2018 EnerCom conference presenting companies are responsible for 3.2 MMBOEPD of production, $251 billion enterprise value

In just one month, for the 23rd consecutive year, analysts, investors and industry professionals will descend on Denver for EnerCom’s 2018 installment of The Oil & Gas Conference®.

At the EnerCom conference, oil and gas company senior leadership teams will present their company’s strategies, update operations and deliver company financial metrics to institutional investors, analysts and portfolio managers, broker/dealers, wealth managers, family offices and high net worth investors during the four-day financial conference.

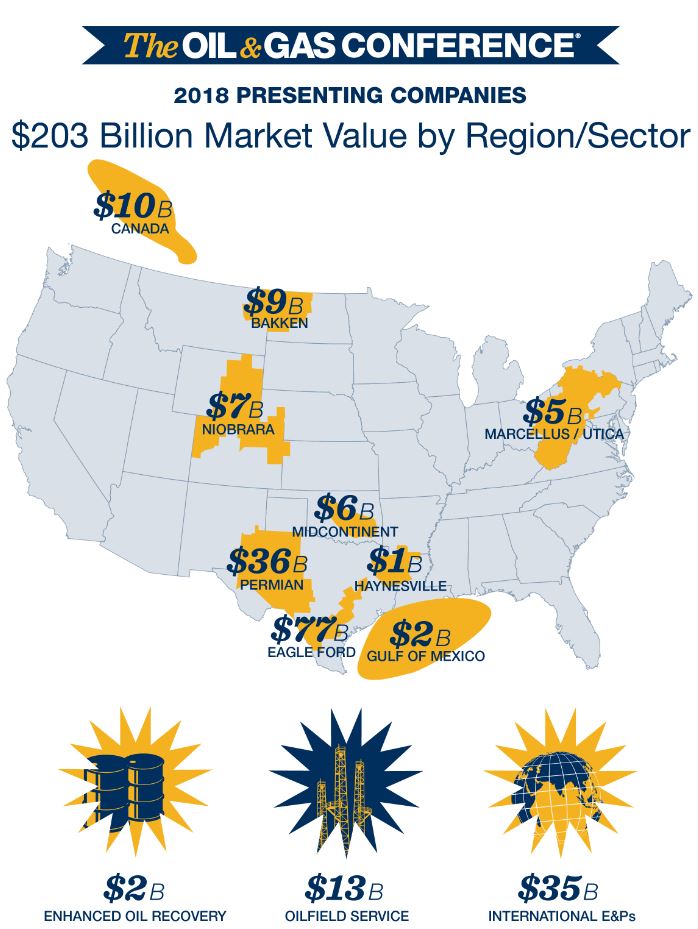

The roster of public oil and gas producing companies, along with global oilfield service, technology and data providers represents a hefty slice of energy capital at work. Here’s how the lineup breaks out for 2018:

- 40 North American shale E&Ps

- 7 international E&Ps

- 10 other producers

- 9 oilfield service providers

- 9 private E&Ps, midstream and data providers

- $203 billion in market value

- 3.2 million barrels of oil equivalent production per day

- $251 billion in enterprise value

The annual Denver-based event started as a modest one-day affair in August of 1996, with eight company presenters and 86 people in attendance. Twenty-three years later, the EnerCom conference has grown to become the largest independent, pure oil-and-gas-focused investment conference in the region.

Included below are schedules and presentation format, along with the operational locations and industry segments for every company scheduled to present at this year’s EnerCom conference.

What you need to know:

- Early check-in for the conference will begin on Sunday, August 19, 2018, at 4:30 p.m. Mountain Time. Attendees should pre-register at the conference website now.

- Company presentations will begin on Monday, August 20, at 7:30 a.m.

- The event will run from approximately 7:30 a.m. to 5:30 p.m. Monday through Wednesday.

- On Thursday, August 23, the conference concludes at approximately 3:00 p.m., following a private E&P company panel discussion.

Registration and Website Links:

- Register at EnerCom’s The Oil & Gas Conference 23® home page.

- Access a full list of the presenting company webcasts.

- Update yourself with ‘work-in-progress’ company presentation schedule.

Format:

- 25-minute company presentations, webcast live on The Oil & Gas Conference 23® website

- Individual Breakout Sessions for Q&A will immediately follow each presentation

- Buyside investors and research analysts may schedule one-on-one meetings with presenting companies by contacting EnerCom prior to the conference, via the conference website registration page login or telephone: (303) 296-8834, EXT. 235

Lunch Presenters (12:30 p.m. Mon., Tue., Wed.)

- EOG Resources (ticker: EOG) – operations throughout the U.S., with focus on Eagle Ford and Permian basins. Luncheon Keynote Monday – August 20

- Mason Hamilton, Petroleum Markets Analyst – U.S. Energy Information Administration – Luncheon Keynote Tuesday – August 21

- TBD – Luncheon Keynote Wednesday – August 22

THE ENERCOM 2018 PRESENTING COMPANIES – WHO THEY ARE, WHERE THEY OPERATE

Bakken/Three Forks

- Enerplus Corp. (NYSE: ERF): E&P operating in the Bakken/Three Forks, Marcellus and Western Canada.

- Northern Oil & Gas (NYSE: NOG): Non-operator targeting the Bakken/Three Forks.

- Whiting Petroleum (NYSE: WLL): Bakken-focused operator with additional northeast Colorado assets.

Eagle Ford

- EOG Resources (NYSE: EOG): Large independent E&P producing the Delaware, Woodford, Eagle Ford, and Rocky Mountains – Q1 Revenues of $3.7 Billion; production of 660 MBOEPD

- Lonestar Resources (NASDAQ: LONE): Eagle Ford E&P with acreage throughout the play.

- SilverBow Resources (NYSE: SBOW): Gas-focused producer targeting southern Eagle Ford.

- Sundance Energy Australia (NASDAQ: SNDE): Pure-play Eagle Ford producer.

- WildHorse Resource Development (NYSE: WRD): Northern Eagle Ford operator with basin’s second-largest acreage holdings.

Permian Basin

- Centennial Resource Development (NASDAQ: CDEV): Pure play Delaware Basin E&P company.

- Encana (NYSE: ECA): Diversified E&P company with operations in the Permian, Montney, Eagle Ford, Duvernay and San Juan Basin.

- Earthstone Energy (NYSE: ESTE): E&P company with operations in the Midland and Eagle Ford.

- Jagged Peak (NYSE: JAG): Pure play Delaware Basin operator.

- Legacy Reserves (NASDAQ: LGCY): MLP with assets in the Permian, East Texas, Rocky Mountains and Mid-Continent.

- Lilis Energy (NYSE: LLEX): Pure play Delaware Basin operator.

- QEP Resources (NYSE: QEP): Midland Basin player with additional acreage in Williston, Uinta and Haynesville.

- Rosehill Resources (NASDAQ: ROSE): Pure play Delaware Basin operator.

- SM Energy (NYSE: SM): Midland Basin producer with additional Eagle Ford operations.

- WPX Energy (NYSE: WPX): Delaware basin E&P company with additional extensive production from Williston.

Woodford & Other Mid-Continent – SCOOP/STACK

- Alta Mesa Resources (NASDAQ: AMR): E&P with operations in STACK portion of Anadarko Basin.

- BNK Petroleum (TSE: BKX): E&P with operations in Tishomingo Field of SCOOP portion of Ardmore Basin.

- Chaparral Energy (OTCMKTS: CHPE): Pure play STACK E&P company.

- Midstates Petroleum (NYSE: MPO): E&P producing from Mississippi Lime in Oklahoma.

- Panhandle Oil & Gas (NYSE: PHX): Leaseholder with interests in SCOOP/STACK, Oklahoma Woodford, Fayetteville and Eagle Ford.

- Unit Corp (NYSE: UNT): Vertically integrated energy company with drilling, producing and midstream businesses. Production in Mid Continent and Upper Gulf Coast.

Marcellus/Utica

- Cabot Oil & Gas (NYSE: COG): Pure play Marcellus E&P company.

- Eclipse Resources (NYSE: ECR): Appalachia-focused E&P company with assets in eastern Ohio.

- Range Resources (NYSE: RRC): Pennsylvania Marcellus producer with additional North Louisiana acreage.

Niobrara

- Bonanza Creek Energy (NYSE: BCEI): Wattenberg field, Mid-Continent producer focused on growth.

- HighPoint Resources (NYSE: HPR): Rocky Mountains-focused E&P with operations in the Wattenberg and Hereford fields.

- PDC Energy (NASDAQ: PDCE): Liquids-focused E&P in the DJ/Niobrara and Delaware basins.

- PetroShare (OTCMKTS: PRHR): Wattenberg producer active in southern portion of field.

Gulf of Mexico/Offshore

- Energy XXI (NASDAQ: EGC): E&P company in shallow Gulf of Mexico.

- GulfSlope Energy (OTCMKTS: GSPE): Louisiana offshore Gulf company, partnered with Delek for drilling new wells.

- Talos Energy (NYSE: TALO): E&P operator with focus on Louisiana Gulf of Mexico, additional properties in U.S. and Mexican GOM.

Haynesville

- Goodrich Petroleum (NYSE:GDP): E&P company with operations in the Haynesville and Tuscaloosa Marine Shale.

Pinedale – Jonah Field – Uinta Basin

- Ultra Petroleum (NASDAQ: UPL): E&P focused on Pinedale and Jonah fields, also developing Uinta basin.

Enhanced Oil Recovery

- Denbury Resources (ticker: DNR): CO2 EOR production with activity in the Gulf Coast and Rocky Mountains.

- Elk Petroleum (ticker: ELK): CO2 EOR company with operations in Wyoming and Utah.

- Evolution Petroleum (ticker: EPM): CO2 EOR production company. Pays a dividend.

- Mid-Con Energy Partners (ticker: MCEP): CO2 EOR company with production in the Permian and Mid-Continent.

Canadian E&Ps

- Advantage Oil & Gas (ticker: AAV): E&P focused on Montney formation in Alberta.

- Blackbird Energy (ticker: BBI): E&P focused on Pipestone Corridor of Montney formation in Alberta.

- Bellatrix Exploration (ticker: BXE): E&P focused on the Western Sedimentary Basin in Alberta, Canada.

- Gear Energy (ticker: GXE): E&P operating heavy oil projects in Saskatchewan and light oil in Alberta.

- NuVista Energy (ticker: NVA): Alberta-based operator focused on Wapiti Montney play.

- Painted Pony Energy (ticker: PPY): E&P producing natural gas from British Columbia Montney.

- Razor Energy (ticker: RZE): Alberta oil producer targeting Swan Hills and Kaybob Montney.

- Strategic Oil & Gas (ticker: SOG): Light oil producer in Alberta and Northwest Territories.

- Tamarack Valley Energy (ticker: TVE): Light oil producing E&P developing Cardium, Viking and Penny Barons plays.

- Vermilion Energy (ticker: VET): E&P with extensive international diversification. Operations in Mannville, Cardium, Powder River Basin, offshore Australia and throughout Europe.

International E&Ps

- Alvopetro Energy (ticker: ALV): Gas-weighted E&P with operations in Brazil.

- Canacol Energy (ticker: CNE): Exploration portfolio encompassing 5 basins in Colombia and Ecuador.

- GeoPark Energy (ticker: GPRK): International E&P with projects in Colombia, Argentina, Brazil, Chile and Peru.

- Gran Tierra Energy (ticker: GTE): Oil-weighted E&P company with assets in Columbia.

- Jadestone Energy (ticker: JSE): E&P company with assets in Australia, Indonesia, Vietnam and Philippines.

- PetroTal (ticker: TAL): Canadian E&P company with assets in Peru.

- Valeura Energy (ticker: VLE): Canada-based company developing gas in Turkey.

Oilfield Service Companies

- CES Energy Solutions (ticker: CEU): Provider of chemical solutions in drilling, production and specialty applications.

- Core Laboratories (ticker: CLB): Reservoir technology and optimization company.

- Flotek Industries (ticker: FTK): Chemical solutions provider with additional reservoir characterization and engineering services.

- Independence Contract Drilling (ticker: ICD): Drilling company focused on unconventional drilling.

- Key Energy Services (ticker: KEG): Well service provider with rigs, coiled tubing, fishing and fluid management.

- Liberty Oilfield Services (ticker: LBRT): Pressure pumping service provider.

- Nabors Industries (ticker: NBR): Drilling company offering rigs, services, software and equipment.

- Superior Drilling Products (ticker: SDPI): Drilling tool provider.

- STEP Energy Services (ticker: STEP): Fracturing and coiled tubing provider, with operations in Texas, Oklahoma, Louisiana, Alberta and British Columbia.

Mineral, Royalty, Infrastructure Holders

- Black Stone Minerals (ticker: BSM): Holds 20 million gross acres throughout the U.S., with holdings in every major basin.

- CorEnergy Infrastructure Trust (ticker: CORR): REIT owning energy infrastructure assets.

Private Companies – E&Ps, Midstream, Energy Data and Technology Providers

- Ameredev II

- BetaZi

- BTU Analytics

- Canyon Creek Energy

- Felix Energy

- Goodnight Midstream

- GuildOne

- RS Energy

- Samson Resources II

Who Attends the Conference: More than 2,000 institutional, private equity and hedge fund investors, energy research analysts, retail brokers, trust officers, high net worth investors, investment bankers and energy industry professionals gather in Denver for the conference.

One-on-One Meetings: EnerCom works in advance with presenting company management teams to arrange one-on-one meetings with the attending institutional investors and research analysts at the conference venue. In 2017, EnerCom managed more than 2,100 one-on-one meeting requests. Buyside investors may request meetings on the conference website or contact EnerCom for more information at 303-296-8834.

How to Register: Investment professionals and oil and gas companies can register for the event through the conference website.

EnerCom History and Sponsors: EnerCom, Inc. founded The Oil & Gas Conference® in 1996. It is the oldest and largest energy investment conference in Denver.

Global sponsors of EnerCom’s conferences are Netherland, Sewell & Associates; RS Energy Group; Moss Adams; and Preng & Associates. Sponsors of The Oil & Gas Conference® 23 are Bank of America Merrill Lynch; AssuredPartners; DNB Bank ASA; Fifth Third Bank; CIBC; Haynes and Boone; Credit Agricole CIB; Natixis; PJ SOLOMON; PNC Financial Services Group; Wells Fargo; MUFG; SMBC; and Opportune LLP.