Vermilion Energy Inc. (ticker: VET) with headquarters in Calgary, Alberta, is focused on the acquisition, exploration, development and optimization of producing properties in North America, Europe and Australia.

North America

Vermilion owns 90,000 net acres in the West Pembina Cardium resource play. Vermilion controls infrastructure in the region including a 15,000 bbl per day oil battery, as well as two owned and operated gas plants. From 2010 to 2016 Vermilion has drilled more than 200 wells in the Cardium play.

Vermilion is currently developing its assets in the Mannville condensate-rich gas and the Duvernay liquids-rich gas plays. Vermilion holds 220,000 net acres of Mannville rights and 115,000 net acres the Duvernay play.

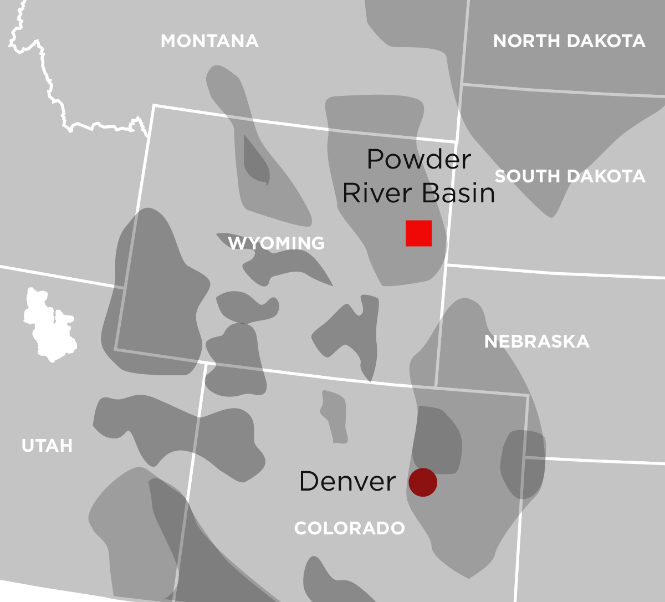

In 2014, Vermilion acquired 53,000 net acres of land in the Turner Sand play in the Powder River Basin in Wyoming. After acquiring more land in the play, Vermilion currently holds over 81,500 net acres in the area.

Europe

In France, Vermilion has an OOIP of the five largest fields combined to be greater than 1.7 billion barrels. From 2013 to 2016, Vermilion has drilled 18 wells in the region with 100% success rate.

In Netherlands, Vermilion holds approximately 800,000 net acres of underdeveloped land. Since 2009, 14 high-rate extension and discovery gas wells have been drilled by the company in the Netherlands, with an average success rate at 67%.

Vermilion also has operations in Germany, Ireland, Croatia, Hungary and Slovakia.

Australia

In 2007, Vermilion acquired the remaining 40% interest in the Wandoo field, providing them with 100% interest in the field. Vermilion drills extremely long-reach lateral wells (3000+ meter laterals) while striving to reach its goal of 6,000 bbl/d from the field.

Q3 2017 Highlights

- Average production of 67,403 boe/d during Q3 2017 was up slightly compared to the prior quarter.

- Fund flows from operations (“FFO”) for Q3 2017 was $131 million, a decrease of 11% from the previous quarter.

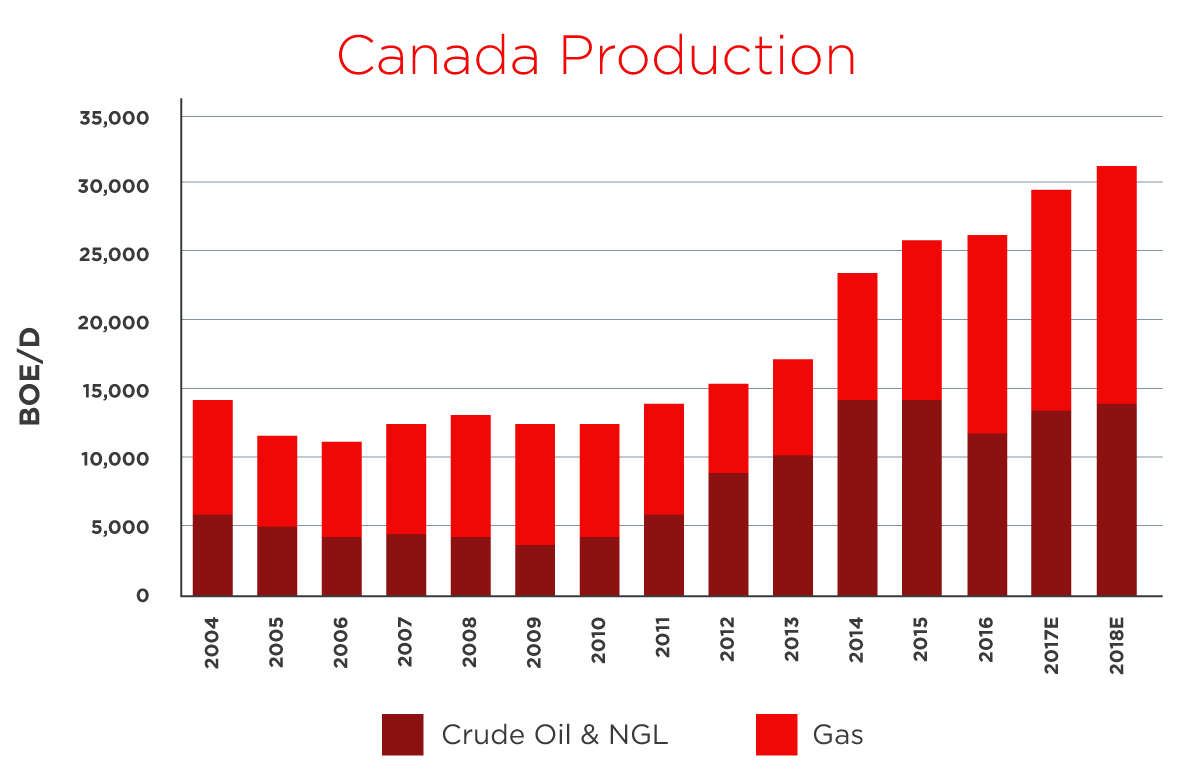

- In Canada, Vermilion drilled 15 (12.8 net) wells and placed 12 (10.4 net) wells on production during the quarter, resulting in quarterly production growth of 10% for the Canadian business unit.

- Vermilion completed its two (1.0 net) well drilling campaign in the Netherlands during the quarter with the drilling of Eesveen-02 (60% working interest) and Nieuwehorne-02 (42% working interest). The Eesveen-02 well tested at a rate in excess of 18 mmcf/d net and is expected to be brought on production in mid-2018. The Nieuwehorne-02 well encountered 10 metres of gas pay and is currently being prepared for a flow test.

- In the US, production continued to grow following the three (3.0 net) well program in the first half of the year. Production exceeded 1,000 boe/d in Q3 2017, representing a 16% increase compared to the previous quarter.

- In Ireland, production from Corrib averaged 49 mmcf/d (8,173 boe/d) in Q3 2017, a 23% reduction from Q2 2017 due to extended downtime following a plant turnaround. Turnaround tasks were completed successfully, but after restarting the plant, unodorized gas was detected in the distribution network resulting in an extended period of downtime. Production at Corrib resumed on October 11th after 21 days of downtime in Q3 and just over 10 days of downtime in Q4. The annualized impact from this downtime, net to Vermilion, is estimated at approximately 900 boe/d.

- Vermilion’s Board of Directors have formally approved an Exploration and Development (“E&D”) capital budget of $315 million for 2018, with associated production guidance of 74,500 to 76,500 boe/d.

EnerCom Dallas Conference

Vermilion Energy Inc. will present at the EnerCom Dallas oil and gas investment conference February 21-22, 2018 at the Tower Club in downtown Dallas. The conference is focused on bringing together publicly traded E&Ps and oilfield service companies with institutional investors.

Buyside professionals and oil and gas company executives may register for the event through the conference website.