(World Oil) – President Donald Trump signaled he’s leaning toward excluding ExxonMobil from his push for U.S. oil majors to rebuild Venezuela’s petroleum industry, saying he was displeased with the company’s response to his initiative.

“I’d probably be inclined to keep Exxon out,” Trump told reporters late Sunday aboard the presidential plane on the way back to Washington from his Florida estate. “I didn’t like their response. They’re playing too cute.”

Trump appeared to be referring to a White House meeting on Friday with almost 20 oil industry executives, where ExxonMobil CEO Darren Woods expressed some of the strongest reservations and described Venezuela as “uninvestable” in its current state.

The president’s latest comments also highlight the challenge of persuading the U.S. oil industry to commit to an ambitious reconstruction of Venezuela’s once-mighty energy sector, which he announced within hours of the capture of former President Nicolás Maduro.

Exxon shares fell as much as 1.7% Monday as crude futures were little changed.

Reviving the oil industry and undoing years of underinvestment and mismanagement would, by some estimates, require $100 billion and take a decade. Despite U.S. moves over the past week to take full control of Venezuelan oil exports, many questions remain over how major investment on the ground could be guaranteed over such a protracted period in a country beset by corruption and insecurity.

When asked Sunday which backstops or guarantees he had told oil companies he was willing to provide, Trump said: “Guarantees that they’re going to be safe, that there’s going to be no problem. And there won’t be.”

Trump didn’t specify in what way he might seek to exclude Exxon. The company didn’t immediately respond to a request for comment outside of U.S. office hours.

Chevron Corp., Exxon’s biggest U.S. rival, is the only Western oil major to have continued operating in Venezuela while Maduro was in charge. Chevron Vice Chairman Mark Nelson said at the White House meeting on Friday that his company was poised to significantly ramp up output in the country from current levels of about 240,000 bpd, and that it could increase production by about 50% over the next 18-24 months.

See also: Trump’s Venezuela oil ambitions face major stability hurdles

In contrast, Woods struck a much more skeptical tone, noting how Exxon assets have been seized by the Venezuelan government on two separate occasions in the past. The company departed Venezuela for good after its remaining operations were nationalized under President Hugo Chávez, Maduro’s predecessor, in the mid-2000s.

“If we look at the legal and commercial constructs and frameworks in place today in Venezuela today, it’s uninvestable,” Woods said at the meeting.

Despite those reservations, Woods said Exxon is ready “to put a team on the ground” if there is an invitation from the Venezuelan government and appropriate security guarantees.

“We’re confident that with this administration and President Trump working hand-in-hand with the Venezuelan government that those changes can be put in place,” Woods said.

While Woods wasn’t alone in expressing caution at the meeting, other executives were more optimistic, including Repsol CEO Josu Jon Imaz San Miguel, who said the Spanish company was “ready to invest more in Venezuela today” once the necessary commercial and legal framework is in place.

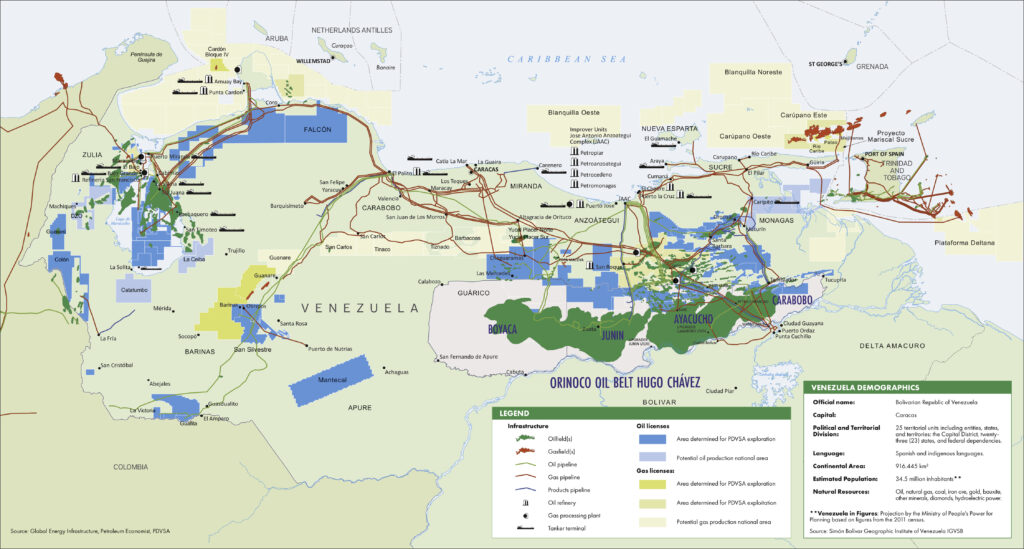

Map created in collaboration with Petroleum Economist and Global Energy Infrastructure. For an overview of this project and other related infrastructure developments, visit Global Energy Infrastructure. Copyright World Oil 2026. All rights reserved.