Whiting presents at EnerCom’s The Oil & Gas Conference®

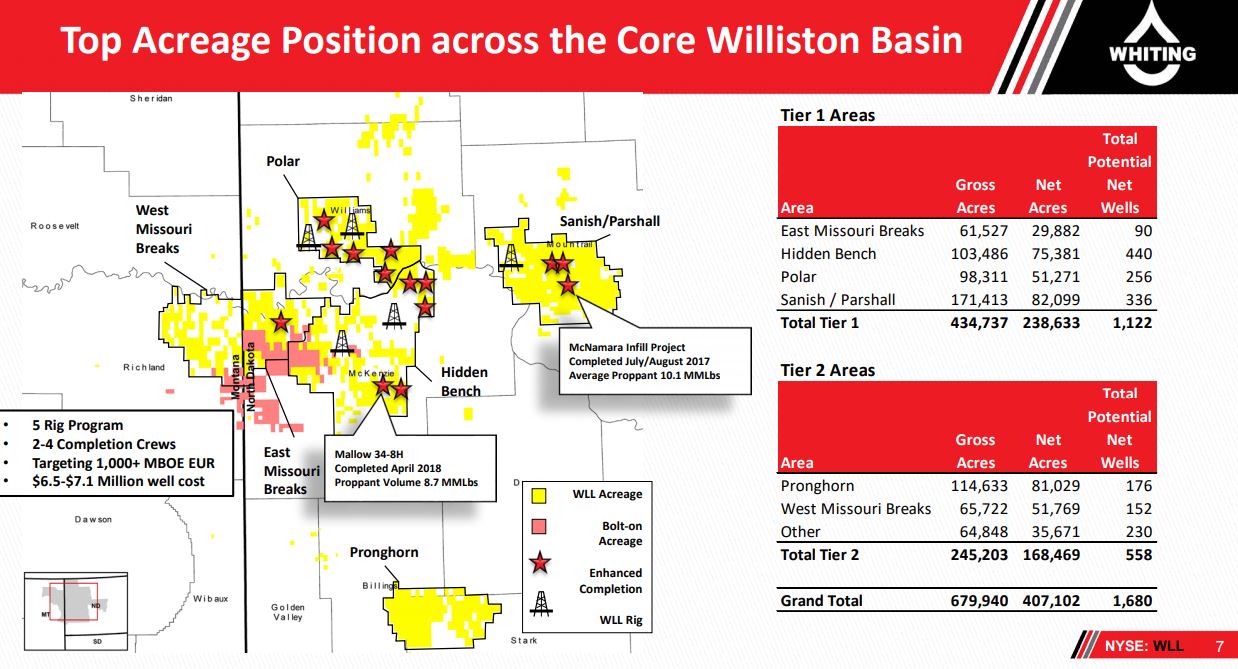

Denver-based Whiting Petroleum Corporation (ticker: WLL) is an independent exploration and production company with an oil focused asset base and a strong production focus in North Dakota’s Bakken/Three Forks formations. Whiting is a top crude oil producer in North Dakota and operates substantial assets in northern Colorado.

Q2 highlights

- Average production of 126,180 BOEPD

- Net cash from operating activities of $310 million exceeded CapEx by $107 million

- Diluted EPS of $0.02 and adjusted EPS of $0.62

- Lease Operating Expense per BOE below Low End of Guidance

- Bolt-On Acquisition Adds 55,000 Net Acres and 1,300 BOE/d for $130 Million

Breakout session at the EnerCom conference

During Whiting’s breakout session at the 2018 EnerCom conference, management was asked the following questions:

- How is the marketing team building up progress, how will this influence the sale price and revenue?

- Could you talk about hedging strategy on oil price, given the company’s capital leverage level?

- Can you talk about completions strategies?

- Could you talk about how you manage an unconventional reservoir?

- How will the pressure to generate free cash influence the company’s capital expenditures?

- Does the company have the plan to divest its tier 2 assets? Is there any plan for using the proceeds to pay back the debt?

- Could you talk about more on the debt payoff plan in 2020 and 2021?

- How long are your service contracts?

You can listen to Whiting’s presentation here.