Unit Corporation (ticker: UNT) is a diversified energy company with three business segments focused on upstream, midstream and drilling operations. The company celebrated its 50th Anniversary in 2013 and is projecting year-over-year growth of 9% to 10% in 2014, with 4% of the growth anticipated in the upcoming fourth quarter.

Q3’14 Financial Results

Unit reported net income of $67.5 million ($1.37 per diluted share) for the quarter ended September 30, 2014. The company has amassed $178.8 million ($3.65 per diluted share) for the first nine months of 2014 – 34% more than 2013. Its revenue breakup, in regards to its upstream, contract drilling and midstream divisions, is consistently in the range of approximately 47%, 30% and 23%, respectively.

The company has historically taken a conservative approach to growing its business and has, in turn, maintained a healthy balance sheet. Its debt to market capitalization ratio was 22% at the time of the release. The average E&P ratio of the 86 companies in EnerCom’s Weekly database was 50% for the week ended October 31, 2014. Its asset intensity, defined as the capital required to maintain current production rates, was slightly below its peers, even though UNT holds two additional business segments.

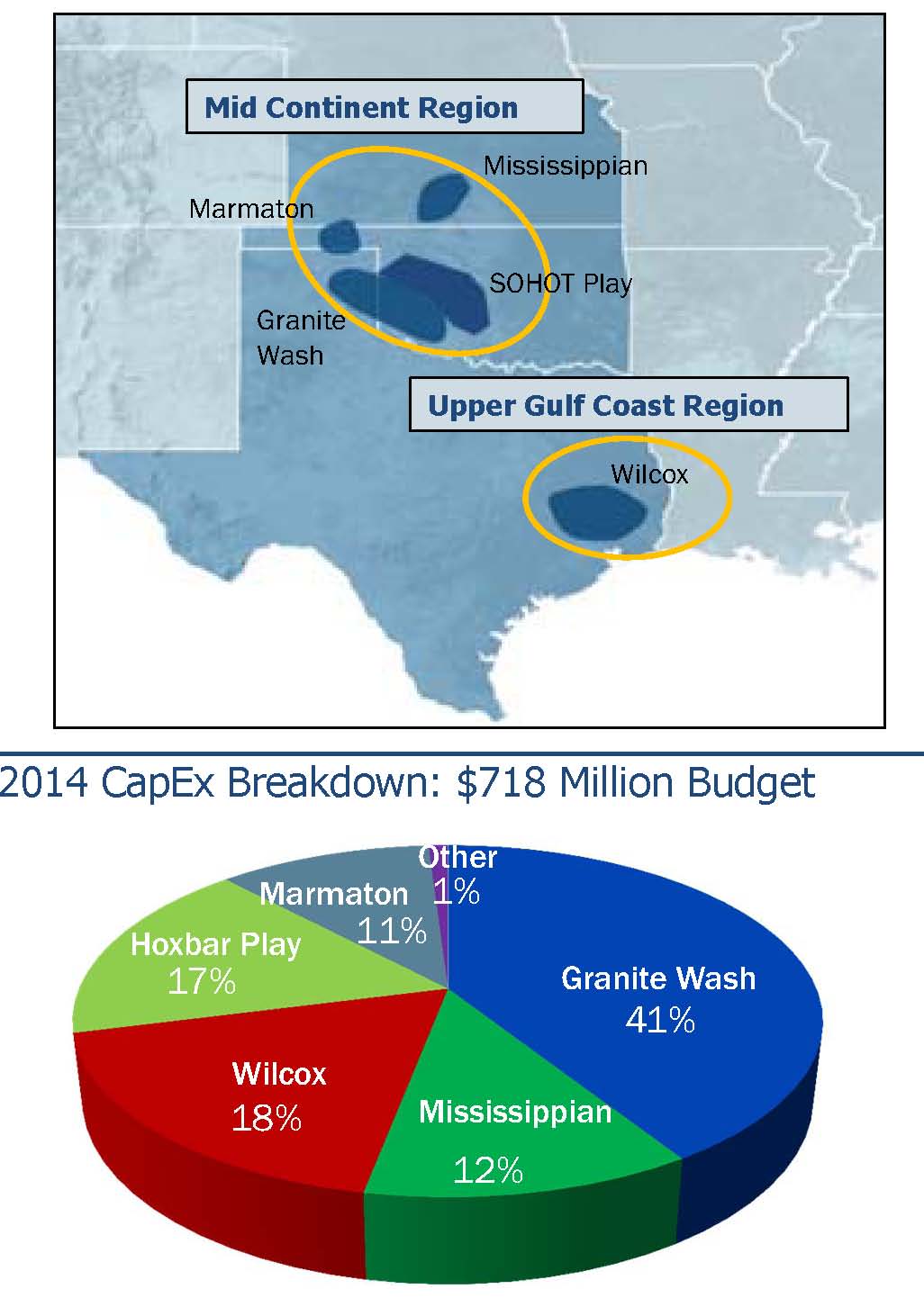

Source: UNT 10/14 Presentation

“Our conservative balance sheet and significant available capital will allow us to take advantage of opportunities as they arise,” said Larry Pinkston, President and Chief Executive Officer of Unit Corporation, in a conference call following the release. “We’re well positioned to deal with the current uncertainty in a very focused and deliberate fashion.

SOHOT Play Living Up to its Name

Unit first rolled out results from its newest core play, the Southern Oklahoma Hoxbar Oil Trend (SOHOT), in Q1’14. Its first well flowed at a 30-day rate of 1,100 BOEPD (90% oil).

Two new operated wells returned 30-day volumes of 1,581 BOEPD and 1,414 BOEPD, with one producing 1,151 BOEPD after 90 days. The volumes consist of 86% oil. Five new operated wells are scheduled to be hydraulically fractured in the upcoming quarter, with production impacts expected in Q1’15. The Marchand and Medrano formations, the primary targets for UNT, are two of as many as six stacked formations in the region.

The Marchand is consistently returning 85% to 90% oil, according to Brad Guidry, Executive Vice President of Exploration and Production. “We’ve seen that not only in our wells, but most of the non-op wells that we’ve participated in,” he said. The Medrano has more variation, ranging from dry gas to as much as 40% liquids.

Innovation in the E&P Segment

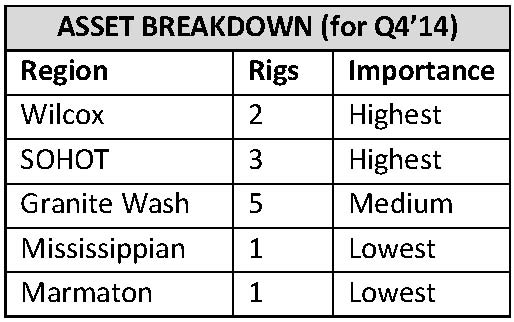

Overall production in the quarter were similar to Q2’14 volumes but represented a 9% increase compared to Q3’13. The company plans on reducing its rig count to 12 from 15 in Q4’14.

Guidry identified the SOHOT and Wilcox regions as Unit’s greatest regions of return and both are economic at prices of $75/barrel and $4 gas. A shallower test on the “Gilchrease” sand of the Wilcox returned a 30-day rate of 1,022 BOEPD with no stimulation. UNT believes the sand is accessible from all of its 13 wells in the region. The company also used an upsized frac design on two separate three-well pads in the Granite Wash field. The design, which involves 80% more sand for completions, is expected to yield returns from the first pad in December 2014.

Guidry identified the SOHOT and Wilcox regions as Unit’s greatest regions of return and both are economic at prices of $75/barrel and $4 gas. A shallower test on the “Gilchrease” sand of the Wilcox returned a 30-day rate of 1,022 BOEPD with no stimulation. UNT believes the sand is accessible from all of its 13 wells in the region. The company also used an upsized frac design on two separate three-well pads in the Granite Wash field. The design, which involves 80% more sand for completions, is expected to yield returns from the first pad in December 2014.

On the midstream side, management is completing an extension in the Marcellus and expects 2015 to involve capital outlay and further build out. The revenue impact from the Marcellus line is not expected to be seen until late 2015.

BOSS Rig Headlines Drilling Segment

Unit deployed its first BOSS rig this year, and the reception of the rig’s new design “has been very positive,” said Pinkston. The company expects to deliver nine BOSS rigs by the end of 2015 and has already secured contracts for three more.

Source: UNT 10/14 Presentation

Rig utilization increased to 79.1% in Q3’14, compared to 73.5% in Q2’14 and 63.5% in Q3’13. Almost all of the 82 contracted rigs are focused on oil/liquid projects. Pinkston acknowledged short-term prospects on the drilling front will be difficult due to market volatility but reminded investors that the company has established itself as a reliable drilling contractor in the Permian Basin.

Moving forward, management expects the BOSS rig to be the prototype for its fleet. “I don’t think there is any question that the future lies with the AC, BOSS type rigs and that’s the direction that we’ll continue to move,” said Guidry. He mentioned the deployment of the smaller 1,500 horsepower rigs still remain the largest part of the business for the time being, but the efficiency and convenience of the BOSS rigs will prove to be superior to the standard rigs.

Investor Day Preview

Unit Corp. is hosting an Investor Day on November 13, 2014 in New York City. We are curious of Unit’s capital expenditure estimates for both the remainder of 2014 and 2015. Its previous guidance was $718 million for the current year, despite a slight pullback on the E&P side. Its future arrangements for the drilling segment will be a interesting development considering the recent changes in the oil market.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.