Drilling Fluids Market Dips to $8 Billion in ’15, but Rise of WBF and Foam-based Muds are Coming on Strong thanks to Environmental Regulations

The global drilling fluids market size was valued at USD 7.98 billion in 2015, a slump from the previous year due to declining oil industry activity, San Francisco’s Grand View Research said in a new report. No surprises there.

One of the major factors that severely affects the global drilling fluids industry is their impact on the environment. Rising concern towards spill containment, boreholes and holding solid wastes is anticipated to increase product demand over the forecast period,

Drilling fluids are classified as oil-based (OBF), water-based (WBF) and synthetic fluids (SBF). The U.S. Environmental Protection Agency (EPA) has promulgated Effluent Limitations Guidelines and New Source Performance Standards for discharge procedure of used synthetic-based (SBFs) and other non-aqueous drilling fluids. These and other environmental regulations across the globe that aim to minimize environmental impact are anticipated to positively steer future demand, according to Grand View.

EPA limits the use of OBFs in offshore drilling owing to high level of aromatic content in them which poses a serious threat to marine organisms. Drilling fluids possess various potential environmental hazards during usage and disposal which directly affects flora and fauna and indirectly affects humans. OBFs contain diesel oil and mineral oil which when used and disposed of into the environment cause hazards to both land and sea animals.

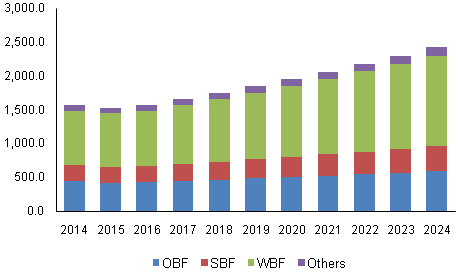

Chart: U.S. drilling fluids market revenue by product, 2014 – 2024 (USD Million)

Product Insights

WBF dominated the global demand and accounted for over 45% of total revenue in 2015. WBF is also expected to emerge as the fastest growing product category over the forecast period. The segment is estimated to grow at a CAGR of 6.1% from 2016 to 2024. Stringent regulatory scenario to minimize the use of OBF is anticipated to remain a key driving factor for the growth of WBF over the forecast period.

Non-aqueous fluids or foam-based muds are anticipated to gain prominence in the global drilling industry, particularly in unconventional reserves.

Application Insights

Onshore oil & gas emerged as the largest application segment accounting for 64.3% of total market revenue share in 2015. Harsh environments such as extreme temperatures, desert topography, and dry environment necessitate the requirement of drilling fluids as a lubricating and cooling agent for drilling equipment.

Offshore oil & gas is anticipated to emerge as the fastest growing application market for drilling fluids with an estimated CAGR of 6.3% from 2016 to 2024. Ongoing investment in existing offshore wells both in deep and ultra-deep waters particularly in the Gulf of Mexico (GoM), North Sea, Persian Gulf and the South China Sea is anticipated to drive product demand in the offshore sector over the next eight years, Grand View reports.

Regional Insights

North America drilling fluids market led the global industry with net revenue expected to exceed US$3.0 billion by 2024. Increasing oil and natural gas production in the region coupled with significant oilfield development especially in the U.S., and Canada tight oil reserves, may be attributed to high drilling fluids industry penetration. Shale boom in Canada and the U.S. is anticipated to play a vital role in driving the drilling fluids demand over the next few years.

Owing to ongoing revisions in legislative norms to exploit hydrocarbon reserves sustainably by providing financial aid tax benefits particularly in India and China, Asia Pacific is expected to witness the fastest growth at an estimated CAGR of 6.9% from 2016 to 2024. In addition, favorable government initiatives such as 100 % FDI in the hydrocarbon sector in India are anticipated further to aid the development of oil & gas industry in the region.

Competitive Insights

The global drilling fluids market is dominated by top drilling companies. Major companies operating in the global drilling fluids industry include Newpark Resources, Halliburton, Schlumberger, Weatherford, Baker Hughes, TETRA Technologies, National Oilwell Varco that offer a diverse product portfolio to cater to the product demand in onshore and offshore oil & gas industries. Some of the other companies operating in the industry include Anchor Drilling, Canadian Energy Services, Flotek Industries, ScomiGroup Bhd, Catalyst LLC, and China Oilfield Services Ltd.