Cove Point Begins Construction, Freeport Secures Financing

Japanese/Asian Customers Lock Up Capacity of Both Projects

With three years of governmental review and permitting out of the way, Dominion (ticker: D) announced today it has begun construction activities on its Cove Point LNG Export project on the western shore of the Chesapeake Bay in Maryland. The estimated price tag to add export capability to the LNG import facility is $3.4 billion to $3.8 billion.

Dominion’s export facility is targeted to begin operations in late 2017, a year ahead of Cameron LNG’s export plant in Louisiana, which broke ground last week. The first LNG export plant to gain approval and begin construction was Cheniere’s (ticker: LNG) Sabine Pass plant, also in south Louisiana. Sabine Pass is targeting 2015 for first exports.

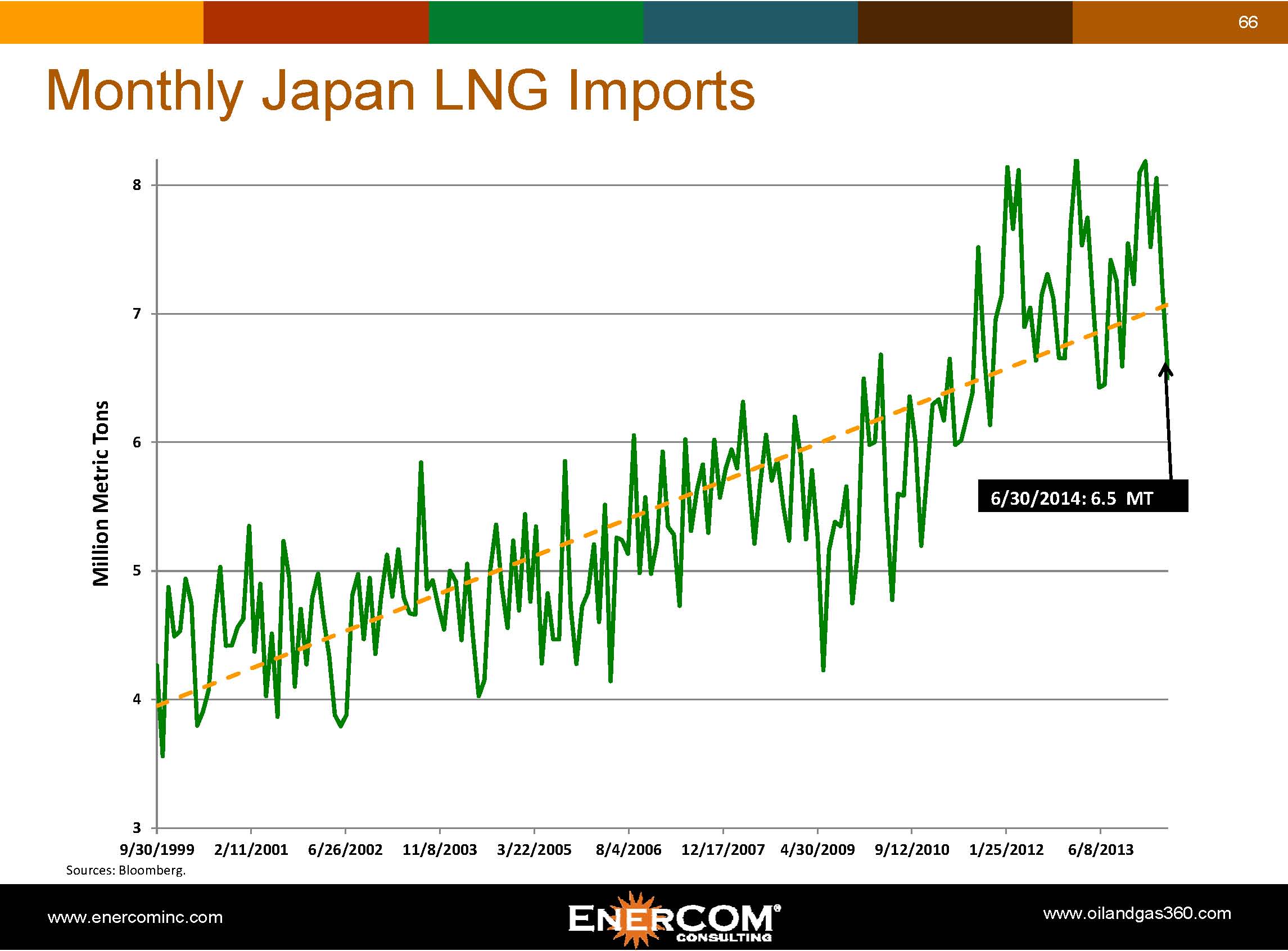

Dominion has fully subscribed the marketed capacity of the project with 20-year service agreements with ST Cove Point, LLC, a joint venture of Sumitomo Corporation and Tokyo Gas Co., Ltd., the largest natural gas utility in Japan; and GAIL Global (USA) LNG LLC, a wholly owned indirect U.S. subsidiary of GAIL (India) Limited. Bloomberg reports that Sumitomo and Tokyo Gas will buy 2.3 million metric tons of liquefied natural gas annually for 20 years from Cove Point.

IHI/Kiewit Cove Point, a joint venture between IHI E&C International Corporation of Houston and Kiewit Corporation of Omaha, Neb., is the engineering, procurement and construction contractor for the new liquefaction facilities. The proposed export project will be within the 131-acre footprint of the existing LNG import terminal site. No new pipelines or storage tanks are required for the facility.

Almost a decade ago Dominion announced it was doubling its LNG import capacity in a joint deal with Norway’s Statoil to bring much needed natural gas from Norway to the U.S. northeast corridor. In the past five years, U.S. shale gas production has reversed the import/export equation.

Freeport Secures Financing, Sees Exports Starting in 2018

Yesterday Freeport LNG entered into definitive agreements for the debt financing of approximately $3.85 billion of capital required for the development of Freeport LNG’s first train facility (Train One) at its proposed natural gas liquefaction and LNG loading facility on Quintana Island near Freeport, Texas.

The Train One debt financing is being provided by Japan Bank for International Cooperation (JBIC) and the following six commercial banks: The Bank of Tokyo-Mitsubishi UFJ, Ltd., Sumitomo Mitsui Banking Corporation, Mizuho Bank, Ltd., Sumitomo Mitsui Trust Bank, Limited, Mitsubishi UFJ Trust and Banking Corporation, and ING Bank N.V., Tokyo Branch. The portion of the loans financed by the commercial banks is insured by Nippon Export and Investment Insurance (NEXI). Pursuant to their previously announced agreement, Osaka Gas Co., Ltd. (Osaka Gas) and Chubu Electric Power Co., Inc. (Chubu Electric) are investing approximately $1.2 billion for the development of Train One, the company said in a press release.

“We are excited to announce our partnership with Japanese governmental institutions to support the financing needs of the Freeport LNG liquefaction facility and to become a key contributor to the long-term diversification and security of energy supplies to Japanese utilities,” said Michael S. Smith, Chief Executive Officer, Freeport LNG. “We look forward to commencing construction of the initial two trains of the liquefaction project in the coming weeks and beginning commercial exports in 2018.”

Freeport LNG’s Train One is anticipated to commence operations 45 months from start of construction, with the second and third trains in operation at approximately six month intervals thereafter. Each liquefaction train has a nameplate design capacity of 4.64 million tonnes per annum. Approximately 13.2 million tonnes per annum of the production capacity of the three liquefaction trains has been contracted under use-or-pay liquefaction tolling agreements with Osaka Gas, Chubu Electric, BP Energy Company, Toshiba Corp. and SK E&S LNG, LLC.

Freeport LNG has received conditional authorization from the DOE to export the entire contracted LNG production volume of the initial three trains of the liquefaction project, the company said in a statement.

Meantime, IEA Chief Tells Asian Energy Summit that U.S. LNG is Not the Answer

At the Singapore Energy Summit this week, IEA chief Maria van der Hoeven said, “There is one thing that Asia cannot count on–cheap, abundant gas unleashed by the [US] shale gas revolution.” Van der Hoeven said that LNG from the U.S. “will not be enough to supply the entire region, and it will be expensive,” Platts reported. Van der Hoeven characterized natural gas as a bridge to renewables.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.