Delaware more gassy than first thought: Producers Midstream’s new gas processing capacity, targeting operations in Q1 2018, will be able to process up to 260 MMcf/day of production

Privately held Producers Midstream, LP (PMLP) announced plans to install a new natural gas gathering system and up to 260 MMcf/day of cryogenic processing capacity in the Western Delaware basin through the formation of Culberson Midstream LLC.

Anchored by 40,000 net dedicated acres, 1000-square mile AMI

The new system is anchored by more than 40,000 net dedicated acres and a 1,000-square mile area of mutual interest from Charger Shale Oil Company.

The development of new natural gas gathering and processing capacity is welcome news for operators in the Delaware where production has been increasingly rapidly. With some of the most economic wells in the country, producers flocked to the basin throughout the downturn to realize the best possible returns on their CapEx dollars. The flood of capital on the E&P side of the equation has translated into a similar need for increased midstream buildout.

PMLP will construct and operate the midstream system consisting of more than 70 miles of pipeline, up to 40,000 horsepower of compression, and a new cryogenic natural gas processing complex with up to 260 million cubic feet per day of capacity.

The project is being designed to meet the needs of the rapidly developing Delaware Basin. The project will serve producers developing the Wolfcamp, Bone Spring, and Avalon formations in the basin.

“This greenfield development will allow Charger and other operators in the area to take advantage of a best-in-class gathering and processing system designed specifically to meet the needs of the rapidly expanding Delaware basin,” said Producers Midstream CEO Jim Bryant.

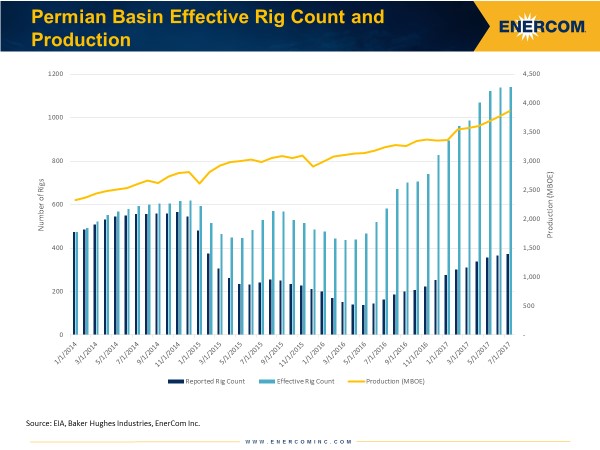

Looking at EnerCom’s Effective Rig Count, which benchmarks production per rig to January 2014 levels, the levels of increased activity are clear. Production has steadily climbed even after the drop in oil prices as individual rigs continue to produce more and more BOEs.

“We take comfort that our teams can remain focused on drilling great wells and proving up multiple production benches knowing we have an economic takeaway solution in place,” Charger Shale Oil Company CEO Joseph Magoto said about the new system.

EnerCom analysis

In EnerCom’s September Energy Industry Data and Trends Report, EnerCom analysts found that, even in the Delaware, full-cycle margins can be thin for E&P companies. Looking at public companies’ cash margins based on half-cycle costs (without finding and development costs) they averaged a 63% cash margin per BOE, but once finding and development was considered, the average fell to 17% with some companies not returning any margin at all.

Metrics improved when using future development costs versus a backward-looking F&D cost, but even in the Delaware E&P companies are looking for new methods and avenues to ensure that every barrel they produce is cost-effective.

More natural gas than originally anticipated

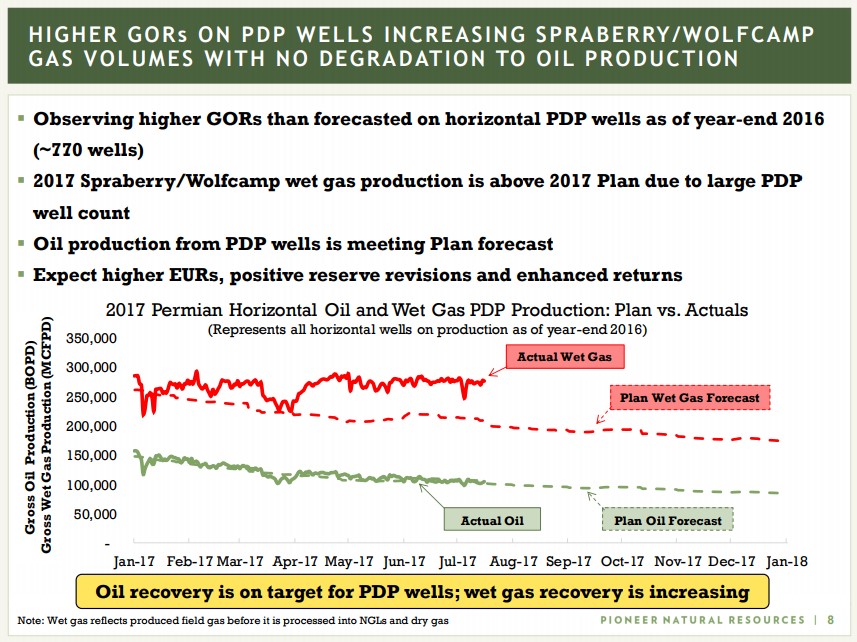

Producers Midstream’s new system will be a boon for the basin especially as operators are finding the play to be gassier than originally anticipated. During Pioneer Natural Resources’ (ticker: PXD) second quarter conference call, the company announced natural gas production from its Permian wells exceeded the company’s expected type curves.

This announcement, along with news that PXD would have to defer some wells, hit the company’s stock price hard, with shares closing 17% lower following the conference call.

EnerCom analysts view the increased natural gas production as a positive since it will ultimately lead to higher EURs if oil production declines at the pace the producer anticipates. The drop in stock price was likely due more to the fact that investors are concerned E&Ps may not understand the basin as well as originally thought, EnerCom said in its report.

New natural gas processing systems such as the one being constructed by Producers Midstream will help to take away the increasing natural gas production coming out of the country’s hottest basin to markets where operators can realize more competitive pricing.

“Culberson Midstream will be able to tap into newer, more competitively-priced markets and avoid capacity constraints which have hindered some legacy systems in the area,” Producers said in its press release. “The system will have capacity to expand as development continues from Charger and other nearby operators.”

PMLP expects the system will be operational in the first quarter of 2018.