the need to safely transport new Canadian and U.S. crude oil to marketplace remains.”

- Napanee Power Project. Construction has begun on the $1 billion facility in Ontario and is expected to be online in late 2017.

- Houston Lateral and Tank Terminal. A 48-mile, 700 MBOPD pipeline is expected to be operational by Q4’15 and is an extension of the existing Keystone Pipeline. TRP will connect its system to a nearby terminal operated by Magellan Midstream Partners (ticker: MMP) to “enhance connections to the Houston market.” The pipeline is expected to be in service by Q4’16.

TransCanada Update

TransCanada Update

TRP completed a $446 million drop-down transaction to its master limited partnership (MLP), TC Pipelines (ticker: TCP), in April. TCP obtained a 30% interest in Gas Transmission Northwest LLC. TransCanada holds 28.3% ownership of its MLP vehicle and plans on transferring all of its United States pipelines to its subsidiary. TCP issued $350 million of ten-year senior notes to finance the transaction.

On the TransCanada side, the company secured $1.75 billion in financing through the issuance of four sets of senior notes. Two of the notes mature in 2018 while the remaining pair matures in 2020.

As of March 31, 2015, the company held about $1.5 billion in cash on hand and about $4.1 billion available in undrawn bank lines.

Roughly $10 billion of small to medium sized growth projects will be placed into service within the next three years. An additional $28 billion of commercially secured projects are anticipated to add to future growth.

Keystone XL Update

The White House blocked construction of TransCanada’s Keystone XL pipeline project, the final leg of the Keystone Pipeline system, when President Obama vetoed a bill that would have authorized construction of it earlier this year. A veto override would have moved the company’s $8 billion project forward, but it failed to pass the U.S. Senate by five votes.

Long time energy expert Tom Petrie predicted that the Keystone XL pipeline will be signed into law before Obama exits office. Petrie’s remarks were made during a presentation at The Oil & Services Conference™ in February. That leaves 18 months before a new president would take the oath of office.

Other career oil and gas industry professionals including former Shell Oil President John Hofmeister and many governors have called for the building of the pipeline. In an exclusive interview with Oil & Gas 360® Wyoming Gov. Matt Mead said, “It’s my belief that it’s a benefit to the country and that it would lift all boats by having that available.”

Colorado Governor John Hickenlooper told Oil & Gas 360®, “On a general basis I think pipelines make a lot of sense–again, much less expensive, much safer, cleaner, better for the environment. We support them.”

With $2.5 billion invested thus far and a massive stockpile of pipe awaiting in North Dakota, TransCanada is ready to proceed with the project. TransCanada’s Corey Goulet, President of Keystone Projects, discussed what’s next for the Keystone XL pipeline in an exclusive interview with Oil & Gas 360 on Mar. 13, 2015.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.