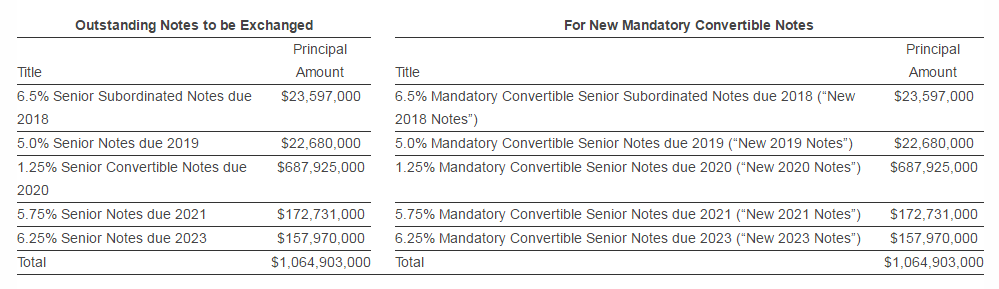

Whiting Petroleum (ticker: WLL) has initiated an exchange offering for senior notes aimed at lowering debt and leverage through the mandatory conversion of senior notes to equity. The announcement on June 22, 2016, will encompass $377.0 million worth of nonconvertible notes and $697.9 million of convertible notes. The exchange will replace the old notes with new mandatory convertible senior notes with the same terms.

The new mandatory convertible notes will be converted to equity with some stipulations. Four percent of the aggregate principal amount of the new convertible notes will be converted into shares of Whiting common stock for each day of the 25 trading day period commencing on June 23, 2016, if the daily volume weighted average price, or Daily VWAP (as defined in the indentures governing the new convertible notes), of Whiting common stock on such day is above $8.75.

As of first quarter 2016 reporting, Whiting is carrying $5.22 billion in debt on its balance sheet. The mandatory note exchange will eliminate $1.07 billion worth of debt, replacing it with equity. Current shares outstanding are 251.7 million shares.

The mandatory conversion of notes into equity will be dilutive to Whiting shares. Whiting stock closed on June 22 at $12.10 per share. Knowing that the floor has been set at $8.75, assuming an average conversion price of $10.43 (halfway between $8.75 and $12.10), that equates to 103.1 million shares being issued through the mandatory conversion. This would mean a dilutive effect of 29.1% on the current shares outstanding.

Whiting’s debt load will be reduced from $5.22 billion to $4.15 billion, reducing debt to market cap to 140% from 177%.

David Tameron of Wells Fargo commented on the transaction: “While we have not spoken to management we believe the transaction has similar motivations to the prior exchange, namely a more effective way to address balance sheet concerns vs. a straight equity offering.”