U.S. opportunity may be closed for decades

On June 26, the U.S. House of Representatives’ Energy & Commerce Committee held a hearing entitled “The Shifting Geopolitics of Oil & Gas.”

The four energy sector experts who testified at the hearing included Sempra Energy (ticker: SRE) Chief Strategy Officer Dennis Arriola; Continental Resources (ticker: CLR) Chairman and CEO Harold Hamm; Dr. Kevin Kennedy, deputy director, U.S. Climate Initiative of the World Resources Institute; and IHS Markit (ticker: INFO) Vice Chairman Dr. Daniel Yergin.

Dennis V. Arriola is chief strategy officer, executive vice president of external affairs and South America, and chief sustainability officer for Sempra Energy. Previously Arriola was chairman, president and CEO of Southern California Gas Co. (SoCalGas), one of Sempra’s regulated California utilities.

During the testimony, Sempra’s Arriola laid out a warning about a rapidly closing window that exists for U.S. LNG export plants to be developed for the much talked about U.S. LNG export boom to come to fruition.

“As a result of two key developments — the U.S. shale energy boom and the growth in U.S. LNG export opportunities — the outlook for domestic and international natural gas markets has never been better,” the Sempra Energy Chief Strategy Officer told the committee.

“If we invest wisely and follow smart, pro-market policies, there is little doubt that the U.S. economy will be the big beneficiary with job growth and even greater energy independence.

“Advances in technology for extracting gas have resulted in an abundance of affordable energy here in the U.S. The Potential Gas Committee (PGC) recently released its latest biennial assessment of the nation’s natural gas resources, which indicated that the U.S. possesses a total technically recoverable resource base of 2,817 trillion cubic feet (TCF) as of year-end 2016, or supplies that will last more than 90 years at current extraction levels.

“While an abundance of U.S. natural gas is leading to a manufacturing resurgence in the U.S., it also has the potential to strengthen alliances with developed and developing countries by providing a stable, affordable, flexible, and reliable source of energy that gives those countries the certainty they need to build their energy infrastructure.

“U.S. natural gas exports also can help our European allies reduce their energy dependence on Russia.

“Finally, U.S. LNG exports can help countries improve air quality and the environment by displacing less clean resources.”

But Arriola warned that permitting and regulatory timing to achieve LNG export plants and pipelines to bring the gas to them are growing longer rather than shorter.

“You can be sure that other major LNG exporting countries, such as Russia, Australia, Qatar and Mozambique, are doing everything possible to enhance their competitive position. If these and other nations provide better certainty of regulatory process than the U.S. does and enable their native companies to get to the market sooner, then they will dominate the market, and the U.S. will lose out.

“Moreover, the lack of certainty with respect to timing undermines the ability of developers to develop and finance these types of projects,” Arriola said.

U.S. LNG export window poised to close quickly

“Once our foreign competitors enter into long-term LNG contracts with customers, the window of opportunity for U.S. based projects closes for decades. And that means we would lose out on the economic and foreign policy benefits to other countries like Russia. We can’t let this happen.”

Sempra Energy Chief Strategy Officer Dennis Arriola (second from left) testified to the House Energy & Commerce Committee about the importance of U.S. LNG exports to world energy geopolitics. Other expert witnesses were Dr. Daniel Yergin, vice chairman of IHS Markit (far left), Dr. Kevin Kennedy, deputy director, U.S. Climate Initiative of the World Resources Institute (third from left), and Harold Hamm, Chairman and CEO of Continental Resources (far right).

“We need to ensure that FERC at least keeps to its typical permit review schedule of no more than 18 to 24 months, and that it looks for opportunities to streamline the process even further,” Arriola said.

Texas Congressman Joe Barton asked Dennis Arriola what was the 10-year outlook for LNG prices on the world market. “I would assume they are going to come down as we ramp up out exports?” he asked.

Arriola: “What we’re finding is that as demand externally continues to increase, there’s more production domestically and it’s helping to keep the prices flat, it’s continuing to push them down. What we’re seeing is that the reason countries on the outside are looking to buy U.S. natural gas is because of those prices.”

Representative Barton referenced Congress’s repeal of the crude oil export ban and lauded the committee’s work “to expedite the permitting of LNG export terminals in a more timely fashion. What’s the geopolitical significance of those two congressional actions?”

Dennis Arriola: “We talk to customers outside the United States. They are looking for options, they’re looking for options away from Russia and other countries, and they want the United States to be one of those options.”

Near the end of the almost three hours of testimony, South Carolina Congressman Jeff Duncan began commenting on the movement of U.S. natural gas to Europe via LNG export plants coming on line in the U.S.

“Even in second-world and first-world Europe, they have problems with intermittency and power supplies.” … Europe is relying on Russia for its energy, Duncan pointed out. He said Russia uses its natural gas supply spigot to affect policy in both Eastern and Western Europe.

As a result, “Western Europe is looking west, toward the United States, a stable energy producer, an ally and a friend, to provide LNG so they can meet their energy needs and lessen their dependence—not on the Middle East for their energy—but to lessen their dependence on Russia,” Duncan said.

Committee Vice Chair Texas Congressman Pete Olson asked Dennis Arriola to talk more about why getting U.S. LNG to market is time sensitive. “Why does it matter how fast you ramp this production up, and what markets are in jeopardy if we delay or drag this out?”

Dennis Arriola: “When foreign countries decide to enter into contracts for LNG they’re ordinarily in the 20-to 30-year time frame. And so, as I’m buying a product or service for 20 or 30 years, I don’t need to come back every year and re-up. And so as U.S. companies including Sempra look at building a project—whether it’s in Cameron or Port Arthur—we’re really focused on trying to get all those contracts together up front so that we can get them financed and to build the projects.

“If we can’t get those projects this year or next year because somebody else has already signed up these 20-30-year contracts, we’re out of the market. And the construction jobs that we talked about and the impact to the local economy goes away, or never develops.”

The San Diego-based energy holding company is comprised of electric utilities, but the company’s subsidiaries own and manage a large natural gas and LNG infrastructure business, including three LNG projects that are under construction or are advancing through planning and permitting phases in Louisiana, Texas and Baja California.

Utilities developing NatGas exports evokes a similar strategy by Dominion Energy to develop the Cove Point LNG export project to ship liquefied natural gas from the U.S. east coast. Cove Point shipped its first LNG cargoes in Q1 2018.

Sempra’s LNG projects include the Cameron LNG joint-venture liquefaction-export project that is currently under construction in Louisiana. Sempra is developing a three-train, 14-million-tonnes-per-annum (Mtpa) liquefaction facility in Hackberry, La. Cameron LNG is targeting to commence operations in 2019. Cameron LNG is jointly owned by Sempra LNG & Midstream, ENGIE (formerly GDF SUEZ), Mitsui and Japan LNG Investment, LLC, a company jointly owned by Mitsubishi Corporation and Nippon Yusen Kabashiki Kaisha (NYK).

Sempra is also developing the proposed Port Arthur LNG liquefaction project in Texas and proposed liquefaction-export facilities at the Energia Costa Azul (ECA) receipt terminal in Ensenada, Mexico. Permitted to be built adjacent to the existing ECA regasification facility, the liquefaction project targets supplying Asian customers via direct access to west coast LNG supplies. Presently, the ECA regasification terminal supplies approximately 1 Bcf of natural gas per day to Baja California and the United States, according to Sempra.

The EPC contractors have been named for both projects. The Port Arthur LNG liquefaction facility is planned to export approximately 11 Mtpa of LNG starting from 2023.

20-year contract with Poland for Port Arthur LNG

On June 26, Sempra announced it had secured a signed an agreement with Polish oil and gas company (PGNiG) establishing terms of delivery for the sales and purchase of two million tonnes per annum (Mtpa) of LNG, which equals about 2.7 billion cubic meters (bcm) per year of natural gas following regasification.

The agreement is a 20-year contract for cargoes to be supplied starting in 2023 from the Port Arthur LNG facility under development in Jefferson County, Texas.

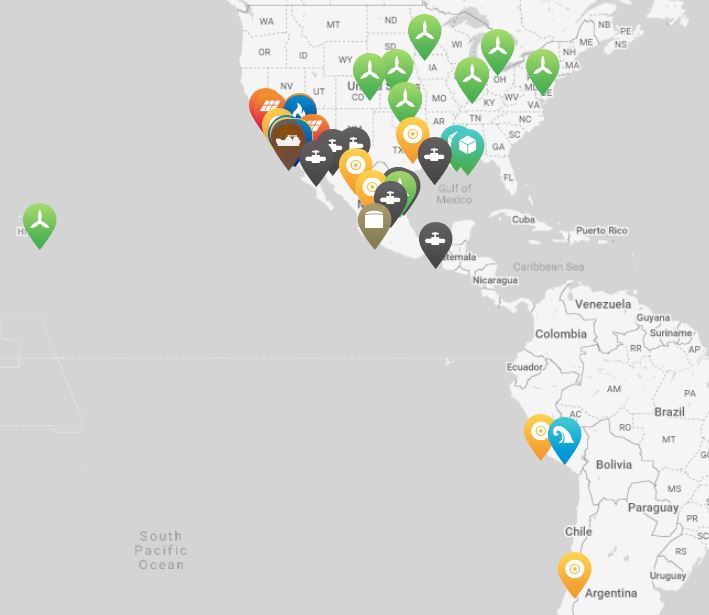

Sempra operates natural gas pipelines in the southern and midwestern U.S. and in Mexico. Sempra also reports 42 billion cubic feet of natural gas storage capacity. Including infrastructure, electric utilities and renewable energy production, Sempra Energy claims 40 million customers and 20,000 employees. Its operations are in North, Central and South America.

Detailed coverage of the House Energy & Commerce hearing is available at Oil & Gas 360®.