A Conversation with Schlumberger’s David Rabley

The only guarantee of the oil and gas industry is its cyclicality. Although veterans of the industry are used to seeing swings on both the upward and downward sides, each cycle comes with a different level of uncertainty.

That uncertainty is compounded in the aftermath of the United States shale boom. Bill Barrett, a legendary wildcatter who discovered scores of hydrocarbon deposits throughout the Rocky Mountain region in the 1980s and 1990s, spoke with Oil & Gas 360® about his open discussions with rival operators as the companies tried to “unlock the code” of various plays. Those days have virtually disappeared. E&Ps have snapped up properties at a feverish pace in recent years, and disclosing any secrets of the play is verboten. For example, Shell announced a Utica Shale discovery near New York in September 2014 – only after it had taken the time to acquire an additional 155,000 net acres in the region. A Shell spokesperson directly said the discovery was not advertised “broadly for competitive reasons.”

But in the new commodity environment, is it possible for companies to open dialogue, share knowledge and adopt a “we’re in this together” approach?

“It is possible, but the current environment is actually going to make things a lot harder,” said David Rabley, Vice President of Schlumberger Business Consulting (SBC) (ticker: SLB), in an interview with Oil & Gas 360®. Mr. Rabley recently published a piece titled “Ushering in Collaboration and Integration,” detailing the beneficiaries of increased efficiencies between operators and suppliers. But the oil price aftershock has changed the landscape once again. “A lot of what was starting to get built up over the course of the last year or so, concerning realization of the value of collaboration, risks getting set back by 12 to 18 months,” said Rabley.

“Efficiency is Lagging”

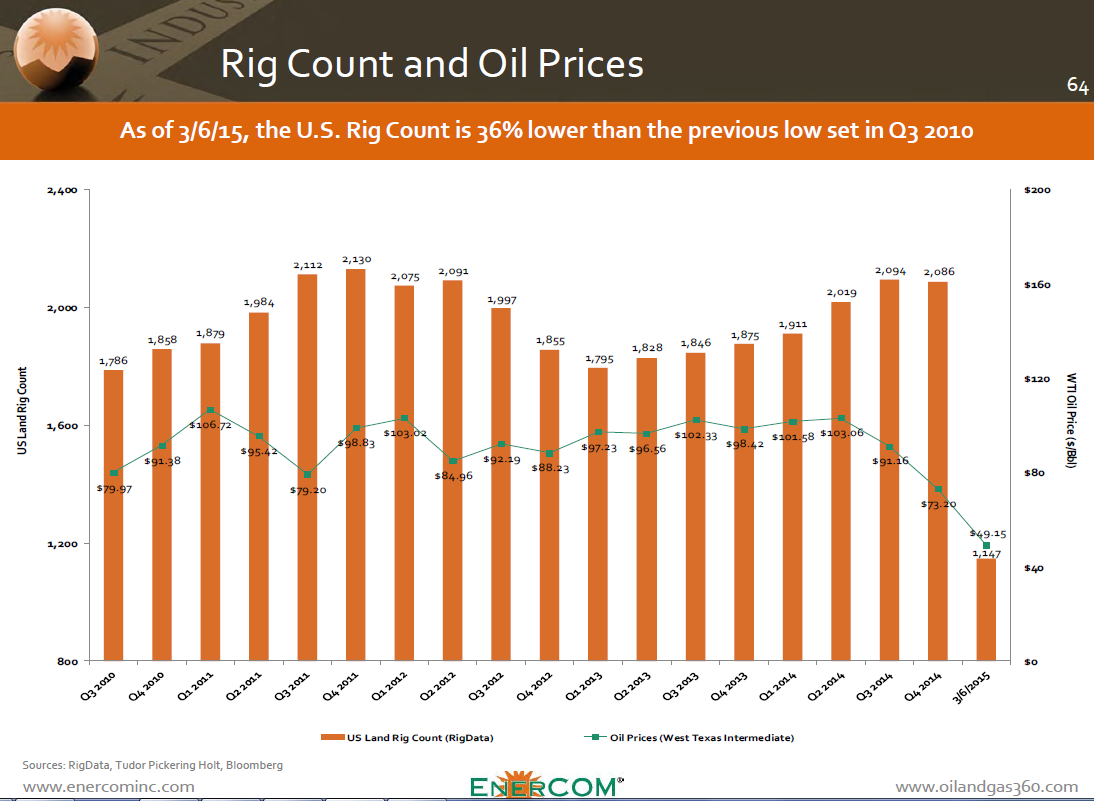

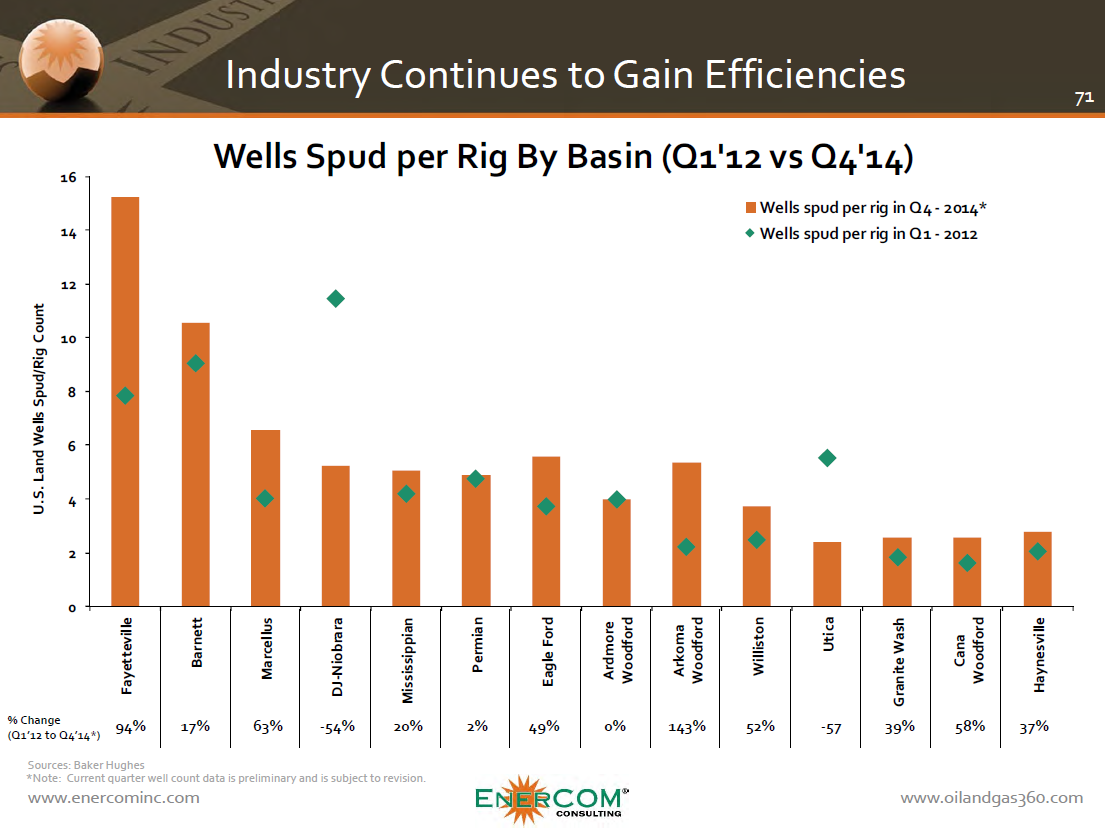

Exploration has slowed to a crawl and rig counts have fallen by 45% since October 2014. Producers and oilfield service providers are taking whatever steps possible to broaden margins in a $50 oil environment. In the past, operators have tended to focus on high initial production rates rather than extracting the most resources from the well throughout its life cycle. “Efficiency is lagging in our industry,” said Rabley. “Producers don’t want to leave value on the table, so I believe the current situation creates an opportunity for a few new operating models to come up, such as re-fracs and other innovations that are more relevant in a down-cycle environment.”

The Conundrum

The shale revolution has changed the global energy landscape, but Rabley says we’re still in the early stages of truly understanding effective reservoir management. “I think we still have a way to go,” he said. “The science is increasingly getting in place, but the challenge is, how do operators leverage that?”

Rabley provided an example where an E&P operator approaches a service operator. He explains: “The E&P operator wants an asset that is stable, operates well, maintenance costs aren’t excessive and it produces over the cycle of the field. On the other hand, if you’re talking about the drilling function, they might want the least amount of days, low entity and cost. Are they equivalently incentivized in terms of production, and what we’ve found is: no.”

The SBC report says effective productivity and collaboration between the crews has a lot of room for improvement – as much as 200%, to be exact. More streamlined operations from the E&P viewpoint is essential to cutting back on nonproductivity. The bottom line, the SBC report says it is essential to: “change the relationship focus to ‘how can we jointly drive efficiency and share gains.’ Collaborating to ensure the improvements are supported, implemented and sustained.”

Disconnect Among IOCs/NOCs

Schlumberger’s international industry presence is unrivaled: the company has 125 research, engineering and manufacturing centers and offices in more than 85 countries and collaborates with producers in every facet of the industry. That includes national oil companies (NOCs), who are effected differently compared to the independent companies in North America. Rabley explains: “In general, the NOCs are going to be slower to recognize any change in their industry. There’s going to be more inertia to change, and inventories outside of North America are more down than up, so maybe that means they’re not quite seeing some of the pressures yet that we’re seeing here.”

Rabley also mentioned NOCs are typically more invested from a relational standpoint with their service companies, and the stability of a long-term relationship can offset the cloudier aspects of NOCs, namely the lack of transparency in financial reporting. The report estimates only 50% of possible revenues are achieved when an operator and service provider work independently, but close collaboration can be a game changer. For example, Ecuador successfully revitalized its Shushufindi oilfield by locking down a performance-based contract with its services operator. With control of the engineering, drilling and workover activities, the service provider nearly doubled production from the mature field in 24 months.

One country generating interest for future investment is Mexico, who just recently opened its doors for private investment. The country is moving forward with its first round of bidding rights, known as Round Zero, but is considering postponing the second auction due to the price slump.

“The price environment doesn’t help anyone to take interest in Mexico right now,” said Rabley. Mexico is trying to collect private investment to help build out its oil and gas infrastructure, which officials estimate needs US$500 billion through 2018. “The reform is positive but it’s going to take a great deal of time,” Rabley said, adding that outside investment will introduce a form of competition for Petroleos Mexicanos (Pemex), the country’s NOC. “Mexico really needs to get out of its own way in terms of allowing certain things to happen, which they seem to be doing, but it’s going to take awhile.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.