The U.S. adds record amount of crude oil storage capacity; smaller than expected draw reported today

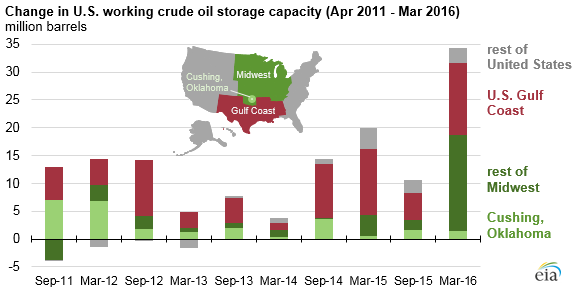

The glut of crude oil has prompted for some time now a fear that storage may not be able to keep pace with the speed of production in the United States. The EIA measures crude oil storage capacity twice each year, and reported today that 34 million barrels (6% of total crude oil storage capacity) was added from September 2015 to March 2016, the largest expansion of commercial crude oil storage since the agency began tracking storage capacity in 2011.

The largest commercial crude oil storage capacity expansions since September were in the Midwest and Gulf Coast regions, which added 19 million barrels and 13 million barrels, respectively. Combined, these regions account for 82% of total U.S. commercial crude oil storage capacity. Within the Midwest, storage capacity at Cushing, Oklahoma, the delivery point for the NYMEX WTI futures contract, expanded 1.5 million barrels.

Crude oil storage builds still outpacing expanding capacity

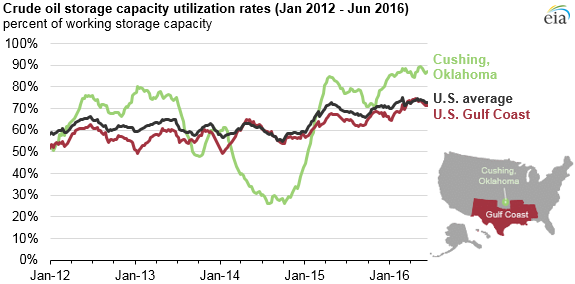

The record growth of crude oil storage capacity has help to accommodate the growing supply of oil in the U.S., but storage utilization continues to increase. The EIA reported crude oil inventories have increased by more than 71 million barrels (15% of working capacity) since the end of September, 2015, pushing crude oil storage capacity utilization to a near record high of 73% for the week ending June 10, 2016.

Storage utilization at Cushing, Oklahoma, averaged 87% over the past four weeks, compared with 81% for the same period last year. U.S. Gulf Coast region storage utilization rates averaged 72% over the past four weeks, after never being more than 70% in the previous four years.

Demand for crude oil storage has increased for most of the past two years as production continues to outpace global demand. Because of generally rising crude oil inventories since the end of 2014, the structure of crude oil futures prices has been in steep contango, where near-term deliveries are priced lower than long-term deliveries. The large and continued contango structure prompted many participants to place more crude oil in storage.

Oil prices down as inventories decrease less than expected

The weekly inventory data released today showed U.S. crude stockpiles fell by 900 MBO in the week ended June 17, 44% less than the average estimate. WTI crude oil was down 1.5% today following the news, keeping the U.S. benchmark below $50 per barrel.