Weatherford International plc (ticker: WFT) reported a net loss of $245 million, or a loss of $(0.25) per share for the first quarter of 2018.

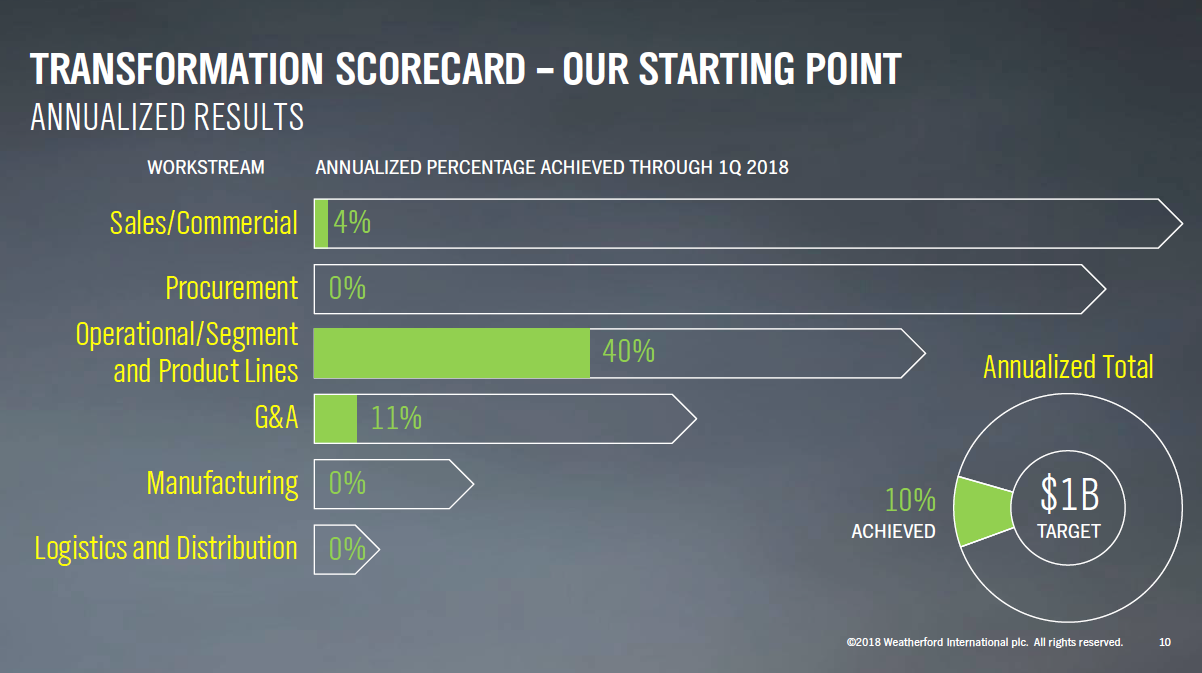

Weatherford President and CEO Mark A. McCollum said, “The goals we have set forth for 2018 and 2019 are realistic and achievable. We are on track and, in the first quarter, have already achieved 10% of our annualized recurring benefit target.”

In the first quarter of 2018, estimated recurring benefits as a result of Weatherford’s transformation plan were $27 million, or $108 million on an annualized basis. The company also registered $41 million in one-time benefits, mostly driven by the sale of surplus or non-strategic assets, along with an improved collections process.

Revenue in the first quarter of 2018 was $1.42 billion, which decreased 4% from revenue of $1.49 billion for the fourth quarter of 2017 and was 3% higher than the $1.39 billion of revenue reported for the first quarter of 2017.

- Operating loss for the first quarter of 2018 was $39 million

- Recorded pre-tax charges of $57 million for the first quarter of 2018

- The first quarter of 2018 tax provision was $32 million, including tax expenses related to profits in certain jurisdictions

- Net cash used in operating activities was $185 million for the first quarter of 2018

- First quarter capital expenditures of $38 million

Both hemispheres

In the western hemisphere, Weatherford recorded first quarter revenues of $756 million, this is down $3 million or 0.4% sequentially. The sequential decrease was primarily in the U.S. due to non-repeating year-end product sales of pumping units and the completion of the pressure pumping and pump-down perforating assets sale in the prior quarter.

The western hemisphere had first quarter segment operating income of $24 million, which was up $59 million sequentially and up $54 million year-over-year. Year-over-year results increased primarily in the U.S. as result of revenue growth in production and well construction, Weatherford said, and a decline in operating costs and lower depreciation.

In the eastern hemisphere, the company posted first quarter revenues of $667 million, this is down $64 million or 9% sequentially. According to Weatherford, the sequential decrease was primarily due to non-repeating product sales as well as seasonally lower activity in the North Sea and Russia.

First quarter segment operating income for the eastern hemisphere was $16 million, which was up $64 million sequentially. The sequential increase was primarily due to a favorable revenue mix, the timing of revenue and cost recognition related to deliveries in Kuwait, non-repeating start-up costs in Asia and an overall lower cost structure.

Q&A Q1 conference call excerpts

Q: On the annualized cost savings that you mentioned, $108 million annualized so far, is there any rough run rates we can think about towards the end of 2018? And then with that, on the sales and commercial, is it fair to think that is revenue versus cost?

CFO and EVP Christoph Bausch: We expect Q2 to ramp up between 50% to 75%, and then for the rest of the year, we build momentum going forward. And I think we also said before that, for the year, we expect a total number of about $200 million to $300 million of recurring savings in our results.

President and CEO Mark A. McCollum: Realized savings.

Bausch: Realized recurring savings in our results. So that will lead you towards the end of the year to a run rate which will be around the $500 million mark.

Now to the second part of the question which is where does it come from, in detail, so it progressed forward. I think you’ve seen the first quarter numbers. In the second quarter numbers we will see an acceleration in the sales and commercial work stream.

We’ll also see an acceleration in the procurement or external spend work stream, and we also see some impacts on the G&A side. We have a detailed plan either by month, by quarter, and so on.

Q: So we’ve been talking about asset sales for a better part of a year now at this point. Can you start to lay out a timeline for us both on the land rigs and the two other divestitures? Because I think, at this point, it’s time to get something done.

McCollum: I’m not happy about not getting things done. We got the pressure pumping deal done, which was part of what was to come. So that has been accomplished.

On the two others that we launched this quarter, we had said that there was a basket of possibly four different transactions that we were going to pursue over the course of 2018. And our commitment is still to try to get those done during the course of the year, but I’m not going to commit to a timeline inside of that.

On the rig deal, look, I’ve used terms like imminent. It’s one of those things where it’s frustrating, because you’re working a to-do list in negotiation and communications and things like that. It’s not a long list, but it’s a formidable list, and so we’re just going to continue to work it. I sit here and look at it and go, it’s soon, it’s going to be soon, but I’m not going to give you a specific day.