President Elect’s Mexican Trade Policy Critical for Gas Exports

Donald Trump’s electoral victory has raised many questions concerning his policies on trade and energy. For the U.S. natural gas industry, trade relations with Mexico will prove critical to balancing out the market and providing the demand necessary for domestic production to grow.

Since 2010, Mexican natural gas production has been falling due to a lack of investment in new production. Demand has risen 20% in the same period as the country’s electricity and manufacturing sectors have moved to take advantage of cheap U.S. shale gas. In August of this year, gas exports to Mexico accounted for an all-time high of 6% of total U.S. gas production.

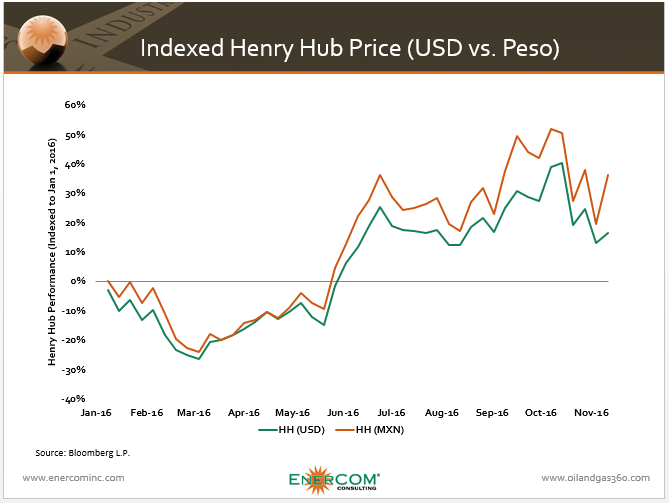

The amount Mexican utilities and companies can expect to pay for U.S. gas will have a significant effect on export demand. The peso has been on a wild ride throughout the election season, weakening against the dollar on news favorable to Trump and strengthening on news favorable to Democrats and Hillary Clinton.

As of today, the Henry Hub price in pesos has risen 36% over the beginning of the year while only increasing 17% in dollar terms. Some would argue this represents a 19% risk premium.

Mexico’s declining domestic production and strong shift to gas mean that domestic gas demand will not be completely inelastic, allowing some wiggle room for prices. At the same time, lower peso prices for U.S. gas will incentivize greater Mexican gas demand, providing a larger outlet for U.S. production.