Quick Take: 2017 Oilfield Service and Drilling Outlook from Bloomberg Intelligence

Bloomberg Intelligence (BI) analysts Andrew Cosgrove and William Foiles presented a briefing today on the outlook for U.S. oil services and drilling. Bottom line: U.S. shale developers will lead a rebound in oilfield service activity in 2017.

Oil Price and CapEx Outlook

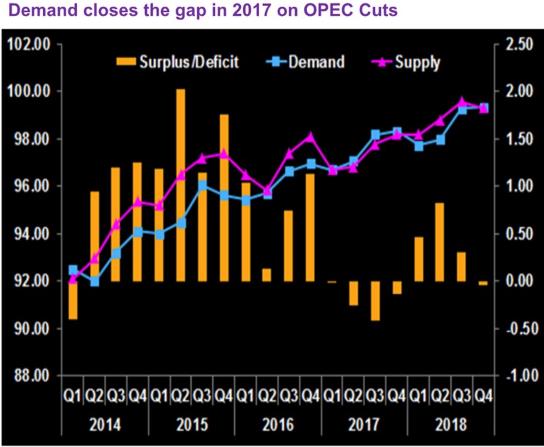

The Bloomberg analysts expect the global oil market to tighten throughout next year, with demand expected to catch up with supply and inventories being gradually drawn down. But higher OPEC and U.S. production could increase the risk of surplus in 2018.

Heading into 2017, U.S. E&P capital spending is expected to rebound while global capex is expected to remain flat, Bloomberg’s analysts said:

- Short-cycle U.S. shale output will drive as much as a 30% rebound in spending.

- The only international growth is expected in the Middle East and Russia.

- Offshore spending is anticipated to fall another 20-25%.

Shale Drillers: day rates have come off the bottom

Momentum in U.S. and Canadian rig counts is expected to roll over into next year as E&Ps reset their budgets higher:

- Day rates for high spec rigs “have come off the bottom.”

- Utilization of rigs is not expected to cause a rise of more than $2,000 to 3,000 per day.

- Reductions in drilling time are expected to cut into rig demand.

Pressure Pumpers/Well Services

Frac horsepower and pressure pumping demand is expected to tighten in 2017:

- Price traction may take time to gain momentum.

- Not everybody is asking for price increases now, some are still sacrificing price to keep market share as much as they can, so price increases will likely happen post-1Q.

- DUC drawdown in the Eagle Ford and Bakken will aid in horsepower demand.

Frac Sand Miners

The frac sand market is leveraged to higher oil prices and has been supported by higher sand intensity per well, with longer laterals, more use of proppant per stage, and higher stage counts:

- 2017 demand is expected to come in at 48 million tons due to a 30% increase in completions and 10-20% growth in intensity.

- 2018 demand is expected to reach 65 million tons.

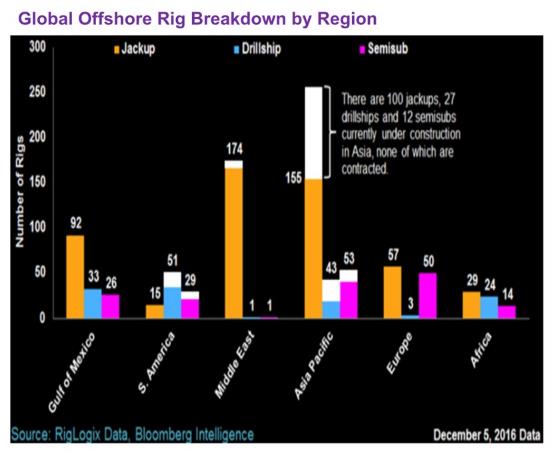

Offshore Drillers

The analyst’s presentation described the OPEC decision as “effectively throwing offshore companies a lifeline.” While the sector’s stock rallies in 4Q were primarily due to short-covering, clearing of debt runways was cited as removing some of the overhead pressure on fundamentals and potentially allowing the stocks to trade closer in line with oil.

“From a fundamental tendering standpoint, many drillers have said a pickup in shallower water activity needs oil to be above $50 for six months while Deepwater would need $60. With that being said, Brent’s 12-month contract has spent the last six months above $50 and this increases the possibility for follow-on, blend-&-extend, and option exercises where available,” the analysts said.

In short, offshore is not going away yet.

A Deep Dive into Service/E&P Efficiency Gains

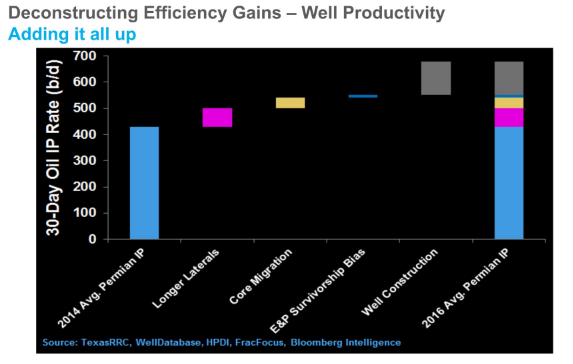

Analyst William Foiles discussed the results of a study on factors driving the increase in 30-day oil IP rates seen between 2014 and 2016. Some observers see recent enhancements in productivity as a temporary by-product:

- High Grading – As prices rise, E&Ps will return to drilling fringe acreage.

- Longer Laterals – They will eventually stop growing.

- E&P Survivor Bias – If oil prices rise, smaller, less efficient E&Ps will return, dragging down averages.

- Cost Concessions – Many advanced techniques currently used won’t be available when service costs rise.

The chart below breaks down the gains observed in the Permian Basin.

- 29% of uplift attributable to longer lateral lengths

- 16% of uplift attributable to high-grading

- 4% of uplift attributable to E&P survivorship bias

- 51% of uplift attributable to well construction techniques